There’s been an upsurge of positive sentiment recently, as the 1Q23 earnings reports have been better than expected. Late last week, with 53% of the S&P companies having reported, 79% had beaten the EPS estimates. This is a historically high number, above both the 5- and 10-year averages, and the aggregate beat, of 6.9%, is above the average beat of 6.4% over the past decade.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Morgan Stanley’s chief investment officer Mike Wilson notes that this has investors expecting a ‘meaningful upward inflection in 2H ’23 EPS growth will come to fruition,’ but adds that such hopes are probably unwarranted, a result of hopes beating reality.

Pointing out that a recession is looming in the second half of the year, Wilson, who has been noted for his bearish outlook in recent years, goes on to say, “Bottom line, stock selection and industry group selection becomes increasingly important late in the cycle. We continue to prefer traditional defensive sectors on a relative basis as well as single stocks with stable earnings profiles and high operational efficiency.”

Putting that recommendation into action, the stock analysts at Morgan Stanley been looking for recession-resistant stocks, the type of equities that will provide portfolio protection in a difficult environment. We’ve opened up the TipRanks database and pulled up the details on two of their picks; here they are, along with the analyst commentaries.

Intra-Cellular Therapies (ITCI)

We’ll start in the world of biotech, where Intra-Cellular Therapies has hit its sector’s jackpot – or found the Holy Grail, just choose your metaphor. To put short, Intra-Cellular has a medication on the market, approved by the FDA, with a patient base in a segment that is known for its high unmet medical needs. Intra-Cellular works in the field of neurologic and neuropsychiatric medicine, and is working on new treatments for schizophrenia, major depressive disorder, as well as Parkinson’s disease, opioid addiction, and agitation and psychosis due to Alzheimer’s.

The company’s leading product, Caplyta, is now available on the commercial market by prescription. Caplyta is the brand name for lumateperone, which was approved in December 2019 for use in adults with schizophrenia. This patient population is known for its non-compliance with medication regimens. Caplyta has shown a lower level of interaction with off-target nervous receptors compared to established medications, making it less likely to cause adverse side effects and more likely to encourage patients to adhere to their physician’s instructions. This is an important feature for promoting commercialization.

So far, commercialization has been proceeding apace. In the first quarter of 2023, the company reported Caplyta product revenues of $94.7 million, up 173% year-over-year. Total revenue in Q1 came to $95.31 million, beating the Street’s forecast by $2.9 million. Turning to the bottom line, the company saw a net loss per share, by non-GAAP measures, of 46 cents, which was 16 cents above expectations.

The company is currently putting the drug through an additional set of clinical trials to evaluate it as a treatment for MDD and bipolar depression. Late in March, the company announced positive topline results from late-phase study (Study 403) of lumateperone as a monotherapy in this patient population.

Intra-Cellular is not resting on its Caplyta successes. The company has an active pipeline program, with another three drug candidates in various stages of pre-clinical and clinical-stage studies.

According to Morgan Stanley analyst Jeffrey Hung, who holds a 5-star rating from TipRanks, the near-term outlook for Caplyta is the primary catalyst for the stock’s performance.

Looking at prescription numbers, he writes, “New patient starts are now 5-6x higher than prior to the label expansion, and the Caplyta prescriber base grew to 25,000+ unique prescribers by the end of 1Q (vs. ~22,000 unique prescribers reported in 4Q) with ~4,000 new first-time prescribers in 1Q, of which 1,400+ were in March alone. We are encouraged that Caplyta continues to demonstrate script and prescriber growth momentum, and we still believe that Caplyta sales will remain strong in 2023 with potential to exceed the company’s 2023 guidance.”

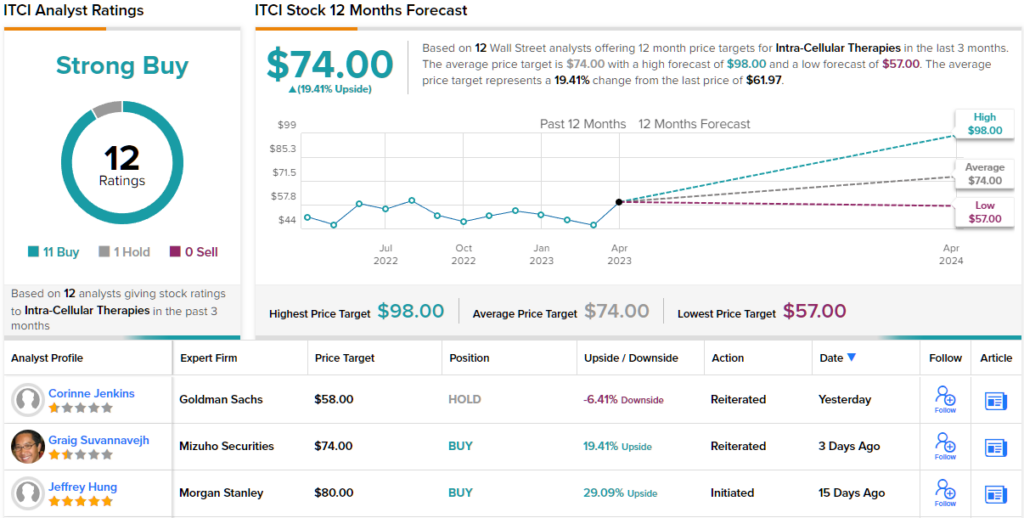

Putting some numbers on the share potential, Hung rates the stock as Overweight (i.e. Buy) with an $80 price target that suggests a 29% one-year gain. (To watch Hung’s track record, click here)

