Domino’s Pizza Enterprises (ASX:DMP) has earned the TipRanks “Perfect 10” Smart Score tag, joining other ASX recent additions to the group, such as Megaport Ltd. (ASX:MP1), Horizon Oil Limited (ASX:HZN), and Lake Resources N.L. (ASX:LKE).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With the current market volatility, it can be daunting for investors trying to identify the best shares to buy for the long-term. TipRanks provides a variety of tools to help investors with their due diligence. The TipRanks Smart Score tool ranks stocks one-to-10, providing investors with insight into a stock’s performance potential.

A higher score signals a greater chance the stock will outperform market averages. Historically, stocks with a “Perfect 10” Smart Score have exceeded market expectations.

Behind Domino’s rise to the “Perfect 10” smart score list

Domino’s Pizza Enterprises is the Australian operator of the Domino’s Pizza brand restaurants. Based in Queensland, Domino’s Pizza Enterprises is the largest Domino’s Pizza restaurant operator outside the U.S., with a presence in Europe, Asia, as well as Australia and New Zealand.

In a sign of booming business for the global restaurant brand despite recession pressures, Domino’s Pizza Enterprises’ American partner Domino’s Pizza (NYSE:DPZ) reported strong third-quarter sales.

Domino’s Pizza Enterprises share price prediction

The stock has drawn limited appetite from investors in 2022, falling about 50% year-to-date. However, analysts believe the pullback could present an opportunity to buy the dip.

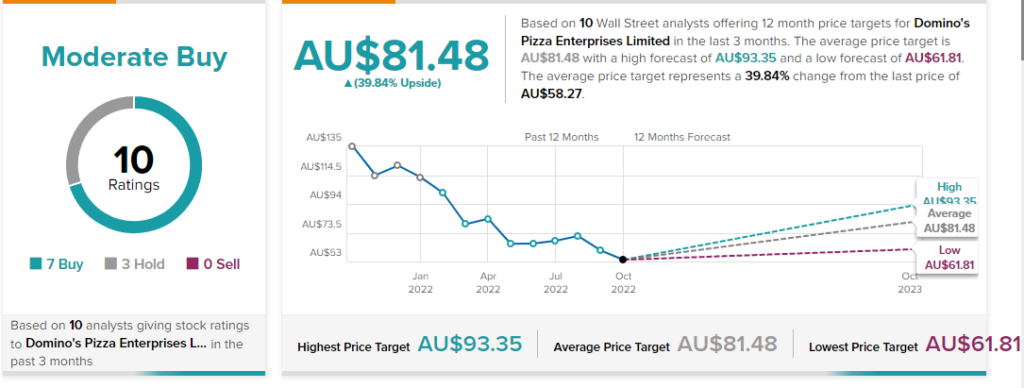

According to TipRanks’ analyst rating consensus, DMP stock is a Moderate Buy based on seven Buys and three Holds. The average Domino’s Pizza Enterprises share price prediction of AU$81.48 implies over 39% upside potential.

Domino’s Pizza Enterprises stock is receiving mostly favourable mentions on financial blogs. TipRanks data shows that financial blogger opinions are 67% Bullish on DMP, compared to a sector average of 68%.