We don’t think about the railroads much. For most of us, the Iron Horse is a relic of the 19th century – but the railroads are still a vital part of the US economy, carrying huge amounts of freight cross country with a combination of efficiency and pricing that trucks can’t hope to beat. Rail freight volumes in the US typically reach higher than 2 billion tons per year, and carry the equivalent of 83 million truckloads while using one-fourth as much fuel.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The rails have caught the attention of Jefferies analyst Stephanie Moore, an expert in the transportation industry and rated by TipRanks in the top 3% of Wall Street analysts, who has been watching railroads with an eye toward investor opportunities in an essential economic sector. While she concedes “most rail stocks are fully valued at this time,” she is a fan of two names in particular, Canadian Pacific Kansas City and Norfolk Southern, on “idiosyncratic stock-specific stories that we think could drive above-peer earnings growth in the long term.”

So, let’s take a closer look at the pair. For added color, we also ran these tickers through the TipRanks database to see what other Street experts make of their prospects.

Canadian Pacific Kansas City (CP)

First up, Canadian Pacific Kansas City, founded in the 1880s as Canadian Pacific and providing a link between Canada’s eastern provinces and the West Coast. More recently, in December of 2021, the company purchased the Kansas City Southern Railway, forming a combined entity called Canadian Pacific Kansas City – or CPKC. The combined company, based in Calgary, operates some 20,000 miles of track and is the only single-line railway to connect Canada, the US, and Mexico. This modern incarnation of the venerable Canadian Pacific offers an unbeatable combination of rail links and port access, with rail-port connections on the Saint Lawrence Seaway, at Vancouver, on the Gulf of Mexico, and on the Mexican Pacific coast.

According to industry data from the Association of American Railroads, rail traffic has been showing consistent year-over-year gains in weekly traffic in recent months. This boost in traffic has been beneficial for CP, which has seen an upward trend in revenues in recent years, even before the Kansas City acquisition. That acquisition was completed in April last year, and financial results since then are for the combined entity.

The company’s last quarterly report, covering 4Q23, showed a top line of C$3.78 billion, up 53% year-over-year – reflecting both the rising trend and the increased business since the acquisition. The bottom-line figure came to C$1.18 per share by non-GAAP measures.

Analyst Moore sees the company in a solid position to capitalize on increased trade within North America – based on its control of the only single-line connection between the three largest North American countries. Increased trade among Canada, the US, and Mexico cannot help but benefit CP, as Moore points out: “With its unique and unrivaled network, we think CPKC has created a powerful base to drive sustainable growth by growing with existing customers to bring on new business, while also competing for new opportunities. We are particularly bullish on the Mexico opportunity, which has recently overtaken China as the largest share of U.S. imports. With the only single-line railroad connecting all three North American countries with connections directly to Mexico’s industrial heartland, we think CPKC stands to benefit from continued industrial growth in Mexico driven by nearshoring. All in, we estimate CPKC can see a HSD% top-line CAGR going forward, outperforming MSD% industry average.”

Moore goes on to put a Buy rating on CP shares, and her US$105 price target implies a one-year upside potential of 22% for the stock. (To watch Moore’s track record, click here)

This stock is currently trading for $86.14 on Wall Street, and its $90.04 average price target points toward a modest 4.5% gain for the coming year. The shares have 21 recent analyst reviews, including 13 Buys to 8 Holds, for a Moderate Buy consensus rating. (See CP stock forecast)

Next up is Norfolk Southern, one of the major US railway corporations. The company, which boasts a market cap of $56.5 billion, is one of the two largest rail operators east of the Mississippi, and its track network of nearly 20,000 route miles connects the Mid-Atlantic, Great Lakes, and Southeast regions, extending into 22 states plus DC. The company traces its roots to 1827, and today links all of the major container ports on the Atlantic seaboard with important port facilities on the Gulf Coast and on the Great Lakes.

Norfolk Southern, an industry to itself, operates across a wide range of economic sectors, carrying for the auto makers, agricultural and forestry producers, mining companies, chemical firms, and energy firms – oil and coal are particularly important cargos on the rails. The company is also an operator of the vital intermodal links that permit a seamless carriage of goods from ports of entry to final destinations. This includes the transfer of containers from ships to rail, and later from rail to trucks.

