It’s no secret that the tech sector took a pounding in last year’s bearish market. In fact, the tech-heavy NASDAQ index lost more than 33% during 2022, leading the way in the market decline. But savvy investors have long bet that what goes down must come back up.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

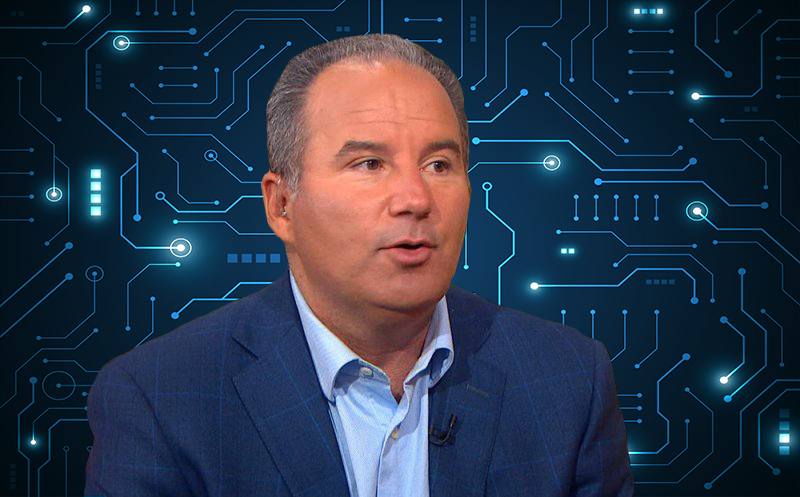

Daniel Ives, Wedbush’s well-known tech bull, sees reasons for hope in the tech sector in 2023. In fact, he sees the sector making a significant bounce, and, at least in part, he credits the current downturn for setting up that possibility: “In this carnage we see growth opportunities as we believe overall the tech sector will be up roughly 20% in 2023 from current levels with Big Tech, software, and semis leading the charge despite the macro/Fed wild cards.”

The 5-star analyst has done more than make a bullish call on the tech market generally; he has also recommended Buy-positions on several tech stocks, particularly in the cloud and software segments, that are well suited to gain in a turnaround. We’ve used the TipRanks platform to pull up the details on two of his picks – turns out both rated Strong Buys by the analyst consensus, too. Let’s dive in.

Alight, Inc. (ALIT)

We’ll start with Alight, a software company in the business process outsourcing niche. Alight has followed the popular as-a-Service model in creating and commercializing its software products, creating a BPaaS offering that gives subscription customers access to cloud-based solutions for managing business processes and analytics, as well as human capital. Alight’s cloud software makes use of AI tech to automate processes, manage risks, and predict needs and opportunities.

In the last few months, Alight has had some developments that should be of interest to investors. First, in November, the company announced a secondary public offering of stock – and sold 23 million shares at $7.75 each. The offering brought in gross proceeds of $178.25 million.

In the second development, in December, the company announced the global expansion of Alight Worklife, its proprietary employee experience platform, by adding a payroll solution to the product. The expansion combines payroll and HR into a single automated platform solution.

On the financial side, Alight’s financial results for 3Q22, the last quarter reported, showed year-over-year revenue gains. At the top line, the company showed $750 million, up 8.7% from 3Q21, while the bottom line came in at 12 cents per adjusted diluted share. This EPS number was down 33% y/y.

In a metric that bodes well for the company, Alight reported BPaaS bookings of $564 million for the first three quarters of calendar year 2022. This was more than 80% of the company’s full-year bookings target, which stands in the range of $680 million to $700 million.

Looking forward, Alight is guiding toward full-year 2022 revenue between $3.09 billion and $3.12 billion, which will represent y/y growth between 6% and 7%.

The fall in earnings has not prevented Daniel Ives from coming down firmly on the bullish side for this stock. He writes, “With over 70% of the Fortune 100 and 50% of the Fortune 500 being Alight customers, we believe that there is still plenty of room to secure more logo wins and continue to cross-sell its diversified product portfolio to its large existing customer base… The company has a significant opportunity to convert its large existing customer base into higher-value BPaaS deals that will help drive up margins over time.”

Quantifying this bullish stance, Ives puts an Outperform (i.e. Buy) rating on Alight shares, and his $13 price target suggests they have room for 49% growth in 2023. (To watch Ives’ track record, click here)

While this stock has only picked up 3 recent analyst reviews, they all agree that it’s one to Buy – making the Strong Buy consensus rating unanimous. Shares are priced at $8.73, and their $12.50 average price target is almost as bullish as Ives allows, implying a one-year gain of ~43%. (See Alight stock forecast at TipRanks)

Zscaler, Inc. (ZS)

The second of Ives’ picks that we’re looking at is Zscaler, a networking security tech firm. The company offers customers access to ‘the world’s largest security cloud,’ the Zero Trust Exchange. Zscaler’s platform allows customers to securely connect apps, devices, and users on any network – and by ensuring network security, improves confidence, simplifies business and online navigation for improved productivity. ZScaler’s Zero Trust Exchange works at various levels, including app-to-app, app-to-user, and machine-to-machine.

Even though Zscaler’s shares are down (the stock lost 67% in 2022), the company has been reporting consistent gains at the top and bottom lines for the past several years. In the last quarter reported, Q1 of FY2023 – the quarter ending on October 31 – Zscaler had total revenues of $355.5 million, up 54% year-over-year. At the bottom line, the non-GAAP EPS more than doubled y/y, from 14 cents in fiscal 1Q22 to 29 cents in fiscal 1Q23.

In addition to sound revenues and earnings, Zscaler also performed on cash flow metrics. The company reported cash from operations of $128.5 million, and free cash flow of $95.6 million. These figures were up 37% and 14% y/y, respectively. The company had $1.824 billion in cash and liquid assets available as of October 31, 2022.

Finally, Zscaler also reported 1.005 billion in deferred revenue as of the end of fiscal Q1. This was up 55% y/y, and indicates a solid backlog of work for the company going forward.

As for the Wedbush view, Ives paints an optimistic picture of Zscaler’s position and path forward, saying of the company: “While macroeconomic factors provide clear uncertainty causing enterprises to become more cautious on strategic moves, ZS is capitalizing on the current market opportunity with customers adopting and innovating to build its pipeline, ultimately mitigating macro pressures and elongating sales cycles… With the rest of the tech industry getting battered by significant macroeconomic pressures, ZS has remained resilient in its market and product strategy, growing with continued success for its zero-trust SaaS applications and cloud workload protection.”

Getting down to the nitty gritty, Ives gives ZS shares an Outperform (i.e. Buy), with a $180 price target to indicate confidence in a 73% gain on the one-year horizon.

Overall, Zscaler has attracted plenty of attention from the Street and boasts 29 recent analyst reviews. These break down 22 to 7 in favor of Buys over Holds, to support the Strong Buy consensus rating. The average price target here is $178.75, practically the same as Ives’ objective. (See Zscaler stock forecast at TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.