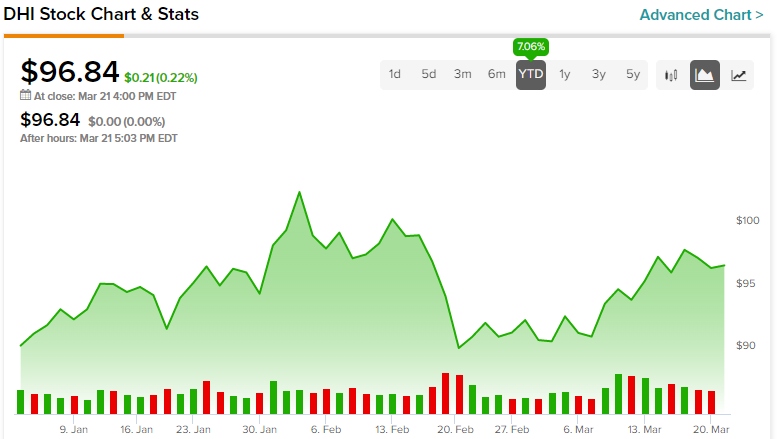

Following a rally at the beginning of the year, the next move for homebuilder D.R. Horton (NYSE:DHI) will likely depend on the Federal Reserve. Adding tremendous complexity to this framework is the recent banking crisis. With global investors on edge, future steps in monetary policy will almost certainly command significant influence. Unfortunately, no good outcome may exist for DHI stock. Therefore, I am bearish.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Economic Backdrop

Amid the failure of SVB Financial Group and Signature Bank due to bank runs, the U.S. government responded quickly. In a joint statement by the Treasury, Federal Reserve, and the Federal Deposit Insurance Corporation (FDIC), the agencies insured the American public that its deposits would be guaranteed. However, the Fed can’t backstop those deposits without opening up its balance sheet.

Subsequently, the central bank implemented inflationary mechanisms to help inject confidence into the banking system. However, at some point, the Fed may need to resume its hawkish strategy to combat stubbornly elevated inflation. If so, this dynamic won’t bode well for DHI stock, as deflationary policies imply an economic slowdown, and slowdowns usually involve mass layoffs.

Unsurprisingly, many market observers believe that the Fed will eschew rising rates in favor of banking stability. After all, controlling inflation won’t mean much if the financial system implodes. With lower interest rates implying lower borrowing costs, home purchasing affordability may rise. Thus, in theory, homebuilders may benefit, thus boosting DHI stock.

DHI Stock Faces Severe Risks, No Matter What

Nevertheless, the problem with inflationary monetary policy centers on transferring affordability problems elsewhere. While borrowing costs may decrease, the prices of homes themselves will probably increase. As well, costs for homebuilders should likewise rise, forcing them to lift prices. With wages historically not keeping pace with inflation, DHI stock may struggle.

So, what if the Fed continues its rate-hiking campaign? More than likely, this circumstance will lower home prices. However, the boost in borrowing costs would mean that fewer prospective homebuyers would qualify for mortgages. Again, stakeholders of DHI stock run into a problem: the affordability gremlin merely shifts from one critical cog in the flywheel to another.

Further, an argument can be made that the Fed’s present monetary tightening strategy broke something in the financial system. Therefore, prominent critics voiced their concerns that more bank runs may erupt. In fairness, this doomsday scenario hasn’t materialized yet. Nevertheless, it may be on the table of realistic possibilities.

Indeed, the banking sector fallout doesn’t just zero in on the U.S. market. Most notably, Switzerland’s Credit Suisse (NYSE:CS) found itself in trouble earlier this week, and UBS (NYSE:UBS) swooped in to take the company over.

In other words, if the Fed continues to raise rates to curb inflation, a soft landing might not be possible. Unfortunately, many people may have to lose their jobs for inflation to normalize. On a net basis, that’s not a positive outcome for DHI stock.

Financials Look Good (for Now)

To be fair, the bearish perspective on DHI stock runs into an objective concrete wall. As circumstances stand now, D.R. Horton looks mighty robust financially. For instance, its three-year revenue growth rate stands at 23.9%. Further, its trailing-year operating and net margins come in at 21.73% and 16.85%. Additionally, its return on equity is 31.7%, reflective of a high-quality business.

Still, these stats reflect past data from the aberrant COVID-19 catalysts. Looking ahead, these factors may diminish substantially in magnitude, posing risks for DHI stock. As an example, DHI appears undervalued based on its trailing earnings multiple of 6.04x. However, against the forward (estimated) earnings multiple of 11.14x, D.R. Horton no longer looks like a great value proposition. From this angle, it’s overvalued compared to the industry median multiple of 8x.

Even worse, no guarantee exists that the homebuilder will hit its forward earnings estimates. If the economy worsens, it could be game over for DHI stock until the next bullish cycle.

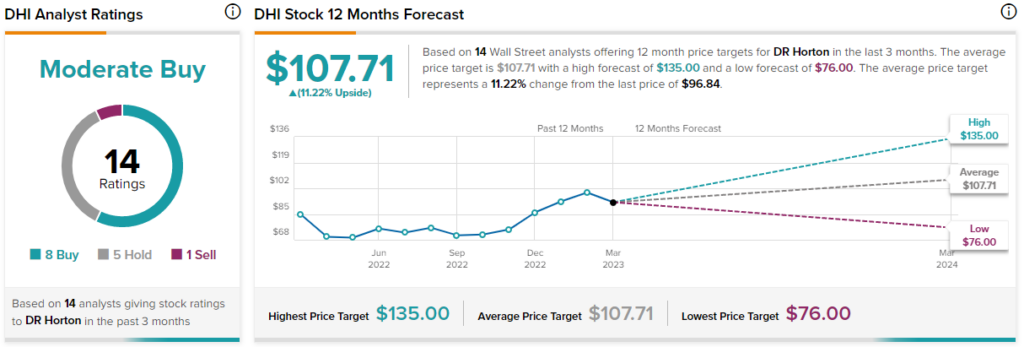

Is DHI Stock a Buy, According to Analysts?

Turning to Wall Street, DHI stock has a Moderate Buy consensus rating based on eight Buys, five Holds, and one Sell rating. The average DHI stock price target is $107.71, implying 11.2% upside potential.

The Takeaway: DHI Stock Faces an Uncertain Future

After the remarkable events of the post-pandemic new normal, the U.S. must pay for the decisions it made to keep the economy afloat. Sadly, this leaves the Fed in a bind. Whether it implements dovish or hawkish policies, the economy may suffer, and that leaves DHI stock with potentially nowhere to run.