Rail transport may still carry the slightly quaint aura of an older time, but Norfolk Southern is a leader in bringing modern technology to bear on the railways. The company has applied AI tech to such vital areas as dispatch scheduling and maintenance prediction, and uses both AI and modern camera technology to perform train inspections. The company’s inspection portals can capture up to 1,000 high-resolution images per railcar, giving maintenance workers a vital new tool. That said,the system is not perfect, as it was a Norfolk Southern train that was involved in the infamous East Palestine, Ohio derailment in February of last year.

On the financial side, NSC reported $3.1 billion in revenues for 4Q23, a figure that was down 5% from the prior year. The company’s bottom-line earnings, the non-GAAP EPS of $2.83, were down 17% from the prior year and missed expectations by 4 cents per share. More recently, the company released some preliminary results for Q1, with the company expecting EPS of $2.49 vs. the Street’s call for $2.59.

Despite Norfolk Southern’s recent difficulties stemming from the East Palestine incident, Jefferies’ Moore still sees this stock as a solid choice for future performance. She says of NSC, “While we think most of the Class 1 rail peers have driven OR (operating ratio) near peak sustainable levels and see little room for them to structurally improve margins further over the long-term, we think NSC is primed to see above-peer margin expansion effectively narrowing the OR spread vs. peers. Specifically, we think NSC can reduce its OR spread vs. CSX from 500bp+ today to 300bps by 2025 as the company (1) improves its business mix to focus on higher-margin Merchandise* volumes and (2) spins off incremental costs brought onto the network. Importantly we think this progression can continue well past 2025 and all else equal think NSC can see above-peer earnings growth over the next five years as it improves its margin. While this isn’t necessarily a 2024 event, we do think it plays out in 2025 and beyond. With the stock <20x 2025 EPS, we think shares are undervaluing the long-term, above peer earnings growth opportunity.”

Moore goes on to quantify the ‘growth opportunity’ with a Buy rating and a $300 price target that shows her confidence in a 21% upside for the next 12 months.

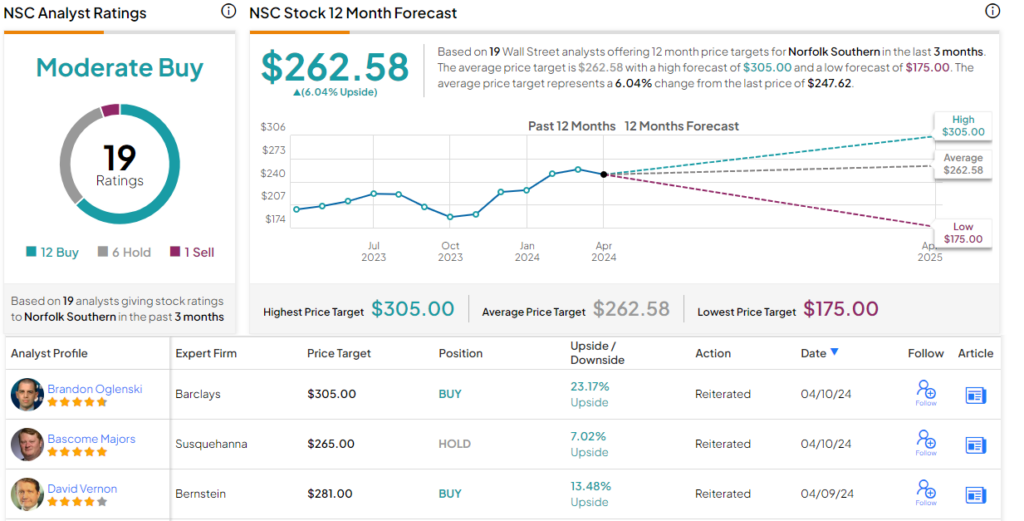

Overall, NSC has a Moderate Buy consensus rating, based on 19 recent analyst reviews that include 12 Buys, 6 Holds, and 1 Sell. The shares are selling for $247.62, and their $262.58 average target price implies a modest one-year gain of 6%. (See NSC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.