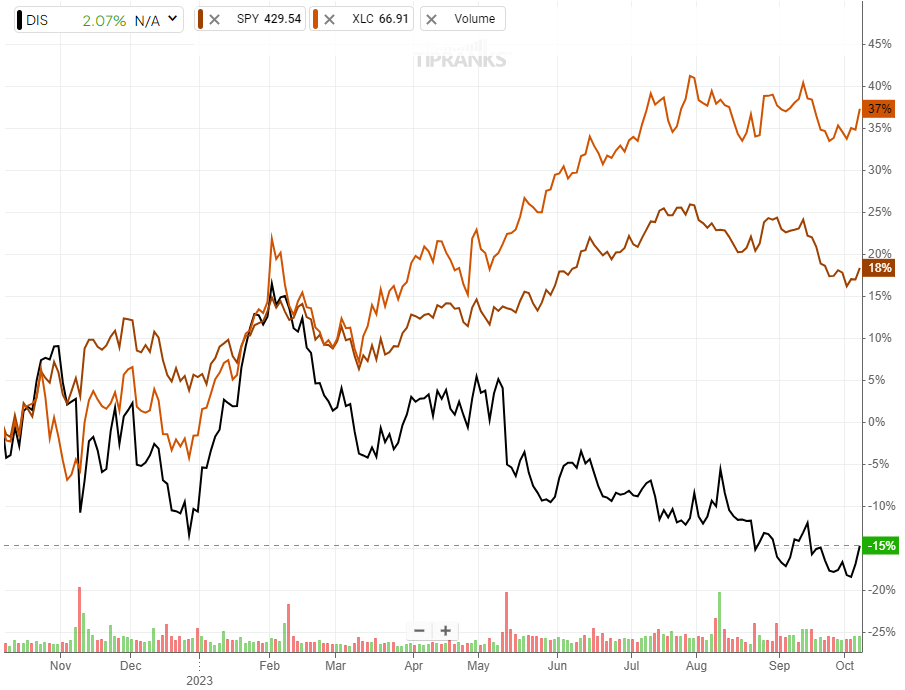

Disney’s (NYSE:DIS) stock is at its lowest in nearly a decade. Despite its powerhouse status, owning Disney+, ESPN, National Geographic, and iconic parks, Disney shares have plummeted to levels not seen since early 2014. Over the past year, the company has underperformed notably, with a decline of 15%, in stark contrast to the S&P 500 (SPX) and the communications sector, which gained approximately 18% and 37%, respectively. With its underwhelming performance likely to persist, I remain neutral on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Slow Fade of Old-School Disney Shows

Disney’s legacy TV channels, like ESPN, Disney Channel, ABC, and National Geographic, used to be a big moneymaker for the company. Even today, Disney’s Linear Networks segment continues to serve as a robust cash cow for the company.

But times are changing, and fewer people are interested in traditional TV. Disney is feeling the pinch, too. In the latest numbers from its most recent third-quarter results, Disney’s revenues from this segment fell by 7% to $6.69 billion. The segment’s operating profit also declined by a worrisome 23% to $1.89 billion.

In the U.S. and Canada, revenues fell by 4% to $5.5 billion due to weaker results at ABC and Disney’s own channels, both of which posted lower advertising revenue. Lower advertising revenue was, in turn, caused by softer average viewership and lower rates. These numbers clearly underscore the overall weakness the broadcasting and cable industry is experiencing.

Internationally, the situation is even worse, with revenues dropping by 20% to $1.2 billion, with similar headwinds adversely impacting its performance. Sadly, following such a steep decline in revenues, the segment also posted an operating loss of $87 million compared to an operating income of $166 million last year.

Consequently, while Disney still makes money from its legacy assets (mainly from the U.S. and Canada), the situation is not looking good for the long term. People are ditching regular TV for alternative options, a trend that is particularly concerning given that Linear Networks comprise around 30% of Disney’s total revenues.

Fun Times at Disney Parks, but Visitation Volumes Could Decline

On a brighter note, Disney’s theme parks are doing well. In the third quarter, revenues from the Parks, Experiences, and Products segment grew by 13% to $8.33 billion. The segment’s operating profit also grew by 11% to $2.43 billion. Higher revenues from Parks were primarily driven by higher visitation volumes at Shanghai Disney Resort and Hong Kong Disneyland Resort. In fact, international parks recorded a massive 94% growth in revenues to $1.53 billion.

Despite this success, I remain cautious regarding Disney’s pricing strategy. Disney has been charging more for everything in its parks, blaming it on prices going up. Given that inflation has slowed down lately, Disney fans might get tired of this trend, which could result in lower visitation volumes. We may have already started seeing the effects of this, as the company experienced a decline in room occupancy and attendance at Walt Disney World Resort in Q2.

Troubles in Disney’s Streaming World

Disney’s streaming service is also facing problems. With consumers battling between so many streaming options like Amazon’s (NASDAQ:AMZN) Prime Video, Netflix (NASDAQ:NFLX), and AT&T’s (NYSE:T) HBO, among other services, it has been hard for Disney+ to grow.

Even though Disney’s Direct-to-Consumer (DTC) revenues grew by 9% to $5.53 billion, the company has yet to achieve profitability. Operating losses from DTC amounted to about $0.5 billion. The higher prices and tough competition caused Disney+ to lose 7% of its subscribers in a single quarter. In particular, Disney+ subscribers fell from 157.8 million in Q2 to 146.7 million in Q3. In fact, this was the company’s third consecutive quarter of declining subscribers.

This is terrible news, especially when you see that even Netflix, which has been around longer, keeps adding more subscribers. Thus, even the part of Disney that’s supposed to reinvigorate its growth is failing in relative terms. Therefore, it comes as no surprise that Disney investors have grown frustrated with holding the stock. Currently, there isn’t a singular segment within the company that presents an exhilarating outlook for the future.

Is DIS Stock a Buy, According to Analysts?

Regarding Wall Street’s view on the stock, Walt Disney features a Moderate Buy consensus rating based on 17 Buys, five Holds, and two Sells assigned in the past three months. At $106.16, the average Disney stock forecast implies 25.3% upside potential.

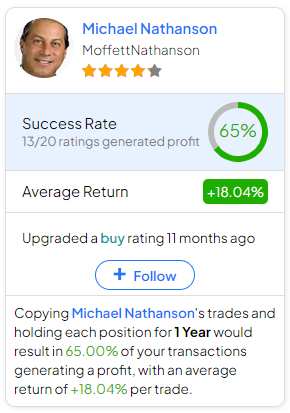

If you’re wondering which analyst you should follow if you want to buy and sell DIS stock, the most accurate analyst covering the stock (on a one-year timeframe) is Michael Nathanson from MoffettNathanson, boasting an average return of 18.04% per rating and a 65% success rate.

The Takeaway

To sum up, Disney’s ongoing struggles across virtually all of its segments paint a challenging picture for the entertainment giant.

Its legacy TV channels face a decline in revenues and operating profits, a trend that is likely set to persist in the coming years. Its theme parks offer a bright spot, yet concerns linger about the viability of increased pricing. In the meantime, its DTC segment’s losses hold the company back, as Disney+ faces stiff competition, resulting in consecutive quarterly declines in subscribers.

As investors grow uneasy with Disney’s investment case, it’s likely that the stock will stay under pressure regardless of whether it looks cheap on paper.