Delta Air Lines (NYSE:DAL) is scheduled to announce its first-quarter earnings on April 13, before the market opens. The company’s topline growth during the quarter may have been aided by a high demand for travel and rising airfares.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

It is worth highlighting that Delta’s CEO, Ed Bastian, stated at the J.P. Morgan 2023 Industrials Conference last month that the company experienced strong demand during the first quarter. He highlighted that in the last 30 days, Delta had its 10 best sales days ever.

Also at the conference, the company reaffirmed its expectations for the first quarter. Delta expects earnings in the range of $0.15 to $0.40, while revenue is anticipated to increase by 14-17% in Q1.

Currently, the Street expects Delta to post earnings of $0.31 per share in Q1, against a loss of $1.23 in the prior-year period. Meanwhile, revenue expectations are pegged at $12 billion, representing a year-over-year jump of 28.5%.

Is DAL Stock a Buy or Sell?

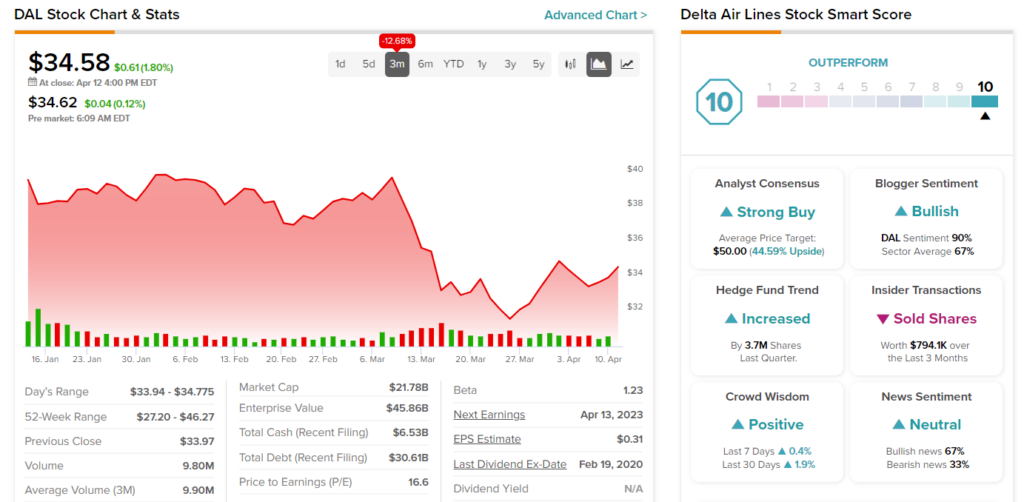

Overall, Delta has a Strong Buy consensus rating based on 10 unanimous Buys. The average DAL stock price target of $50 implies 44.6% upside potential. The stock has tanked nearly 13% in the past three months.

Ending Note

DAL stock boasts a Smart Score of “Perfect 10” on TipRanks, which points to its ability to outperform the market averages. In addition, given the strong domestic travel demand and a promising outlook, Delta Air Lines’ future appears to be bright.