It’s amazing how a dividend hike and some positive quarterly results can dramatically change the outlook for a company. Far from being a “Magnificent Seven” darling of the market, Walt Disney (NYSE:DIS) looked like an old, flailing company with a dim future last year. However, Disney might turn out to be the comeback story of 2024, and I am definitely bullish on DIS stock today.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Disney is an international provider of theme parks, films and television programming, toys, streaming services, and more. While Disney’s theme-parks business certainly suffered during the onset of the COVID-19 pandemic, it’s the company’s unprofitable Streaming business that has bothered some investors in recent quarters.

Not only that, but a famous activist investor has practically been breathing down Disney’s neck, trying to make changes to the company’s board of directors. That’s a lot of pressure for Disney to deal with, but perhaps a glance at the company’s latest developments – including an arrangement with a pop star you’ll surely recognize – will put the worry warts’ minds at ease.

A Whole Lot Going on at Disney Lately

It’s funny to consider that DIS stock was once considered a boring safety stock that hardly moves. Lately, Disney has actually been an exciting company with notable developments, and, as you may have noticed, the stock price has been moving quickly to the upside.

Let’s start with the elephant in the room, an activist investor named Nelson Peltz. It’s probably fair to say that Peltz isn’t the world’s biggest fan of Disney CEO Bob Iger. In an ongoing corporate soap opera, Peltz has been attempting to shake up Disney’s board of directors and get a seat on that board for himself.

As you might expect, Iger hasn’t just handed over a board seat to Peltz. It will be easier for Iger to resist Peltz’s pressure if Disney’s financial results improve — but more on that topic in a moment.

Quick — what do Peltz and pop superstar Taylor Swift have in common? The answer is that they’ve both been in the headlines recently in connection with Disney. Specifically, Disney will soon premiere Swift’s The Eras Tour concert film on the company’s Disney+ Streaming service. This is important because Disney’s Streaming segment hasn’t been profitable, so maybe Swift’s film can bring swift revenue to the company.

In addition, Disney’s streaming unit might get a substantial boost from a new partnership between Disney subsidiary ESPN, Fox (NASDAQ:FOX), and Warner Bros. Discovery (NASDAQ:WBD). These companies are joining forces to create a sports-focused streaming platform. So again, there’s another opportunity for Disney to improve its streaming division’s top and bottom lines.

Closing the Gap and Hiking the Dividend

As notable as the Swift news and the sports-streaming partnership are, these aren’t the only reasons why DIS stock jumped 6% in after-hours trading on Wednesday. Surely, the market also took notice of Disney’s earnings for its first quarter of Fiscal Year 2024, along with an excellent opportunity for passive-income investors.

Here are the basics. In Q1 FY2024, Disney generated revenue of $23.5 billion, just slightly missing analysts’ consensus estimate of $23.8 billion. Moreover, Disney’s quarterly adjusted earnings of $1.22 per share easily beat Wall Street’s consensus estimate of $0.99 per share.

Here’s the best part, though. Disney’s Streaming segment’s net loss narrowed considerably from $984 million in the year-earlier quarter to $138 million in Fiscal Q1 2024. Furthermore, Disney’s management assured, “We continue to expect to reach profitability at our combined streaming businesses in the fourth quarter of fiscal 2024.”

Finally, Disney’s board announced that the company’s next dividend payment will be $0.45, which is 50% higher than the previous dividend distribution. Hence, passive-income investors might want to get on board and consider a dividend-reinvestment strategy with DIS stock.

Is Disney Stock a Buy, According to Analysts?

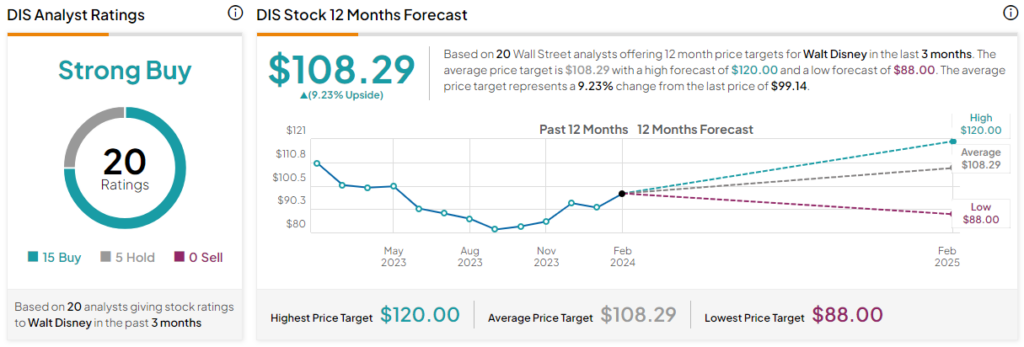

On TipRanks, DIS stock comes in as a Strong Buy based on 15 Buys and five Hold ratings assigned by analysts in the past three months. The average Disney stock price target is $108.29, implying 9.2% upside potential.

Conclusion: Should You Consider Disney Stock?

What’s the best way for Disney to keep activist investors off of its back? The answer is to make the shareholders happy with good earnings results and to offer the hope of closing the profitability gap in Disney’s Streaming segment.

Along with all of that, investors should consider Disney’s boosted dividend, the Swift film being added to Disney+, and the new partnership that could make Disney’s ESPN a go-to source of sports-streaming content. Consequently, I believe this is a perfect time to think about adding DIS stock to your portfolio.