Electric Vehicles (EVs) are undoubtedly the future of mobility. Thanks to their growing adoption and favorable government policies, EV stocks could be a highly profitable bet in the long term. While Tesla (NASDAQ:TSLA) is one of the top stocks that investors love, speculative bets like Mullen Automotive (NASDAQ:MULN) also draw a lot of attention.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With secular sector trends, should investors stick to industry leaders like Tesla or allocate some of their funds to companies like Mullen? Let’s dig deeper.

MULN vs. TSLA

Before moving ahead, let’s admit that it will be unfair to compare Mullen against Tesla. One is an EV pioneer with bulging sales and growing profitability. Another is in its developmental stage and has yet to start production and prove its product’s market fit. But before you completely write off Mullen, remember that Tesla was once a little-known company as well.

As for Mullen, a series of positive developments have caught our attention. It secured exclusive sales and distribution rights for Mullen’s I-GO (an urban delivery EV) in select European markets. Further, it got a purchase order of about $200 million (for 6,000 Class 1 EV cargo vans), which is encouraging.

Further, Mullen completed the acquisition of a controlling interest in Bollinger Motors. Also, it acquired the assets of Electric Last Mile Solutions. These acquisitions will help the EV maker move toward production. It’s worth highlighting here that Mullen plans to start the retail production of its electric crossover, the Mullen FIVE, in Q4 of 2024.

As the company is heading towards production, BlackRock (NYSE:BLK) increased its holdings in Mullen Automotive.

While the recent developments pave the way for future growth, a heightened competitive environment, equity dilution, and challenges in accessing capital could hurt its prospects.

What’s the Prediction for Mullen Stock?

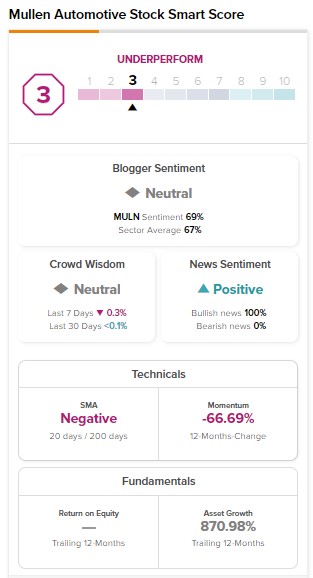

Given the challenges mentioned above and the uncertain economic environment, MULN stock carries a Smart Score of three on TipRanks. This implies that it is more likely to underperform the benchmark index.

On the other hand, TSLA stock commands an Outperform Smart Score of nine, with hedge funds and analysts showing confidence in its prospects.

Bottom Line

Needless to say, Tesla is a clear winner here. Mullen is a pre-revenue company and carries significant risks compared to Tesla. It will have a lot of catching up to do to generate sales. However, MULN is moving in the right direction and could generate explosive returns as the production of its Mullen FIVE starts.

Thus, investors who want to play it safe can consider TSLA stock. Meanwhile, investors with an appetite for high risk can allocate a small portion of their portfolio to MULN stock.