Palantir Technologies (NYSE:PLTR) stock has been on a tear in the last 12 months, up almost 192%. Still, Palantir stock deserves more love as the company’s AI business continues to gain traction amid favorable macroeconomic trends. The company’s aggressive expansion into commercial capabilities is likely to accelerate revenue growth, paving the way for robust earnings growth. I am bullish on Palantir, as there is compelling evidence to suggest that the company is just getting started.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The Commercial Expansion Is Gaining Momentum

In Q4 2023, Commercial revenue grew 32% year-over-year (YoY) to $284 million, while Government segment revenue grew 11% YoY to $324 million. Although the Government segment still accounts for the bulk of revenue, the Commercial segment continues to grow at much higher rates, indicating the strong momentum behind this business segment. This stellar growth is coming on the back of the success of its AI integration platform.

Artificial Intelligence Platform (AIP) “bootcamps” are proving to be effective in expanding the addressable market opportunity of the company. After setting a goal of executing 500 AIP bootcamps within a year in October, the company has already conducted 560 bootcamps involving 465 organizations.

According to the company’s management, these bootcamps have already helped Palantir reduce sales cycles and accelerate customer acquisition. In Q4 2023, the company reported a doubling of new U.S. commercial deals with a value of over $1 million compared to Q4 2022.

To drive Commercial revenue growth internationally, the company has resorted to forming strategic partnerships. For example, Palantir has partnered with Fujitsu to extend its reach in Japan, enabling the company to bring AIP and data integration capabilities to a new geographic location. Another example is the company’s partnership with SOMPO Care, a leading healthcare insurer in Japan, to deliver real-time data to nursing homes and elder care facilities.

Palantir is focused on developing industry-specific solutions to drive the growth of this segment as well. For instance, in the automotive sector, Palantir is focusing on electrical systems manufacturers to help them optimize production. In the manufacturing sector, the company is developing AI-powered disruption management applications to help companies save millions of dollars in losses resulting from the potential disruption of business.

In addition to these sectors, Palantir is expanding into the healthcare, retail, and financial services sectors through strategic partnerships to establish its footprint.

Investments Are Paying Off

Palantir, for many years, has been investing heavily to develop robust platforms and customer acquisition. Today, the company is reaping the rewards of these investments. The fourth quarter of 2023 marked the fifth consecutive quarter of profitability for Palantir. From a net loss of $124 million in Q2 2022, the company has come a long way to report a net profit of $93.4 million in Q4 2023. The growing profitability of Palantir is a testament to the scalable business model of the company.

A closer look at the recent success of AIP reveals this has been possible because of the massive investments committed by the company to developing its core platforms, Foundry and Gotham. AIP, in essence, is bringing the power of these two platforms into a more accessible, commercially viable form.

The company’s close relationship with governments – made possible through substantial investments in its core products – has come in handy to attract large-scale corporate clients in the recent past. Palantir’s expertise in operating software across high-profile government agencies is helping the company take on commercial software implementation in challenging environments, which, in the long run, may prove to be a strong competitive advantage.

Palantir has historically spent large amounts of money on integrating large language models and other AI components into its suite of products, which is proving to be a differentiator today.

Palantir’s Improving Margins

In Q4, Palantir’s adjusted operating margin reached 34%, a substantial improvement from just 22.5% a year ago. Its free cash flow margin also improved to 50%, indicating strong operational efficiency and the ability of the company to convert revenue into cash.

Diving deep into the recent financial performance of Palantir reveals several reasons behind the continued improvement in margins. The growth of the commercial sector, which carries higher margin contracts compared to the government sector, is one major reason behind margin expansion. In addition, economies of scale and the company’s focus on responsible growth have also played a major role in driving margin growth.

Overall, Palantir seems well-positioned for further expansion in margins on the back of the growing contribution to revenue from the Commercial segment. This should enable the company to report record free cash flow in 2024, potentially boosting the stock price.

Is Palantir a Buy, According to Wall Street Analysts?

In early February, PLTR stock jumped more than 20% after reporting strong earnings for the fourth quarter of 2023, resulting in a notable expansion in valuation multiples. This forced HSBC analyst Stephen Bersey to downgrade Palantir while maintaining a price target of $22. The analyst, in a note to clients, acknowledged the positive developments in the U.S. commercial business front and the better-than-expected success of API bootcamps.

Jefferies analyst Brent Thill also struck a bearish note in January, claiming that AI is overhyped today. In summary, he believes Palantir’s valuation has already elevated to unsustainable levels.

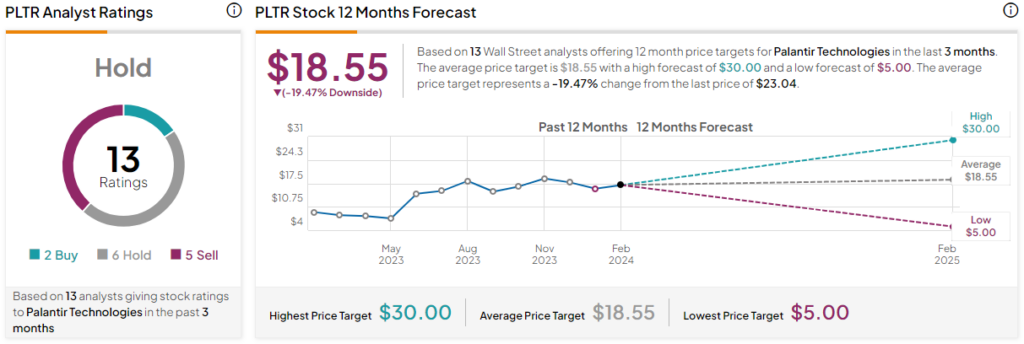

The consensus estimates on Wall Street mirror this pessimism. Based on the ratings of 13 Wall Street analysts, the average Palantir stock price target is $18.55, which implies downside risk of 19.5% from today’s market price. Overall, the stock has a Hold consensus rating.

Nonetheless, despite the expansion in valuation multiples, there is no hiding the fact that Palantir enjoys a long runway to grow. Continued growth in revenue, net income, and free cash flow will support higher stock prices in the long run.

The Takeaway: Palantir Is Not Cheap but Still Attractive

Amid the rapid growth of its Commercial sector, Palantir is well-positioned to hit new financial highs in 2024. The company is likely to emerge as a big winner in the growing adoption of AI across various business sectors. Although analysts believe the valuation is lofty, Palantir stock is likely to trade at much higher prices in the long term when earnings growth accelerates.