In less than two weeks, we’ll take a short break from trading to celebrate the New Year. It’ll be a chance to catch our collective breath as the holiday season ends before getting back into the rough and tumble of the ordinary market runs. What will happen in 2024, we can’t say now; one thing is certain, however, and that’s the need to find the right stocks to build a winning portfolio.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Finding those stocks is a challenge. The markets are made up of thousands of traders, dealing in thousands of shares – and they make millions of trades every day. The volume of data is enormous and itself presents a barrier to the retail investor.

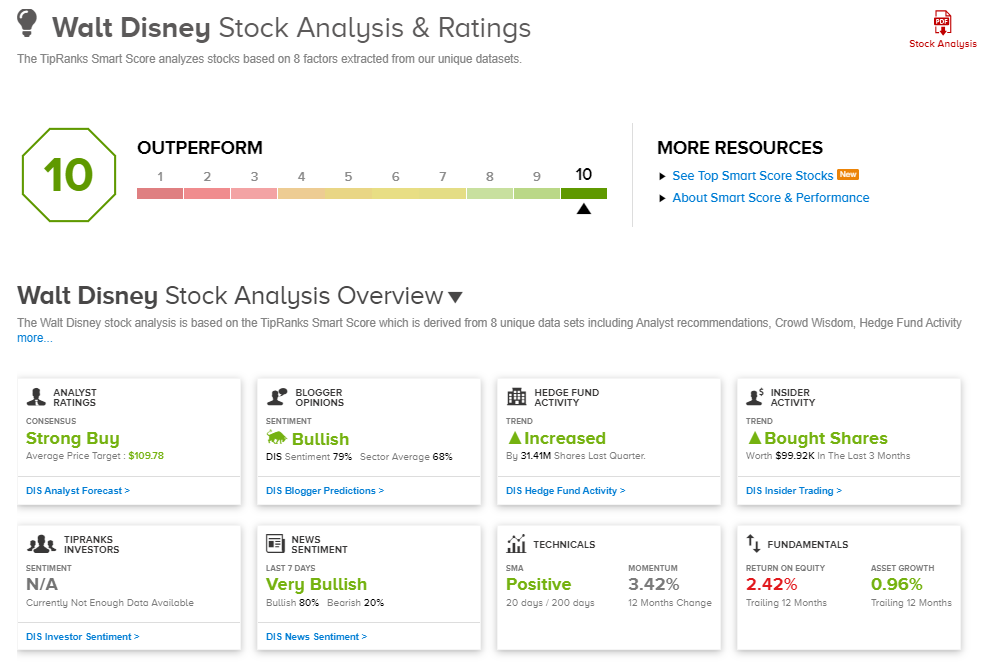

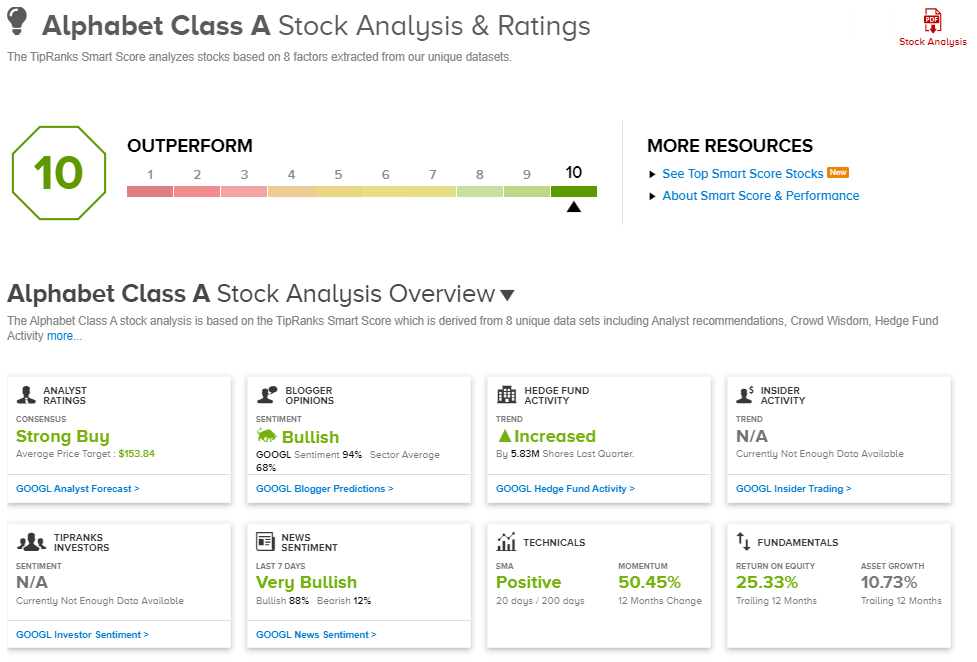

How to sift through the reams of information put out by the stock market? The TipRanks’ Smart Score can make sense of the data, using its AI and natural language algorithm to gather and collate the market data and to rate every stock against a set of factors that are proven to correlate with future share outperformance. Every stock gets a simple rating, on a scale of 1 to 10 – and the ‘Perfect 10s’ show the stocks that are lined up for gains in the next 12 months.

