Investors eyeing reliable passive income could consider investing in top-quality dividend stocks. While several companies have been paying and increasing their dividends, Coca-Cola (NYSE:KO) is a Dividend King, implying it has consistently raised its dividend for over 50 years. Also, KO is a low-beta stock (it has a beta of 0.57), implying it is relatively less volatile than the S&P 500 Index (SPX).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For instance, the graph below shows that KO stock has outperformed the SPDR S&P 500 ETF Trust (SPY) this year. SPY aims to provide returns similar to the S&P 500 index.

Coca-Cola’s Stellar Dividend Payment and Growth

As stated above, Coca-Cola is Dividend King, implying that it has consistently enhanced its shareholders’ value through higher dividend payments. To be precise, Coca-Cola has increased its dividends for 60 years in a row. Moreover, it offers a dividend yield of 2.8%.

The beverage giant paid $7.3 billion in dividends in 2021. Furthermore, it returned about $69.2 billion in dividends between 2010 and 2021. As for 2022, KO has paid $3.9 billion in dividends for the nine months that ended on September 30.

Coca-Cola’s resilient business, strong organic revenue, consistent EPS growth, and solid balance sheet support its higher payouts. Thanks to the strength in its business despite macro headwinds. Its CFO, John Murphy, is upbeat and expects to create “value” for its shareholders through “strong top-line growth, cash flow generation, and dividend growth.”

Is KO Buy or Sell?

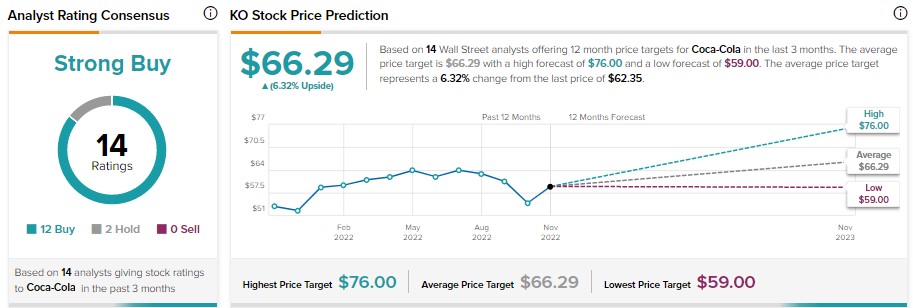

On TipRanks, KO stock has received 12 Buy and two Hold recommendations, translating into a Strong Buy consensus rating. Moreover, analysts’ average price target of $66.29 implies 6.3% upside potential to current levels. Also, Coca-Cola stock sports a Smart Score of nine on TipRanks, indicating a positive outlook.

Bottom Line

Coca-Cola’s resilient business, low beta, high Smart Score, and solid dividend payment and growth history make it an attractive investment to earn reliable passive income.