All eyes are on Walt Disney (NYSE:DIS) now, as the company just posted its quarterly earnings results. DIS stock is definitely worth a look, but don’t look for magic in Disney’s financial results. I’m bullish on the stock because Disney’s streaming income, a crucial part of the company’s business in the 2020s, is showing improvement.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Disney is a well-known provider of theme parks, films and television programming, toys, streaming services, and more. After the COVID-19 pandemic, however, Disney’s theme parks became less important, and the company’s streaming services, such as Disney+, came into focus.

Still, it’s important to get a full-picture view of Disney’s quarterly results before making any investment decisions. With that in mind, let’s how Disney stacks up against Wall Street’s expectations for this iconic entertainment brand.

Disney’s Results: Not Spectacular but Good Enough

There’s an old saying in the financial markets which goes like this: the first move is the wrong one. In other words, after a significant event such as a highly-anticipated earnings event, don’t jump into a trade too quickly because the first share-price move might be a head-fake. This turned out to be the case with DIS stock immediately after the company released its second-quarter 2023 earnings results.

Disney stock quickly dropped, but after an hour had passed, it was up several percentage points in after-hours trading. Again, the first move is often the wrong one. Most likely, financial traders were disappointed with some of Disney’s data points but pleased with other ones, so they needed time to digest the results.

Starting with the top-line results, Wall Street called for Disney to report revenue of $22.51 billion. The actual result was $22.33 billion, which might be a letdown to some investors, but really it’s a very slight miss. Therefore, I wouldn’t make a big deal about this. Besides, Disney’s revenue grew by 4% year-over-year, which is decent.

Turning to Disney’s bottom-line results, the company reported adjusted (i.e., excluding certain items) diluted Q2 2023 EPS of $1.03. That’s moderately lower than the $1.09 per share that Disney posted in the year-earlier quarter, but it also beat the consensus EPS estimate of $0.96.

Disney Demonstrates Improvement in a Key Area

So far, Disney’s quarterly results aren’t great, and it’s easy to see why traders might have sold DIS stock at first. Yet, bear in mind that streaming services are vital to Disney’s business nowadays. In that area, Disney posted results that probably caused some shareholders to breathe a sigh of relief.

It requires a little bit of “reading between the lines” to find Disney’s streaming segment sales and income for Q2. Under the results for Disney’s Media and Entertainment Distribution segment, you can find the sub-segment known as Direct-to-Consumer. This includes Disney’s streaming services (I don’t think the company’s management is deliberately trying to hide its streaming results, but it might require a trained eye to find them).

Here’s the scoop. Disney generated $5.525 billion in Direct-to-Consumer revenue, up 9% year-over-year. That’s probably better than some investors expected. Furthermore, Disney’s Direct-to-Consumer segment incurred a quarterly operating loss of $512 million.

If that sounds like bad news, it’s actually not. In the year-earlier quarter, Disney sustained a $1.061 billion operating loss in its Direct-to-Consumer segment. Hence, the company’s Q2-2023 result in this segment shows a 52% improvement on a year-over-year basis.

Is DIS Stock a Buy, According to Analysts?

On TipRanks, DIS comes in as a Moderate Buy based on 13 Buys, six Holds, and two Sell ratings assigned by analysts in the past three months. The average Disney stock price target is $115.11, implying 31.6% upside potential.

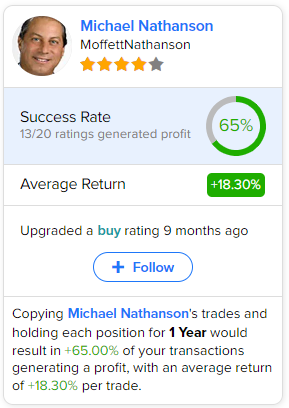

If you’re wondering which analyst you should follow if you want to buy and sell DIS stock, the most accurate analyst covering the stock (on a one-year timeframe) is Michael Nathanson of MoffettNathanson, with an average return of 18.3% per rating and a 65% success rate. Click on the image below to learn more.

Conclusion: Should You Consider DIS Stock?

I’m not going to claim that Disney’s streaming segment is as good as it needs to be. Hopefully, Disney will continue to demonstrate improvement in this area during 2023’s third and fourth quarters.

That remains to be seen, but for now, Disney has avoided disaster, and DIS stock traders are in a good mood. All in all, I’d say it’s fine for investors to consider a small position in Disney shares in anticipation of further improvement in the company’s streaming segment and other divisions.