As recently as the 1990s, space exploration and travel were the exclusive domain of national or transnational governments. But in recent years private companies have begun cutting into that governmental dominance – and their encroachment is opening up vistas of opportunity for risk-tolerant investors.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Some estimates put the eventual value – say, by the 2030s – of the private space industry at $1 trillion or more. Potential sectors that investors should watch are space tourism, satellite launching, geospatial imaging, solar power generation, possibly even asteroid mining.

So, let’s take a look at two space stocks, potential winners at two very different ends of this arena. But for all their differences, both are considered Strong Buys on Wall Street, and both offer investors opportunity for triple-digit upside in the coming year, according to TipRanks’ database.

Rocket Lab USA, Inc. (RKLB)

We’ll start with Rocket Lab, a firm working in the space-launch segment and a leader in the development of reusable small-payload launch vehicles. This is a high-potential niche, combining two major trends in orbital space travel – and Rocket Lab has taken a strong position. The company’s Electron rocket, its flagship launch vehicle, is capable of putting a 300 kilogram payload into low Earth orbit, and over the course of 32 launches has successfully deployed 152 satellites. Electron is currently the only reusable small launch vehicle in service, and Rocket Lab is working to supplement its capabilities through development of the larger Neutron rocket – an ambitious program that will see a reusable rocket capable of putting a 13,000 kilo payload into Earth orbit, or carrying 1,500 kilograms to Mars or Venus.

Rocket Lab has been launching its missions from its New Zealand facility, but starting this month it will also be able to launch Electron rockets from US soil. The company has scheduled its first US launch from a launch complex at the Virginia Space Mid-Atlantic Regional Spaceport of the NASA Wallops Flight Facility on January 23. The US launch site will facilitate Rocket Lab’s work with customers from the US, both government and commercial entities. Overall, Rocket Lab hit 9 successful launches in 2022, a company record for one calendar year.

The company’s revenues have been showing consistent quarter-over-quarter gains. In the last reported quarter, 3Q22, the company showed a top line of $63.1 million, for a gain of 14% sequentially – and an impressive 1,093% year-over-year.

Covering this space launch firm for Morgan Stanley, analyst Kristine Liwag describes Rocket Lab as a ‘diamond in the rough,’ and writes: “We see opportunity in the market’s indiscriminate treatment of Space companies and view RKLB’s recent price performance presenting attractive risk / reward proposition for an early space mover with real revenue, an increasingly visible growth profile and initiatives underway that could potentially upend traditional launch economics.”

“Moreover,” the analyst added, “we expect satellite manufacturers’ reduced risk appetite in the current economic environment, along with recent setbacks to global launch capacity, to provide tailwinds to RKLB given its relatively strong space heritage (2nd most launched US rocket). We continue to view RKLB as a small launch standout with exciting potential as Neutron’s development progresses and management makes headway toward long-term profitability goals while upholding its execution track record.”

Liwag doesn’t just write up an optimistic outlook, he backs it with an Overweight (i.e. Buy) rating on RKLB shares and a $10 price target that implies a one-year upside potential of 101% from current levels. (To watch Liwag’s track record, click here)

While the Morgan Stanley outlook is bullish, the Street generally is even more so. Rocket Lab has 7 recent analyst reviews, with a 6 to 1 breakdown favoring Buys over Holds – and the $10.96 average price target implies a 120% upside over the next 12 months, from the current trading price of $4.97. (See RKLB stock forecast)

AST SpaceMobile, Inc. (ASTS)

The second space stock we’ll look at, AST SpaceMobile, is based in Midland, Texas, and like Rocket Lab is closely involved with the private satellite industry. But where Rocket Lab focuses on launch technology, AST focuses on the satellites – and what they can do. Specifically, the company is working on putting satellites into low Earth orbit to provide space-based cellular broadband networking. The company’s goal is to make space-based broadband into the global standard.