Overall, there are 12 recent analyst reviews for this stock, and they include an 11 to 1 breakdown favoring the Buys over the Holds – for a Strong Buy consensus rating. The stock’s average price target is $74, implying 19% growth over the next year from the share price of $61.97. (See ITCI stock forecast)

Elevance Health (ELV)

For the second Morgan Stanley pick we’ll stick with the healthcare sector – but move over to a health insurance provider. While the Elevance name may not be immediately recognizable, the company was well-known under its previous moniker, Anthem. The company rebranded to Elevance in June of last year, but retained its customer base and market share.

As Elevance now, the company boasts 48.1 million members, a total that reflects the 1.3 million new members added in 1Q23. Elevance, with its $110 billion market cap, is one of the largest health insurance providers in the US market, offering customers a range of services that includes insurance plans for medical, dental, disability, long-term care, behavioral health, and pharmaceutical services. The company works with Blue Cross Blue Shield, and is the largest managed health care company in the BC/BS network.

The US healthcare sector is big business, making up more than 18% of the nation’s total GDP. Elevance capitalizes on that, to good results – the company saw $41.9 billion in revenue in its last reported quarter, 1Q23. That number marked a 10.6% year-over-year increase, and represented $960 million beat compared to analyst expectations. At the bottom line, Elevance reported a non-GAAP EPS figure of $9.46. This was 17 cents ahead of the forecast, and was 14.6% ahead of the year-ago number.

Also in the first quarter, Elevance reported an operating cash flow of $6.5 billion. When early receipts of the April premium payments are stripped out, the company still shows $3.5 billion in cash flow, up $963 million y/y. The cash flow supported the dividend, which is currently set at $1.48 per share, or $5.92 annualized. At that rate, the payment yields a modest 1.3%. In Q1, Elevance paid out a total of $351 million in dividends.

In February of this year, Elevance completed its acquisition of the pharmacy services company BioPlus. Details of the transaction were not disclosed – but BioPlus brings with it a range of services for patients dealing with serious, chronic condition, including MS, Hep C, autoimmune conditions, and cancer. BioPlus operates in all 50 states, and covers more than 100 medications of limited distribution.

The completion of the BioPlus transaction is major win for Elevance, and forms the base for Morgan Stanley analyst Michael Ha’s portrait of the company.

“We see strong long term earnings growth upside from fully scaling their specialty pharmacy, BioPlus. As we look beyond 2024, we believe Elevance is intentionally building specialty pharmacy (BioPlus) and claims adjudication (DomaniRx) capabilities to position themselves to fully in-source all of their drug spend to CarelonRx. Over time, as BioPlus fully scales… we estimate these drivers could add +110bps to +290bps of upside to Elevance’s long term earnings growth,” Ha opined.

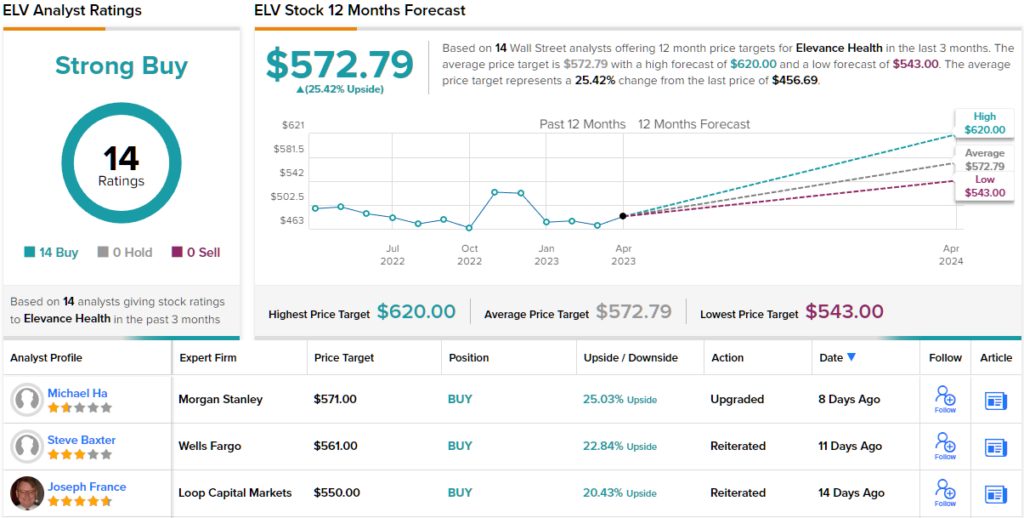

Ha goes on to rate Elevance stock an Overweight (i.e. Buy), and to set a price target of $571, indicating his belief that the stock will appreciate 25% over the next 12 months. (To watch Ha’s track record, click here)

All in all, this stock has a unanimous Strong Buy from the analyst consensus, based on 14 positive reviews. The shares are selling for $456.69 and have an average price target of $572.79, suggesting a one-year potential gain of ~25%. (See ELV stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.