With a share price of $6.83, SoFi Technologies (NASDAQ:SOFI) stock has lost 40% of its value since its recent high at the end of July. But that doesn’t mean SoFi stock can’t still go even lower.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

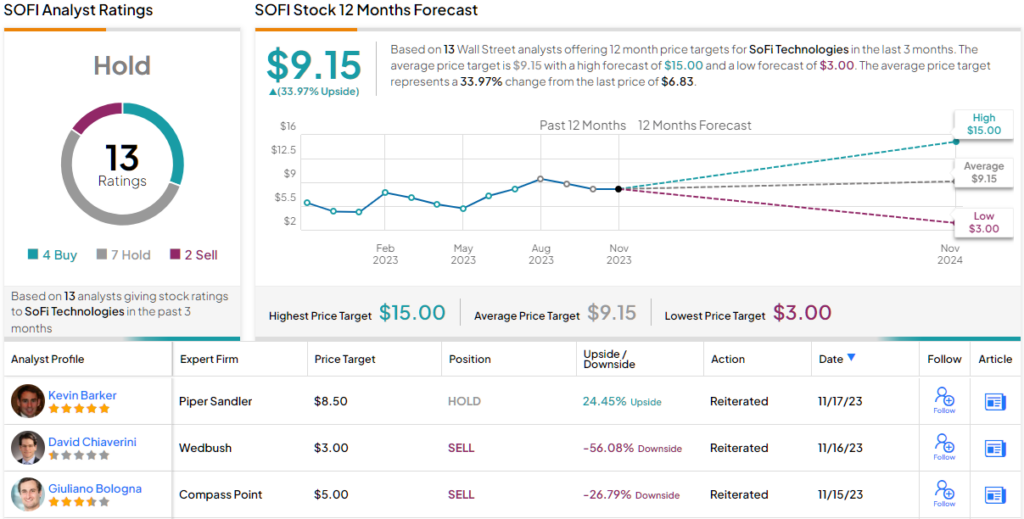

Wedbush analyst David Chiaverini argues that that’s exactly what SoFi stock is set to do — lose more than half its value over the next 12 months.

It almost goes without saying that Chiaverini thinks investors should dump SoFi stock. He accompanies his $3 price target on the shares with an Underperform (i.e. Sell) rating. But the reasons why Chiaverini thinks SoFi stock is a dog with fleas may surprise you.

As the analyst explains, a lot of investors have been asking about SoFi’s revelation, in its most recent 10-Q filing, that in Q3 the internet bank was able to record “105%” gains on sales of asset-backed securities, and “105.1%” sale execution prices on the loans that it originated, and later sold to other investors, as “forward flow” transactions — those in which a loan buyer commits to purchasing a whole series of loans from an originator (like SoFi) over a period of time. In each case, SoFi is saying that it succeeded in selling off loans that it originated at a profit.

This sounds like good news. Not only did SoFi successfully make loans, and then offload them onto other buyers, getting its cash back so that it can redeploy it into new loans. Not only did SoFi replenish its capital so that its balance sheet looks healthy when financial regulators come to examine it. SoFi also did all of this at an immediate profit.

But as Chiaverini points out, there’s a catch.

SoFi, notes the analyst, has confirmed that these loans, while sold at a profit, also have the potential to saddle SoFi with future losses if their borrowers fail to pay. This is because “there’s a loss sharing component to these deals.” Which is to say, SoFi didn’t totally sell the loans, and all the risk that they won’t be repaid, to its buyers. Rather, it assumed the risk that in case of non-payment, both SoFi’s buyers and SoFi itself will eat part of the losses if borrowers don’t pay.

SoFi, continues Chiaverini, did say that its potential losses on these transactions are “capped.” But it didn’t say at how much the losses are capped — and as a banker itself, this makes the Wedbush analyst nervous. Wedbush’s worries only grow as he points out that SoFi has also apparently been providing “seller financing” to its loan buyers. And what this means is that SoFi has been basically lending its buyers the money to buy SoFi’s loans — apparently, at below-market rates.

On the one hand, this probably makes it easier for SoFi to resell its loans — and negotiate strong profits on those sales. On the other hand, even viewed charitably, it seems a risky way to do business for the bank, and — less charitably — could be interpreted as SoFi taking extra risks in order to make its growth rate look better than it otherwise would.

Long story short, yes SoFi succeeded in growing its revenues 26% last quarter. But no, even with this fact in SoFi’s favor, Chiaverini would not recommend buying SoFi stock. (To watch Chiaverini’s track record, click here)

According to TipRanks, the consensus on Wall Street is that SOFI stock is a Hold (i.e. Neutral) for investors. But TipRanks might as well have said Buy — because analysts, on average, think the stock could zoom ahead to $9.15 within a year, delivering ~34% profits to new investors. (See SOFI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.