There’s nothing better than a beaten-down stock that’s rebounding, right? Yet, when it comes to Dish Network (NASDAQ:DISH) stock, what you’re seeing today is likely only a dead-cat bounce. Dish Network is a satellite television provider. A polite commentator would call this a “legacy” business in a world where streaming dominates the home entertainment market. Really, though, Dish Network is basically a dinosaur that’s in peril of becoming extinct unless the company drastically changes its business model.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It’s impressive that Dish Network was profitable for a long time, but the company is currently in trouble, and I’m definitely bearish on DISH stock.

Usually, I like to root for underdogs in the financial markets. When it comes to Dish Network, however, I see trouble ahead and hope that overeager traders don’t get head-faked by today’s price move in Dish Network stock.

A Few Warning Signals Before the DISH Stock Crash

DISH stock gained about 2.3% today and was up more at one point. Let’s put this in context, though. The stock is down sharply over the past week, month, year, and decade.

Of course, this has something to do with Dish Network being in the moribund satellite television business. Nevertheless, some brave/heedless folks may have tried to buy the dip in Dish Network along the way, with poor results, unfortunately.

Even before yesterday’s trash-tastic earnings report, there were signs that all was not well with Dish Network. For instance, Citigroup (NYSE:C) analyst Michael Rollins slashed his price target on DISH stock from $9 to $6.

Along with high borrowing rates, Rollins cited an “ongoing expectation that Dish needs more than $7B of incremental capital through 2025 to fund its network investments and upcoming debt maturities.” That’s a deep financial hole that Dish Network will have to dig itself out of, and higher-for-longer interest rates won’t make it any easier.

Another warning signal was Dish Network’s announcement that the company has agreed to sell its DISH spectrum assets in Puerto Rico and the U.S. Virgin Islands. Sure, this will give Dish Network a quick capital infusion from the sale, but the company will lose approximately 120,000 pre-paid mobile subscribers in those markets.

Besides, the aggregate asset-sale price of $256 million will only be a drop in the bucket compared to the $7 billion or more of “incremental capital” that Dish Network will need, according to Rollins’ aforementioned estimate.

On top of all that, Dish Network revealed through a regulatory filing that W. Erik Carlson plans to step down from his roles as president and CEO, effective November 12. The company chose to issue the press release for this disclosure yesterday, the same day as Dish Network’s third-quarter 2023 earnings release. Isn’t that just wonderful?

Even Dish Network’s Shareholders Can Have a Good Day Sometimes

Generally speaking, a stock won’t go straight down to zero even if the company is in real trouble. Hence, I would interpret today’s rebound in DISH stock as a head-fake or, to use the bizarre but popular term, a dead-cat bounce.

This type of bounce is common after a rough day. Yesterday was certainly rough for Dish Network and its shareholders, as the company published a set of Q3-2023 results that could only be described as disappointing.

I’ll acknowledge that Dish Network was (believe it or not) profitable for quite a while. However, Dish Network just swung from positive net income to a loss with its most recently released set of quarterly earnings data. To be more specific, the company posted a Q3-2023 loss of $0.26 per share. This is substantially worse than the income (not loss) of $0.11 per share that analysts had expected.

Moreover, Dish Network’s revenue declined by 9.7% year-over-year to $3.7 billion in Q3, a result that fell short of Wall Street’s forecast of $3.82 billion. Plus, Dish Network’s net pay-TV subscriber count decreased by around 64,000 in 2023’s third quarter. That’s notable because, in the year-earlier quarter, Dish Network reported a net increase of roughly 30,000 net pay-TV subscribers.

Is DISH Stock a Buy, According to Analysts?

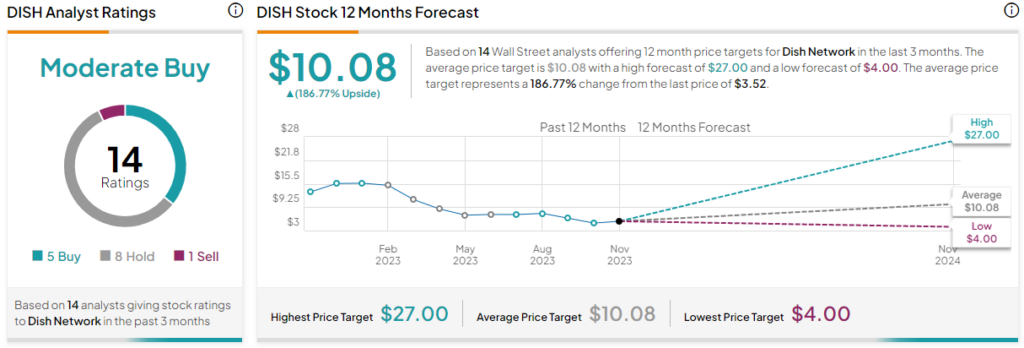

On TipRanks, DISH comes in as a Moderate Buy based on five Buys, eight Holds, and one Sell rating assigned by analysts in the past three months. The average Dish Network stock price target is $10.08, implying 186.8% upside potential.

Conclusion: Should You Consider DISH Stock?

Frankly, even if you like to root for underdogs, Dish Network probably isn’t one to wager your hard-earned money on. Maybe the company can revamp its business model as Nokia (NYSE:NOK) did when it pivoted from outdated cell phones to 5G network connectivity.

I didn’t see any signs of Dish Network attempting to reinvent itself, however. The only things I see are that the company is losing subscribers through an asset sale, suddenly switching out its CEO, and devolving from income-positive to income-negative. So, in case I didn’t make it crystal clear already, I absolutely do not believe that anyone should consider DISH stock.