It has not been a good year for the hydrogen industry. A combination of elevated interest rates, delayed adoption and worsening hydrogen economics have all helped to push Hydrogen OEM stocks down by ~40% in 2023.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In fact, a 40% drop would be considered a relief by investors of one leading hydrogen name. Plug Power (PLUG) shares have shed 65% year-to-date with 50% of those losses taking place over the past 3 months.

Considering such a massive pullback, should investors be eyeing an opportunity to pick up shares on the cheap? Unfortunately not, according to Morgan Stanley analyst Andrew Percoco. In fact, the opposite rings true.

“Even after the underperformance in 2023, we see significant risk around PLUG’s business model given the operational challenges that the company has faced in commercializing its first few green hydrogen facilities,” Percoco explained. “On paper, PLUG’s strategy makes sense to us, but we have reduced confidence in the company’s ability to execute on that strategy barring a potential dilutive capital raise and a near-perfect execution going forward.”

Although PLUG’s business encompasses various aspects, its core strategy relies on constructing affordable green hydrogen production facilities within the US. However, this approach has faced significant obstacles due to delays and budget overruns in projects. As such, the company has had to keep on purchasing expensive liquid grey hydrogen from its industrial gas counterparts. Consequently, the fuel delivery business has experienced consistent pressure on gross margins, which have seen a -276% drop in the first nine months of the year.

And following several quarters marked by delays in construction/commissioning, there is a risk the company won’t be able to establish the financially viable clean hydrogen facilities needed to “offset the highly unprofitable” grey hydrogen contracts with the industrial gas firms.

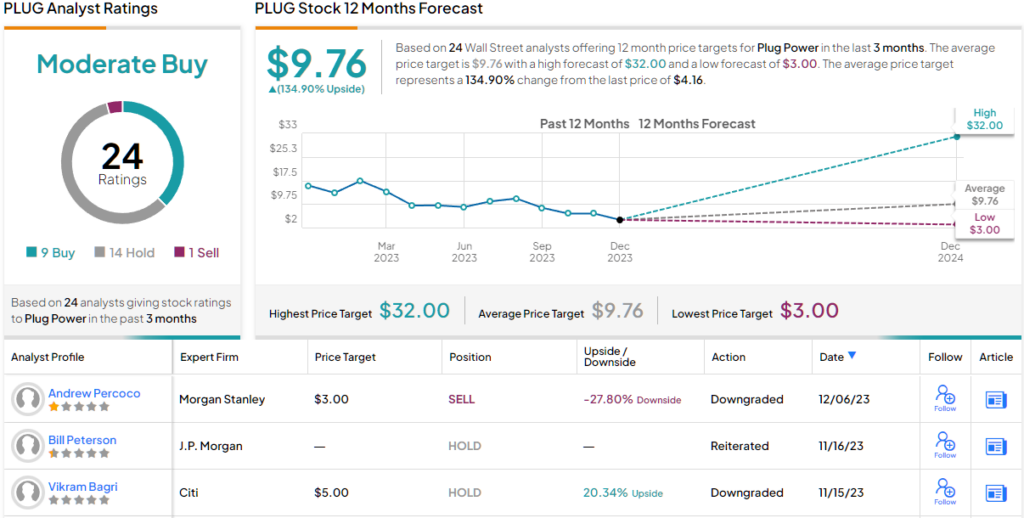

Accordingly, until PLUG’s “operational track record” and cash flow profile improve, Percoco sees a “negative risk-reward” for PLUG shares. The result of which is a downgrade from Equal-weight (i.e., Neutral) to Underweight (i.e. Sell), while the price target is also lowered from $3.5 to a Street-low of $3. The implication for investors? A potential decline of ~28% from current levels. (To watch Percoco’s track record, click here)

Percoco, however, is alone in the PLUG bear camp. Elsewhere on the Street, the stock receives an additional 9 Buys and 14 Holds, all for a Moderate Buy consensus rating. Moreover, the average target remains a bullish one; at $9.76, the figure suggests shares will record gains of a big 135% in the months ahead. (See Plug Power stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.