Danaher (DHR) is a multinational science and technology innovator focused on supporting its clients to encounter tough challenges while improving the quality of life around the world.

The parent company includes more than 20 fully operating companies, which usually enjoy market-leading positions in the life sciences, diagnostics, and environmental industries.

A fantastic characteristic of Danaher’s companies is that a significant amount of their products and services are being sold on a recurring basis. This allows Danaher to enjoy rather predictable cash flows despite the underlying circumstances in each respective industry it operates.

Danaher’s prolonged operating excellence was once again demonstrated in its most recent results, despite the several hurdles currently challenging global markets. I was previously cautious regarding Danaher’s investment case as, despite its numerous qualities, the stock’s premium valuation could be limiting shareholders’ total return potential.

However, with the general market sell-off carrying away Danaher shares lower, I believe that the stock’s valuation is more or less reasonable now. Thus, I am now bullish on Danaher stock.

Strong Profitability Despite Margin Headwinds

Danaher’s performance continued to impress in its most recent results, with the company delivering double-digit growth despite coming off of last year’s inflated diagnostics results amid the pandemic. For Q1, revenues came in at $7.7 billion, 12% higher year-over-year.

The company’s base business was up 8%, while COVID-19 testing-related products contributed the remaining 4% of growth. It’s noteworthy that COVID-related revenues continued to grow, despite the pandemic easing year-to-date.

Moving forward, I would expect COVID-related revenues to soften, but amid some degree of COVID-19 testing remaining, as well as robust growth in the company’s core businesses, total revenue generation should retain its current record levels.

Moving toward Danaher’s profitability, the company’s operating margin declined by 80 basis points to 28.3%. This was primarily due to year-over-year changes in foreign currency exchange rates and product mix, mainly within the company’s life Life Sciences segment.

In my view, the decline should not only be viewed as not worrisome but even encouraging to some extent. This is due to most companies in the space suffering considerably steeper margin compressions during the first quarter of 2022 amid enduring supply chain bottlenecks. If anything, the company remains very profitable.

Adjusted diluted EPS came in at $2.76, representing a 9.5% increase compared to last year. To put this in perspective, based on 746.3 million shares used to derive this amount, the company achieved an adjusted net income of $2.06 billion, suggesting an adjusted net income margin of 25.8%. This compares with an adjusted EPS of $2.52 on 743.7 million shares last year, implying an adjusted net income of $1.87 billion and an adjusted net income margin of 27.3%.

Thus, while margins were slightly down, Danaher remains a cash cow, with around a fourth of its revenues ending up in the bottom line. Few companies the size of Danaher can boast such margins.

For the full year of 2022, management didn’t modify its previous guidance, which still targets revenue growth in the high single digits. This makes sense, after all, as COVID-related revenues should ease through the rest of the year, as I mentioned earlier. Combined with the ongoing headwinds in margins, adjusted net income growth should also soften in the coming quarters.

Thus, consensus estimates point towards an adjusted EPS of $10.35 for the year, implying year-over-year growth of just around 3%. Still, this should make for a considerably fruitful year considering the overall challenges presently pressuring the profitability prospects of most companies in the industry.

Valuation & Capital Returns

Based on a consensus adjusted EPS estimate of $10.35, Danaher shares are currently trading at a forward P/E of around 24. The company has traded with an average forward P/E in the high 20s over the past five years due to its wide industry moat, high-quality revenues, continuous growth prospects, and unparalleled profit margins.

While the ongoing rising-rate environment justifies the overall compression in multiples we see in equity markets, I believe that Danaher shares do deserve a premium. A forward P/E in the high 20s to low 30s, like previously, could be too pricy.

However, I believe that the current multiple still attaches a premium price tag to the stock amid the company’s unique qualities while still taking into account the ongoing headwinds that could pressure its growth prospects amid the ongoing macro environment.

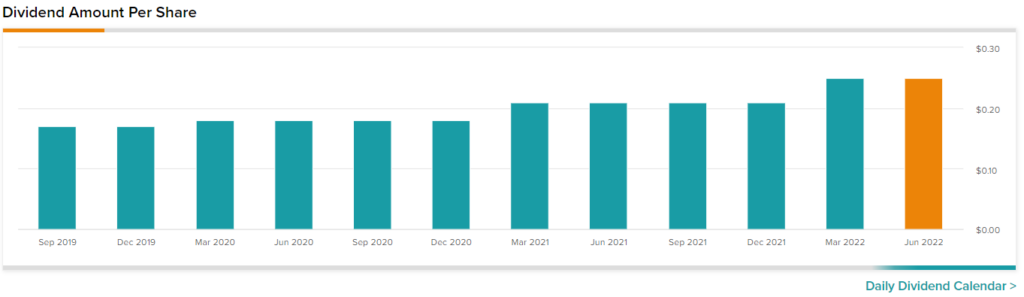

As far as Danaher’s capital returns go, they should only marginally contribute to shareholders’ total return prospects. While Danaher has only grown its dividend since 2013 and has never slashed it since commencing dividend payments in 1993, the current payouts remain rather underwhelming.

Danaher features a five-year dividend per share CAGR of around 11.3%. Yet, the stock yields a tiny 0.4%, and that is despite the stock’s notable correction year-to-date. Thus, shareholders should expect future returns to be in the form of capital gains, as has been the case for Danaher historically.

Wall Street’s Take

Turning to Wall Street, Danaher features a Strong Buy consensus rating based on four Buys and one Hold assigned in the past three months. At $319.13, the average Danaher stock price forecast implies 27% upside potential.

Takeaway

Despite the underlying macro tensions, Danaher continues to deliver robust results, with its outlook pointing toward another highly profitable year. The company’s qualities were once again proven beneficial, with net income levels remaining very juicy despite a modest margin compression.

Following the stock’s correction, the valuation has returned to rather reasonable levels compared to its historical average. Thus, shareholders who were previously on the verge regarding Danaher’s investment case amid valuation worries may find the current buying opportunity rather worthwhile.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure