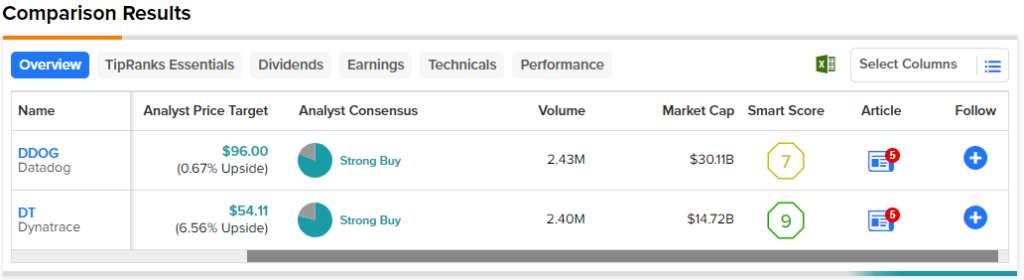

In this piece, I evaluated two cloud stocks, Datadog (NASDAQ:DDOG) and Dynatrace (NYSE:DT), using TipRanks’ comparison tool to determine which is better. Both stocks are up significantly year-to-date, with Datadog up 39% and Dynatrace gaining 37%. However, Datadog is still off 7% over the last 12 months after that tremendous rally, while Dynatrace is up 24% over the past year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Datadog provides a monitoring and analytics platform for developers, information technology operations teams, and business users, while Dynatrace offers a software intelligence platform built for the enterprise cloud.

With such sizable gains year-to-date, some investors might be wondering if any upside is left in either name, so a closer look is in order. To start with, the U.S. software industry is trading at a price-to-sales (P/S) ratio of 10.4, which is in line with its three-year average.

Datadog (NASDAQ:DDOG)

The first red flag for Datadog is its lack of profitability, while the second is its P/S multiple of 18.3, which immediately suggests it’s overvalued. Due to a confluence of current and potential issues, a bearish view looks appropriate for Datadog at this time.

Unfortunately, this stock is driven by the recent hype around cloud stocks and especially artificial intelligence (AI). Investors have inflated a massive balloon around virtually any company that has anything to do with AI, and with Datadog’s lack of profitability, there’s just nothing here worth investing in right now.

Generally, analysts agree that Datadog should record its final annual loss in 2024 and become profitable in 2025, with profits of $321 million. This timeline would require an annual growth rate of 66% over the next two years.

However, Datadog’s revenue growth rate has been shifting, notching 66% in 2020, 70.5% in 2021, and 63% in 2022, which could put that profitability timeline in jeopardy. Additionally, the company’s operating expenses have been slightly outpacing its revenue growth, causing its annual losses to widen to $84 million for the last 12 months.

Finally, Datadog insiders have unloaded over $18 million worth of the company’s shares over the last three months, including a long list of Informative Sells by multiple insiders over the last two to three days. When the insiders are abandoning ship en masse, that’s never a good sign.

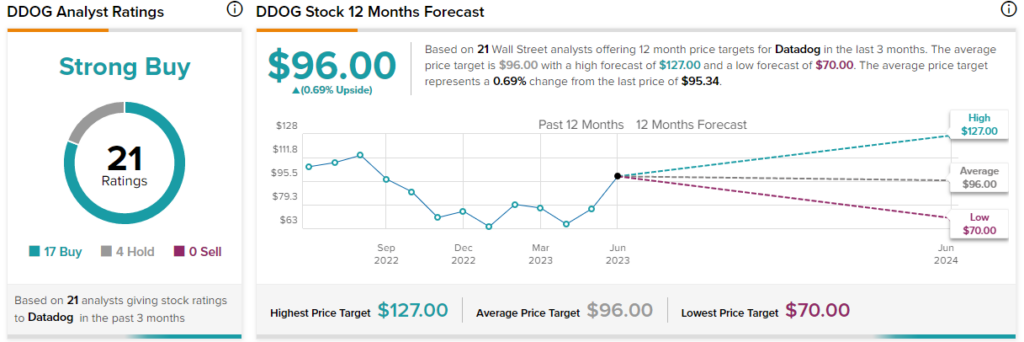

What is the Price Target for DDOG Stock?

Datadog has a Strong Buy consensus rating based on 17 Buys, four Holds, and zero Sell ratings assigned over the last three months. At $96, the average Datadog stock price target implies upside potential of just 0.7%.

Dynatrace (NYSE:DT)

At a P/S multiple of 13.2, Dynatrace immediately looks overvalued. The company hasn’t been growing nearly as fast as Datadog, although its growth is more stable, notching revenue growth rates in the 29% to 32% range over the last three years. Due to these factors and others outlined below, a neutral view seems appropriate for Dynatrace now.

Dynatrace has also benefited from the AI-related hype, but its financial position is far better than Datadog’s. Unfortunately, Dynatrace’s net income margins have been quite low — generally staying in the 6% to 11% range (currently 9.3% for the past 12 months) since the company became profitable in 2021. Most software companies have healthier margins than that, but Dynatrace is still in the early stages.

On the other hand, the company has managed to keep its operating expenses under control, which cannot be said for most technology companies, which saw their expenses explode in 2022. Dynatrace also relies less on stock-based compensation than most tech companies, which also bodes well for its long-term stability.

Notably, however, there was a large insider sale four months ago, including several Informative Sells, right around the last spike before the stock dropped temporarily. Now in early June, we’re seeing another spike in Dynatrace shares, and another large Informative Sell was made two days ago.

Over the long term, Dynatrace could be a nice portfolio addition, but for now, it looks fairly valued.

What is the Price Target for DT Stock?

Dynatrace has a Strong Buy consensus rating based on 15 Buys, four Holds, and zero Sell ratings assigned over the last three months. At $54.11, the average Dynatrace stock price target implies upside potential of 6.5%.

Conclusion: Bearish on DDOG, Neutral on DT

Datadog and Dynatrace both offer cloud-based intelligence platforms with AI-related solutions, but a look at their fundamentals reveals that Dynatrace is in a much better position. While the company looks fairly valued, for now, any significant sell-off could create an attractive entry point.

On the other hand, Datadog is unprofitable and less compelling. A review might be in order for Datadog in two years’ time to see if it’s profitable and whether its financial position has improved at all. However, for now, there’s very little to like about this stock.