Media and entertainment giant The Walt Disney Company (NYSE:DIS) is scheduled to announce its fiscal first-quarter earnings after the market closes on February 7, 2024. The quarterly performance might have benefited from strong demand for its international and domestic theme parks and ongoing cost-control measures. However, the loss of subscribers in the Direct-to-Consumer segment and weak TV advertising revenues may impact results to some extent.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

DIS – Q1 Expectations

Wall Street expects Disney to report revenue of $23.71 billion in Q1, marginally higher than the prior-year quarter’s sales of $23.29 billion. The recovery in the theme park business owing to new attractions might have aided top-line growth.

Meanwhile, analysts expect DIS Q1 earnings to remain flat at $0.99 per share. The benefits from the company’s strategic steps to curb costs and streamline operations are likely to have been offset by weak TV advertising revenues and a lower subscriber base.

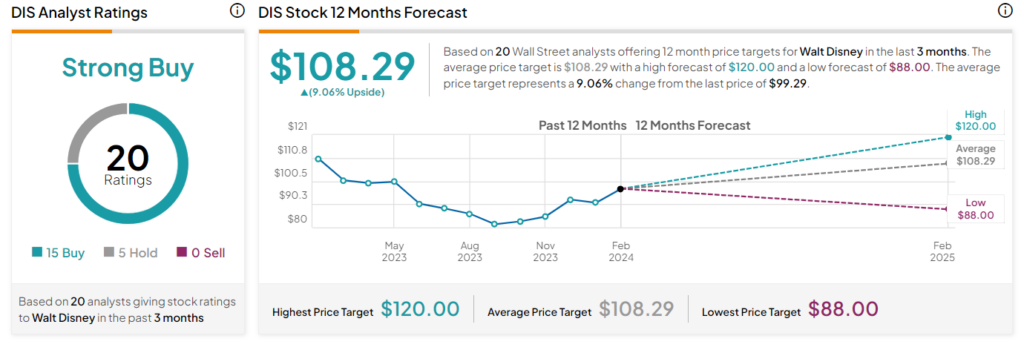

Analysts’ Ratings

Ahead of the company’s Q1 earnings announcement, Citi analyst Jason Bazinet reiterated a Buy rating on Disney stock with a price target of $106 (6.8% upside potential). The analyst expects a strong revenue performance from Disney’s Domestic Parks in the upcoming quarter.

Also, Deutsche Bank analyst Bryan Kraft reaffirmed a Buy rating and raised the price target on Disney to $116 (16.8% upside) from $115.

Recent Update

Yesterday, actress Gina Carano filed a lawsuit against Disney and its subsidiary, Lucasfilm, a film and television production company. Carano claims that she was unfairly fired from the television show “The Mandalorian” in 2021 due to her social media posts that received public backlash.

It is noteworthy that Carano is receiving financial support from Elon Musk‘s social media platform, X, for her case against Disney.

Is Disney a Buy, Sell, or Hold?

Of the 20 analysts covering DIS stock, 15 have a Buy rating and five assigned a Hold rating in the past three months. Overall, DIS comes in as a Strong Buy. The average Disney stock price target stands at $108.29, implying an upside potential of 9.1%. Shares are up 17.8% over the past three months.

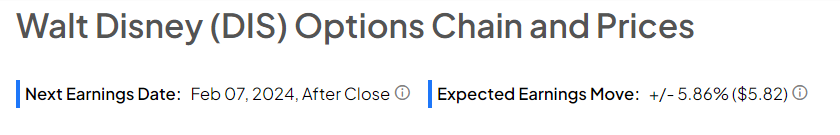

Insights from Options Trading Activity

While analysts are sidelined about DIS stock, options traders are pricing in a +/- 5.86% move on earnings, smaller than the previous quarter’s earnings-related move of 6.92%.

Learn more about TipRanks’ Options tool here.

Bottom Line

The company’s efforts to improve its theme parks and streaming services are likely to attract more customers. Furthermore, Disney’s new measures to crack down on password sharing for its streaming services, including Hulu, Disney+, and ESPN+, might support subscriber growth in the near term.