AST has achieved a number of important milestones over the past few months. Chief among those was the successful launch and deployment of the company’s BlueWalker 3 satellite. This is a test platform for the technology, and will act as predecessor for the more ambitious constellation of five Block 1 Blue Bird satellites, tentatively set for launch before the end of this year. For now, BlueWalker 3 boasts the largest communications array every deployed on a commercial satellite in low Earth orbit.

In another important milestone, one with a vital impact on intellectual property, AST had, as of November 14 of last year, more than 2,600 granted patents and patent claims pending. In fields as competitive as private satellite launch and broadband networking, the protection of proprietary tech is as important as successfully deploying that tech.

On the financial end, AST reported revenues of $4.17 million in 3Q22, and a gross profit of $1.64 million. These numbers compare favorably to the $2.45 million top line and $347K profit in the prior-year quarter. The company’s net loss per share came to 18 cents.

Deutsche Bank analyst Bryan Kraft has been covering AST SpaceMobile for several years, and is impressed with what he sees. Looking at the company’s recent milestone achievements, he writes: “In our view, AST’s progress with BlueWalker 3 has substantially reduced the technical risks for the business plan. AST’s first satellite was launched into orbit on September 10 and is currently testing various mechanical and technical elements for the system in space for the first time. On November 14, AST confirmed that BW3’s array was successfully unfolded in low earth orbit, which represents a significant testing milestone, in our view.”

“We remain bullish on AST SpaceMobile’s long-term business opportunity given the company’s large TAM, highly differentiated technology, partnerships with many of the world’s largest mobile network operators (MNOs), and attractive wholesale/revenue share business model,” Kraft summed up.

Kraft goes on to give this stock a Buy rating, and a $32 price target to indicate room for a stunning 516% share appreciation in the year ahead. (To watch Kraft’s track record, click here)

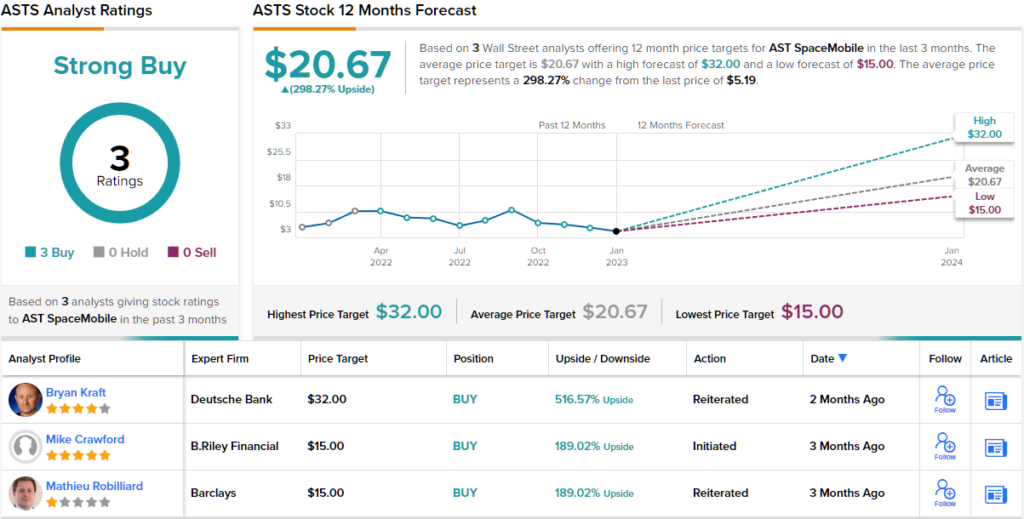

AST SpaceMobile is admittedly still a highly speculative company – but it has picked up 3 recent analyst reviews and they are all positive, making the Strong Buy consensus rating unanimous. Shares are trading for $5.19 and have an average price target of $20.67, suggesting a robust 298% upside on the one-year horizon. (See ASTS stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.