As a discount dollar store operator, Dollar Tree (NASDAQ:DLTR) offers a seemingly relevant business. While optimism may be rising since the nation avoided a recession last year, circumstances such as stubbornly elevated inflation and simultaneously high interest rates pose significant challenges. However, circumstances might not be that bad for consumers to bite the trade-down bullet, the bullet that might help Dollar Tree. Therefore, I’m neutral on DLTR stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Economic Trends Make a Better Case for DLTR Stock

Fundamentally, an investment like DLTR stock benefits from the trade-down effect. Basically, when consumers face financial challenges, they might not go cold turkey on their spending right away. Rather, they trade down to cheaper alternatives until they find an acceptable balance between price and quality. With Dollar Tree offering numerous consumer goods at rock-bottom prices, it’s an attractive proposition during an inflationary cycle.

And certainly, it’s reasonable to make the case that DLTR stock offers a better proposition than it did a year earlier. Despite the broadly appealing nature of the discount retail business, profitability became a concern. Unfortunately, that’s where the discount model becomes a double-edged sword.

Unlike a must-have video game console or smart device, when people shop at bargain outlets, they do so with a primary motivation: low prices. Otherwise, if they were seeking specific brands, they would shop at higher-tier retailers. With a business like Dollar Tree, it’s all about keeping costs low to sustain everyday low prices.

However, in an inflationary environment, costs rise for everyone. And the reality is that Dollar Tree doesn’t really have pricing power. If it raises prices to sustain its pre-inflation margins, consumers will simply shop at competing retailers. Therefore, the dollar store industry is vulnerable to negative feedback loops.

That said, the consumer base may be boxed in due to the tough economic circumstances. For example, last November, Walmart (NYSE:WMT) disclosed its expectations for weak consumer spending for the holiday season. Obviously, that wasn’t what Wall Street wanted to hear, leading to a decline in WMT shares.

As for DLTR stock, with another year of debilitating inflation in the books, relief can’t come soon enough. In hindsight, then, it probably wasn’t too surprising that DLTR began rebounding in October.

However, the Case Might Not be a Good One

Although the case for DLTR stock is arguably more attractive than it was in 2023, it might not necessarily be a good case. Once more economic data comes in, investors will be able to get a better view. Nevertheless, the main challenge for Dollar Tree is that the economy continues to march robustly northward.

It’s not a perfect situation for the economy by any means. However, the December jobs report showed an addition of 216,000 new employment opportunities. Prior to the disclosure, Wall Street anticipated a rise of 175,000 jobs for the month. While consumer prices remain elevated, more people have jobs, enabling mobility within the economy.

Put another way, circumstances aren’t great compared to pre-pandemic norms. However, they’re not nearly bad enough that consumers are barreling down Dollar Tree’s doors. Notably (despite the usual ebb and flow), retail sales at restaurants and other eating places have steadily risen since the pandemic doldrums.

Moreover, this metric was conspicuously flat during the Great Recession. During that time, DLTR stock soared. So, the thesis is clear. Dollar Tree’s proposition has improved because consumers have absorbed significant pain for a long time. However, a level of desperation has yet to hit most consumers, which may explain the broader pensiveness in DLTR.

After all, despite the recent rise in the share price, it’s still down around 8% in the past 52 weeks.

Plus, it’s also conspicuous that Dollar Tree didn’t meet expectations for its third quarter of Fiscal Year 2023 earnings report. While sales landed at $7.31 billion (up 5.4% year-over-year), the figure slipped below the Street’s estimate of $7.4 billion.

Gross Margins Remain a Challenge

As stated earlier, companies like Dollar Tree don’t benefit from pricing power. Instead, they must compete primarily on price lest they go out of business. Ideally, then, the best retailers will keep their gross margins intact. However, that’s not the case for DLTR stock, with its underlying gross margin slowly fading this year.

Naturally, this dynamic presents an issue regarding the stock’s valuation. Currently, DLTR stock trades at 25.75x trailing-year earnings. However, the specialty retail sector features a multiple of 19.05x, If the margins are going to decline, then Dollar Tree isn’t that attractive of a proposition.

Is DLTR Stock a Buy, According to Analysts?

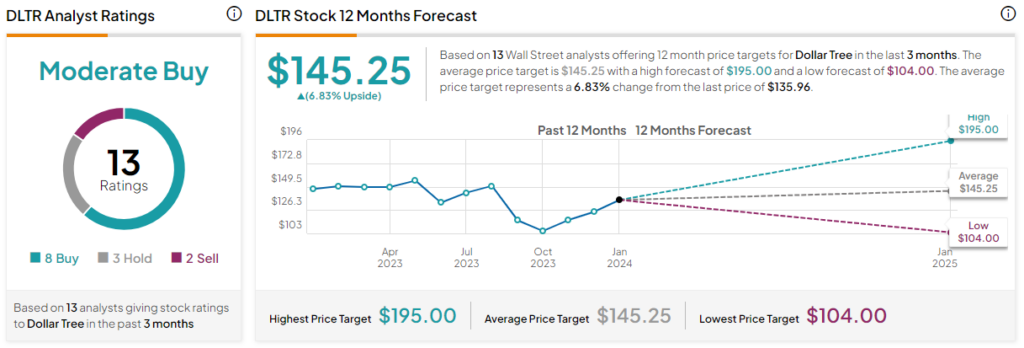

Turning to Wall Street, DLTR stock has a Moderate Buy consensus rating based on eight Buys, three Holds, and two Sell ratings. The average DLTR stock price target is $145.25, implying 6.8% upside potential.

The Takeaway

While DLTR stock might appear attractive based on a tough consumer economic backdrop, the reality is that circumstances aren’t bad enough. People continue to spend on discretionary items, bolstered by a robust labor market. As such, Dollar Tree improved its attractiveness. However, it may not be quite attractive enough for investors at the moment.