DocuSign, Inc. (NASDAQ:DOCU) is the leading provider of electronic signature products globally. In addition to e-signature, the software company helps organizations effectively manage other aspects of their electronic agreement processes, including identity management and data collection. After losing its sheen to falling demand and high costs and expenses in the post-pandemic period, stakeholders’ interest in the stock seems to have subsided considerably.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to TipRanks, the confidence signal of hedge funds is Very Negative on DocuSign. These financial institutions have sold 3.8 million DOCU stock in the last quarter. Also, the top retail investors share the same sentiment about DocuSign. Notably, the top portfolios, with investments in DOCU stock, have decreased by 3.2% in the last 30 days.

It is worth mentioning that shares of this California-based company have decreased 79.4% in the past year. A chart depicting the company’s multi-year price trajectory is provided below.

Factors Affecting DOCU Stock’s Investment Appeal

Loss of business due to weak demand resulting from changing preferences of customers in the post-pandemic period is a concern for DocuSign. Revenue growth rate (year-over-year) decelerated to 45% in Fiscal 2022 (ended January 31, 2022) from 49% in Fiscal 2021.

For Fiscal 2023 (ending January 2023), the company forecasts revenues to be within the $2,470-$2,482 million range. This projection reflects a 17.5% increase (at the mid-point of Fiscal 2023 guidance) from the previous year.

Also, high costs and expenses have adversely impacted DocuSign’s margin profile and profitability. The company’s costs of revenues and operating expenses grew 28.1% and 34.8%, respectively, in Fiscal 2021, while the same expanded by 22.9% and 26% in the first half of Fiscal 2023 (ended July 31, 2022).

DocuSign has planned actions to control its costs and expenses in the second half of Fiscal 2023. Also, it believes that resources saved from cost-control initiatives would help it fund growth investments. It projects gross margin (non-GAAP) to be within the 79%-81% range and operating margin (non-GAAP) between 16%-18% in Fiscal 2023.

It is worth noting that DocuSign reported better-than-expected results for the second quarter of Fiscal 2023. Its adjusted earnings were $0.44 per share, above the consensus estimate of $0.42 per share. Revenues were $622.2 million in the quarter, surpassing the consensus estimate by 3.3%.

For the third quarter of Fiscal 2023 (ending October 2022), the company anticipates revenues in the range of $624-$628 million. The consensus estimate for revenues is $625.4 million. Meanwhile, the consensus estimate for earnings is $0.44 per share for the quarter.

Recently, the company’s Interim CEO and Board Chair, Maggie Wilderotter, said, “We have a $50 billion market opportunity, an industry leading digital agreement platform, strong market position, and an experienced leadership team. I have total confidence our team will successfully deliver for all stakeholders.”

What Is the Price Target for DocuSign Stock?

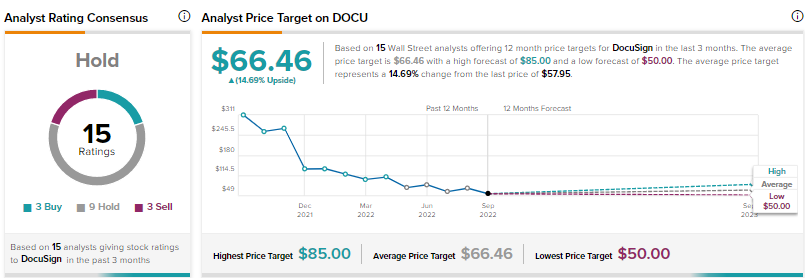

On TipRanks, DOCU’s average price target is $66.46, which reflects 14.69% upside potential from the current level. The highest price target is $85, and the lowest is $50. The company’s market capitalization is $11.6 billion.

Recently, Tyler Radke of Citigroup lowered the price target on DocuSign to $68 (17.34% upside potential) from $90. However, the analyst maintained a Buy recommendation on the stock.

Is DocuSign Stock a Buy, Hold or Sell?

From the above discussion, a wait-and-watch approach to DOCU stock could be a nice idea for prospective investors.

This idea is underpinned by the company’s Hold consensus rating on TipRanks. Of the 15 analysts covering the stock, three gave Buy ratings, while nine assigned Hold and three provided Sell recommendations.

Read full Disclosure