The analysts boast a 100% success rate on their ratings on these two stocks: American automated electronic broker Interactive Brokers Group, Inc. (NASDAQ:IBKR) and Australian coal mining company Whitehaven Coal (OTCMKTS:WHITF) (ASX:WHC).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wall Street analysts conduct thorough research on the economy and companies in their coverage and give recommendations accordingly. Some of their analysis yields a foolproof success rate and impressive returns on calls. Let’s look at both of these companies and these analysts’ stupendous ratings on their stocks.

Interactive Brokers (NASDAQ:IBKR)

Connecticut-based Interactive Brokers specializes in executing and clearing trades in securities, futures, foreign exchange instruments, bonds, and mutual funds.

Analyst Craig Siegenthaler of Bank of America Securities has given consistent Buy calls on IBKR stock since March 2020. Notably, his views have generated an impressive 23.93% average return per call. IBKR stock has gained 22.1% in the past six months.

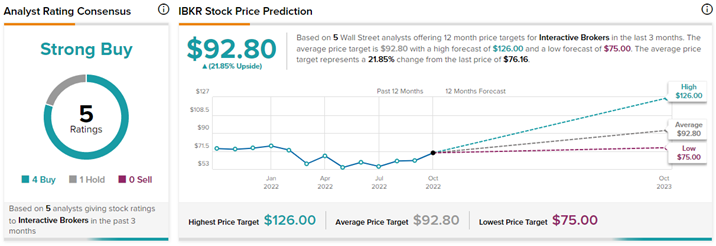

Is IBKR a Good Stock?

With four Buys and one Hold rating, IBKR stock commands a Strong Buy consensus rating. On TipRanks, the average Interactive Brokers price forecast of $92.80 implies 21.9% upside potential to current levels.

Whitehaven Coal Ltd. (OTCMKTS:WHITF) (ASX:WHC)

Sydney-based Whitehaven Coal Ltd. engages in the development and operation of coal mines. Year to date, WHITF stock has skyrocketed 257.81%.

Analyst Rahul Anand of Morgan Stanley has been highly optimistic about Whitehaven Coal stock since October 2020. Anand has given all Buy recommendations on WHITF stock to date. His views have generated a humongous 129.29% average return per call.

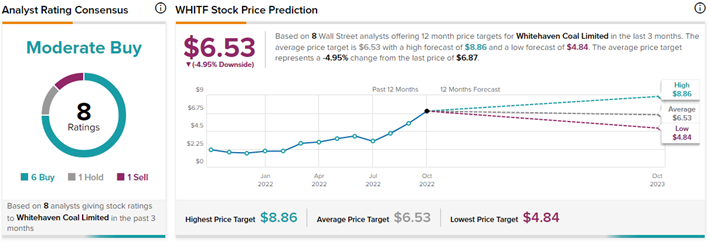

What is the Future of Whitehaven Coal?

Wall Street analysts are split on Whitehaven Coal’s stock trajectory. On TipRanks, WHITF stock has a Moderate Buy consensus rating based on six Buys, one Hold, and one Sell. The average Whitehaven Coal price target of $6.53 implies nearly 5% downside potential to current levels.

Conclusion

From the above details, we can safely say that if an investor had followed either of these analysts’ views on IBKR or WHITF, he or she would have earned similar average returns on their investments to date. Investors may choose to follow analysts’ calls to make informed investment decisions. Notably, TipRanks accumulates the recommendations of several Top Experts, which can be considered while making investment choices to maximize returns.