Here are two healthcare-focused mutual funds with a “Strong Buy” rating. Plus, both these funds have the potential to earn over 15% appreciation in the next twelve months.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The healthcare sector is one of the best-played sectors during economic uncertainty since it is considered a defensive sector. Irrespective of the interest rate or inflationary scenario, people do spend on medicines and related healthcare facilities as they are considered necessities. Companies in this sector are considered value stocks with relatively low-risk profiles but steady returns. Healthcare stocks are generally good long-term investments.

Having said that, there is a huge universe of healthcare companies in the U.S., making the selection of individual stocks a tedious task. Given this scenario, an investor can choose to invest in healthcare-focused mutual funds to ease the process and gain exposure to diversified stocks from the sector.

Fidelity Select Medical Technology and Devices Portfolio (FSMEX)

The Fidelity Select Medical Technology and Devices Portfolio fund invests more than 80% of its funds in companies engaged in the research, development, manufacture, distribution, supply, or sale of medical equipment and devices and related technologies. The FSMEX has a Smart Score of seven, meaning it has the potential to perform in line with market expectations.

As of today’s date, FSMEX has 49 holdings with total assets of $6.60 billion. As the investing strategy suggests, 99.9% of the fund’s portfolio consists of healthcare stocks.

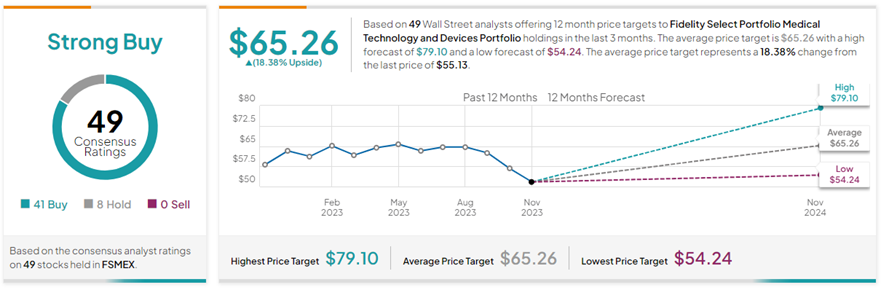

On TipRanks, FSMEX has a Strong Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Of the 49 stocks held, 41 have Buys, while eight stocks have a Hold rating. The average Fidelity Select Medical Technology and Devices Portfolio price target of $65.26 implies 18.4% upside potential from the current levels.

Year-to-date, FSMEX has lost 9.9%. Its top five major holdings include Thermo Fisher Scientific (TMO), Danaher (DHR), Boston Scientific (BSX), Stryker Corp. (SYK), and Penumbra (PEN).

Fidelity Select Health Care Services Portfolio (FSHCX)

The Fidelity Select Health Care Services Portfolio mutual fund invests more than 80% of its funds in companies engaged in the ownership or management of hospitals, nursing homes, health maintenance organizations, and other companies specializing in the delivery of health care services. The FSHCX has a Smart Score of eight, meaning it has the potential to outperform market expectations.

FSHCX has 26 holdings with total assets of $1.59 billion. Notably, 100% of the fund is invested in healthcare sector companies.

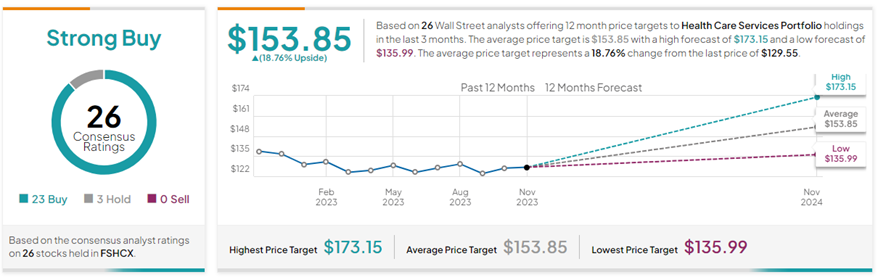

On TipRanks, FSHCX has a Strong Buy consensus rating. This is based on 23 stocks with a Buy rating and three stocks with a Hold rating. The average Fidelity Select Health Care Services Portfolio price target of $153.85 implies 18.8% upside potential from the current levels.

FSHCX has gained 2.4% in the past six months. Its top five holdings are UnitedHealth (UNH), CVS Health (CVS), Cigna (CI), Centene (CNC), and Molina Healthcare (MOH).

Ending Thoughts

Both FSMEX and FSHCX focus on two very different segments of the healthcare sector. Investors can choose from the wide variety of MFs available to park their funds. TipRanks has a host of interesting mutual fund research tools that can help simplify your decision. Importantly, investing in MFs that are focused on the healthcare sector could help you gain exposure to the well-established sector during the current tough macroeconomic environment.