Although trading the cryptocurrency market carries natural risks, even the most hardened investors probably didn’t anticipate what recently transpired for Bitcoin (BTC-USD) and other digital assets. With popular crypto exchange FTX declaring bankruptcy, many blockchain stakeholders rushed for the exits. However, rather than representing a buying opportunity, speculators should wait for the real discount to materialize in BTC.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

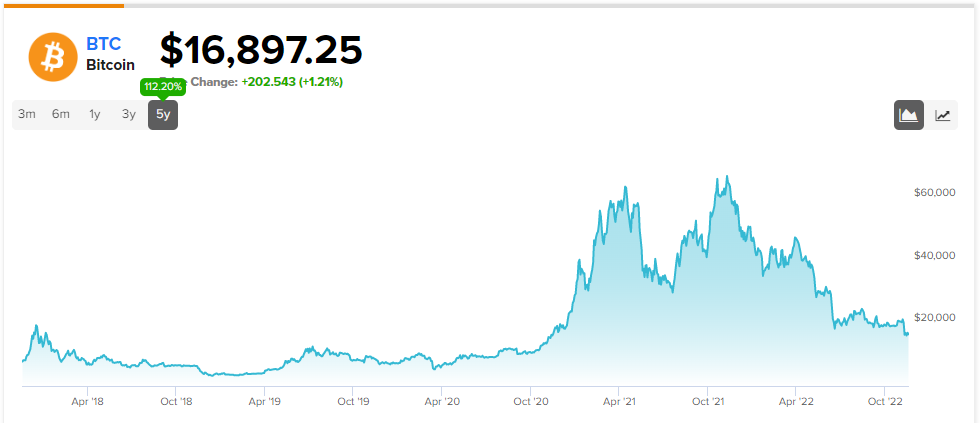

At writing, Bitcoin trades hands around the $16,900 level. What worries technical analysts is that since the second half of June of this year, BTC has generally traded around the psychologically significant $20,000 level. Bear in mind that this threshold commands historical significance. In the prior bull market cycle that culminated in late 2017/early 2018, Bitcoin knocked on the doorstep of $20,000.

From a market sentiment perspective, this level now represents the barometer separating optimism from pessimism. Should Bitcoin rise convincingly higher from this milestone, the action may embolden beaten-down speculators into taking another shot. However, many stakeholders probably implemented stop losses at $20,000, which may partially explain BTC’s volatility.

Of course, most of the recent negativity centered on the crypto complex’s structural concerns. According to TipRanks reporter Shrilekha Pethe, the FTX bankruptcy prompted MicroStrategy’s Founder and Executive Chairman, Michael Saylor, to weigh in during a CNBC interview:

We saw what can go wrong if a centralized token, trading on an unregistered exchange, blows up this week. I think the bitcoiners have been predicting this for a long time. Speaking for all the bitcoiners, we feel like we are trapped in a dysfunctional relationship with crypto, and we want out.

Moreover, the contagion didn’t just impact Bitcoin and other digital assets directly. Services that facilitate crypto transactions, including Coinbase (NASDAQ: COIN) and Robinhood Markets (NASDAQ: HOOD) dropped significantly amid the news.

Bitcoin Poised to Fall Further

Nevertheless, crypto market sentiment tends to respond differently to dynamics associated with Wall Street. Longtime participants of Bitcoin and other digital assets recognize the volatility that can erupt – in both directions. Therefore, given the upward bias thus far for BTC, many investors undoubtedly seek to buy the dips. However, they should probably wait.

Throughout the evolution of Bitcoin and blockchain-based networks, the fundamental focus centered on decentralization. Without the need for human intermediaries to validate, transfer and otherwise manage virtual currencies, blockchain assets can theoretically spark equity in economics. While this particular subject features various nuances, the bottom line is that value (wealth) can be transmitted without any of the artificial, arbitrary barriers that humans impose on the flow of money.

However, where decentralization falls short is that protocols leveraging this concept are essentially only transactional in nature. Decentralization alone cannot catalyze wealth in ways that centralized authorities (such as the U.S. and its economic machinery) can engineer.

How this plays out practically is that BTC’s pricing likely depends mostly on central bank policies, specifically the Federal Reserve. Juxtaposing the real M2 money stock with the average monthly Bitcoin price between October 2014 through September 2022, the correlation coefficient between the two metrics comes out to 87.81%.

This is significant because Fed policy throughout the lifecycle of Bitcoin has mostly been inflationary. It was only recently that the central bank implemented aggressive interest rate hikes. Not only did a spike in borrowing costs reduce homebuying demand, but it also impacted growth-oriented sectors.

Naturally, non-dividend-paying tech stocks suffered. However, cryptos represent pure risk-on assets, meaning that so long as the Fed remains hawkish, Bitcoin will remain suspect. Therefore, it’s likely that BTC will continue to decline from here.

$10,000 Here we Come

Generally speaking, technical analysis doesn’t command as much respect on Wall Street as fundamental analysis. However, when it comes to Bitcoin, the fundamentals don’t really exist. BTC doesn’t release earnings reports, nor does it pay dividends (in the traditional sense). Structurally, cryptos are open source, rendering arguably most forms of valuation assessment meaningless.

In other words, Bitcoin rises based on the greater fool theory. People buy BTC based on the assumption that someone else will buy the unit at a higher price. Given this simplistic perspective, investors will more than likely gravitate toward visual cues such as chart patterns.

Admittedly, readers must engage in a bit of a Rorschach test. Nevertheless, drawing an imaginary horizontal line across the $10,000 level, one can discern a concentration of activity above and below this threshold. By this assessment, Bitcoin will likely approach this milestone. Call it a reversion to the mean if you like.

However, free market dynamics don’t always align neatly with clean round numbers. Instead, they can overshoot the mean before reverting back to it. Therefore, it’s quite possible that Bitcoin can dip below 10K before settling at or around this price point.

Again, this projection combines monetary and technical catalysts. Broadly, so long as the Fed keeps hiking rates, Bitcoin’s value proposition as a risk-on trade will diminish. How low BTC will decline is where technical analysis comes into the picture. Based on reasonable psychological trends, $10,000 Bitcoin (or lower) appears as a logical target.

Thus, I wouldn’t wager too heavily until it reaches this critical marker.