In this piece, I evaluated two oil major stocks, Chevron (NYSE:CVX) and Exxon Mobil (NYSE:XOM), using TipRanks’ comparison tool to determine which is better. Both companies are multinational oil and gas companies based in the U.S., with Chevron being the second-largest direct descendent of Standard Oil and Exxon Mobil being the largest direct descendent of it.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Shares of Chevron are off 9.4% year-to-date, but they’re up 12.8% over the last 12 months. Meanwhile, Exxon Mobil shares are down 4.2% year-to-date, although they’re up 19.4% over the last year.

Unfortunately, this isn’t a particularly great time for oil companies. Although oil prices have ticked slightly higher recently, they continue to hover near $80 a barrel for West Texas Intermediate (WTI) crude and $84 a barrel for Brent. As a result, most oil companies have seen their profits decline, so a closer look is in order to see whether the sector has any deals to offer.

Chevron (NYSE:CVX)

Chevron shares have held up well since the company surprised the market by releasing preliminary earnings numbers for the second quarter on Sunday, earlier than expected. Although the company beat consensus estimates, its earnings plunged almost 50% year-over-year to $3.08 per share, but its stock didn’t drop much. The market was largely unfazed because lower oil prices mean lower profits, but history suggests Chevron could be fairly valued currently, calling for a neutral view.

Notably, Warren Buffett bought Chevron shares during the fourth quarter of 2020 when they were trading in the $70 to $80 range. However, he’s been selling those shares in recent quarters, unloading an estimated $6 billion worth of Chevron stock during the first quarter of 2023.

Meanwhile, he’s been adding to his stake in Occidental Petroleum (NYSE:OXY), indicating that he hasn’t soured on the oil space as a whole. Occidental Petroleum is trading at an EV/EBITDA ratio of 4.4, making it immediately cheaper than Chevron with its enterprise value/ EBITDA multiple of 5.4.

While Chevron’s five-year mean EV/EBITDA multiple is 9.3, it benefited from higher oil prices in the past. Meanwhile, Occidental is expected to grow its earnings by 20% this year, twice the growth Chevron is expected to put up.

Finally, like most energy companies, Chevron pays a solid dividend yield of 3.9%, making it a potential long-term dividend play.

What is the Price Target for CVX Stock?

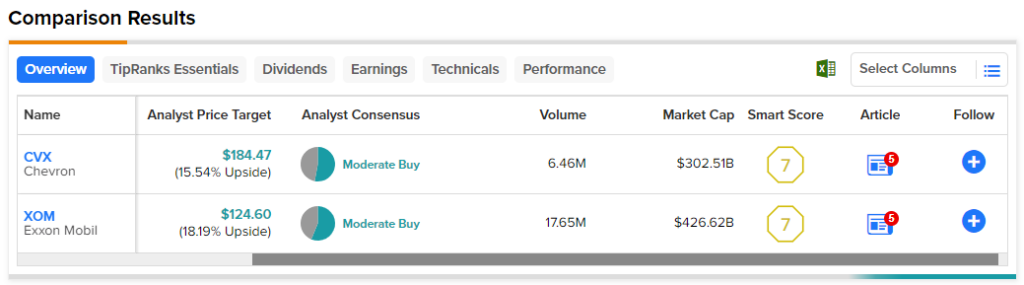

Chevron has a Moderate Buy consensus rating based on seven Buys, seven Holds, and zero Sell ratings assigned over the last three months. At $186.43, the average Chevron stock price target implies upside potential of 16.77%.

Exxon Mobil (NYSE:XOM)

At an EV/ EBITDA multiple of 4.7, Exxon Mobil looks slightly cheaper than Chevron, especially versus its five-year mean EV/EBITDA multiple of 10.2. However, its stock price action puts it on similar footing as Chevron, so a neutral view seems appropriate.

Exxon Mobil is expected to report its second-quarter earnings on Friday. Wall Street expects a similar profit plunge to what Chevron reported, but again, Exxon Mobil shares haven’t really budged this year. The consensus for Exxon Mobil’s second-quarter report stands at $2.04 per share in earnings on $90.32 billion in revenue. In the year-ago quarter, it reported $3.85 per share in earnings on $112.06 billion in revenue.

Notably, the company is the only oil major that hasn’t grown its production over the last 14 years. It’s still producing about four million barrels per day of oil equivalent, the same it reported in 2008. However, the five-year growth plan calls for increased investments to grow production to five million barrels a day equivalent by 2025.

Finally, Exxon Mobil has a dividend yield of 3.5%, which could make it a solid addition to a dividend portfolio, notwithstanding the other factors.

What is the Price Target for XOM Stock?

Exxon Mobil has a Moderate Buy consensus rating based on eight Buys, six Holds, and zero Sell ratings assigned over the last three months. At $125.69, the average Exxon Mobil stock price target implies upside potential of 19.2%.

Conclusion: Neutral on CVX and XOM

Chevron and Exxon Mobil are about as similar as two oil companies can be. They face similar challenges amid the lower oil prices, but their share prices haven’t adjusted low enough to account for those lower prices. In fact, the stock price actions of both give Chevron the slight advantage over Exxon Mobil, but not enough to warrant different ratings.

Free cash flow (FCF) is another important metric for oil companies, with the industry recording record cash flows last year. With Chevron’s FCF at $35.7 billion and Exxon Mobil’s at $58.4 billion over the last 12 months, neither company is going anywhere. However, in terms of valuation, there may be marginally better choices in the energy space, at least for now.