So we can follow the Smart Score and look for Perfect 10s, as a sound way to find perfect ideas for 2024’s portfolio. Follow this lead, and you’ll find plenty of big names – iconic brands and market giants, like Disney (NYSE:DIS) and Alphabet (NASDAQ:GOOGL). We’ve opened up the TipRanks database to find out what Wall Street thinks of these stocks.

Walt Disney

We’ll start with Disney, one of the world’s best-known names. The company was founded 100 years ago, in 1923, and quickly built a reputation for making quality animated films. In 1928, Disney released its first sound film, an animated short spot called Steamboat Willie, that featured a new character named Mickey Mouse. From that point forward, Disney’s history is marked by its significant achievements.

That history has built up, for Disney, one of the world’s greatest archive libraries of movies – animated films, live-action, children’s films, computer animation, short spots, and full-length features – and created a host of iconic characters, songs, and associated marketing.

The company’s business today is split into three main segments. Disney Entertainment includes the entertainment media and content-related businesses, including Disney Studios, Disney Streaming, and Disney Platform Distribution, as well as the full archive of Disney-owned films, which includes such major acquisitions as Star Wars and the Marvel Cinematic Universe. The company’s second division is ESPN, which covers Disney-owned sports content and products, including sports experiences. Finally, Disney Experiences covers the company’s eponymous theme parks in California and Florida, as well as its cruise line, international theme parks, and consumer products, games, and publishing.

Early in November, Disney released its financial results for the final quarter and full year of its fiscal year 2023. For the quarter, the company showed a top line of $21.2 billion, up 5% year-over-year but $170 million below expectations. The bottom line, the non-GAAP earnings per share figure of 82 cents, was 11 cents ahead of the forecast. For the full fiscal year, Disney’s revenue was reported as $88.9 billion, up 7% y/y, and the EPS came to $1.29 per diluted share; this was down 26% from fiscal 2022.

Covering Disney for Deutsche Bank, analyst Bryan Kraft sees plenty of potential for investors to grab onto.

“We remain Buy-rated on Disney and believe the company has turned a corner, shifting from four consecutive quarters of flat to down OI growth, to solidly positive OI growth in F4Q that should continue in F2024 and F2025. While the Theme Parks have been the earnings growth juggernaut of Disney ever since 2022 and continue to be strong, it is DTC (aka streaming) that is raising prices, better managing costs, cracking down on account sharing, and leaning into CTV advertising more aggressively to drive an improving OI trajectory,” Kraft opined.

Kraft’s Buy rating on DIS comes with a $115 price target that indicates potential for a 22% share appreciation over the next 12 months. (To watch Kraft’s track record, click here)

Overall, Disney gets a Strong Buy consensus rating from the Street, based on 22 recent analyst reviews that include 17 Buys and 5 Holds. The stock is currently trading for $93.93, and its $109.78 average target price suggests ~17% upside on the one-year time-frame. (See Disney stock forecast)

Alphabet

The second stock we’ll look at is Alphabet, the parent company of Google, and one of the tech world’s major players. While Google is busy dominating the online search and ad sectors, Alphabet’s other subsidiary companies include the world’s largest online video search engine and playback platform, YouTube, as well as the AI research venue Deep Mind, the autonomous vehicle company Waymo, and the drone-based air-freight delivery venture Wing. Alphabet is even entering the world of generative AI with its Bard chatbot.

Alphabet is one of the Big Tech names that has been driving market gains in recent months. The company is also the third-largest publicly traded firm on Wall Street and one of the world’s handful of trillion-dollar-plus companies; Alphabet boasts a market cap of $1.72 trillion. Google, its largest segment, dominates the important online search and advertising business and is the primary revenue generator for the company as a whole.

That revenue is substantial – it came in at more than $282 billion last year. Alphabet’s most recent quarterly report, for 3Q23, showed a solid top line of nearly $76.7 billion, for an 11.1% year-on-year gain and beat the Street’s expectations by an impressive $980 million. Of the quarterly revenue, Google’s Search segment accounted for $44 billion, or 57.4% of the total.

At the bottom line, Alphabet recorded a diluted EPS of $1.55, 10 cents per share better than had been anticipated – and significantly higher than the $1.06 EPS reported for the third quarter last year.

Alphabet is part of Tigress Financial’s coverage universe, and 5-star analyst Ivan Feinseth takes an upbeat position on the stock. Starting with GOOGL’s capacity for growth and moving on to the company’s AI position, Feinseth sees reason for investors to buy in.

“GOOGL should see a significant reacceleration of revenue growth in Q4 of this year and accelerate further in 2024 and beyond, driven by increasing monetization results due to ongoing AI integration and capabilities that will drive increasing product optimization and growth, especially in Search and YouTube… GOOGL’s ability to increase its Return on Capital (ROC) will continue to drive growing Economic Profit and greater shareholder value creation… We reiterate our Strong Buy rating on GOOGL and… believe further upside in the shares exists,” Feinseth noted.

That Strong Buy rating is complemented by a $176 price target that shows Feinseth’s confidence in a 29% potential upside for the next 12 months. (To watch Feinseth’s track record, click here)

The Street as a whole is also bullish; Alphabet stock has a Strong Buy consensus rating based on 32 recent reviews, with 26 Buys and 6 Holds. The average target price here is $153.97, suggesting an upside of ~13% from the current trading price of $136.65. (See Alphabet stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.