It looks like Domino’s Pizza (NYSE:DPZ) stock is likely to hit new all-time highs soon. The largest pizza franchisor in the world enjoys robust growth momentum, backed by bold new store openings and strong same-store sales growth. The company has also been undergoing a margin expansion, further strengthening its profitability prospects. Though shares of Domino’s aren’t cheap, its earnings growth trajectory indicates potential for the ongoing rally to be sustained. Thus, I am bullish on DPZ stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

New Openings, Same-store Sales Growth Drive Revenue Rebound

While Domino’s revenues declined by 1.3% in Fiscal 2023, Fiscal 2024 appears set for a strong rebound. The company posted revenue growth of 5.9% to $1.08 billion in Q1, marking the best revenue growth in six quarters. This was driven by both strong momentum in new store openings and same-store sales growth.

Regarding same-store sales growth, looking at the U.S., the company saw a meaningful rise of 5.6%. This result was driven by an increase of 9.5% in Carryout (i.e., picking up the pizzas from stores instead of having them delivered) and a growth of 2.9% in Delivery, primarily driven by higher transaction growth. This, in turn, was aided by growth from Domino’s new loyalty program, including a continued benefit from the “Emergency Pizza” promotion, a benefit of 0.9% from pricing, and a 1.4% sales mix growth from Uber.

Meanwhile, International same-store sales growth was a humble 0.9% but still a welcome development.

Regarding new openings, Domino’s sustained vigorous momentum, adding a net total of 164 locations during the quarter. This pushed its trailing 12-month new net openings to 747 locations. Thus, Domino’s had a total of 20,755 locations at the end of the quarter compared to 20,591 at the end of last year. It’s evident that the market’s craving for Domino’s pizza remains robust, as new store openings (see below) quickly meet the regional demand.

Margin Expansion Drives Exceptional Profitability

While Domino’s modest single-digit revenue growth in Q1 might not grab investors’ attention, I think its profitability progress likely will. For those unfamiliar with Domino’s business model, it’s worth noting that 99% of its locations are franchised. Through this model, Domino’s effortlessly collects royalties amounting to 5% of each location’s total sales. Further, as the sole distributor of all essential ingredients to its stores, Domino’s enjoys a streamlined model that makes it quite easy to scale its margins as it gradually expands.

In particular, Domino’s supply chain gross margin expanded from 9% last year to 11.1%. Its company-owned store margin (though a tiny chunk of revenues) also rose from 16.9% to 17.5%. Most importantly, along with collecting higher royalties (the largest chunk of its revenues) from higher same-store sales and new store openings, for which it incurs no incremental expenses, its operating income margin rose to 19.4%. This marked a notable expansion from last year’s operating margin of 17.3%.

Consequently, Domino’s operating income grew by 18.4% to $210.4 million, its net income grew by 20.1% to $125.8 million, and its earnings per share grew by an even larger 22.2%, aided by a lower share count due to share buybacks. Now, reflect on the single-digit revenue growth, and you can see the quality of Domino’s business model and why investors have been consistently willing to pay a premium valuation for the stock.

Domino’s Valuation Remains Reasonable

Speaking of Domino’s valuation, I find the stock to be fairly priced. This is why I see further upside from its current levels. To begin with, consensus earnings-per-share estimates forecast growth of 8.4% to $15.89, which I find quite conservative, given the much stronger Q1 earnings-per-share growth. But even if we assume this estimate holds, Domino’s Pizza stock is trading at about 32x this year’s expected earnings.

Given that Domino’s double-digit earnings growth is expected to be sustained for years to come, along with its business model’s qualities and brand value, this multiple appears quite reasonable. For context, DPZ stock has consistently traded at much higher multiples in the past despite similar growth prospects. Thus, I can see shares reaching new highs sooner rather than later from their current levels.

Is DPZ Stock a Buy, According to Analysts?

Looking at Wall Street’s sentiment on the stock, Domino’s Pizza features a Moderate Buy consensus rating based on 16 Buys, 11 Holds, and one Sell assigned in the past three months. At $543.19, the average DPZ stock price target implies 6.2% upside potential.

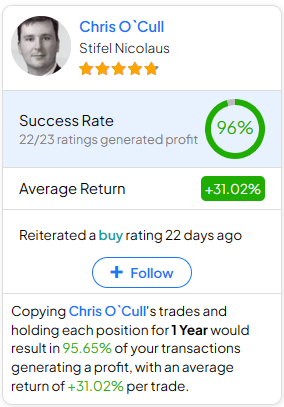

If you’re unsure which analyst to follow to buy or sell DPZ stock, check out Chris O’Cull from Stifel Nicolaus. Over the past year, he has consistently shown outstanding performance, boasting an impressive average return of 31.02% per rating with a success rate of 96%. Click on the image below to learn more.

The Takeaway

In conclusion, I believe that Domino’s Pizza stands poised to achieve new all-time highs in the near future. The company’s ongoing trajectory is undeniably impressive. Domino’s displayed a robust revenue rebound, fueled by new store openings and strong same-store sales growth, along with extraordinary profitability driven by margin expansion.

While the stock trades at a premium valuation, Domino’s potential for continuous double-digit earnings growth makes its current multiple appear reasonable—hence my bullish stance.