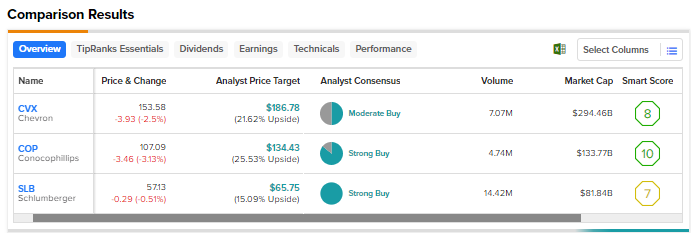

Oil and natural gas prices have fallen from the elevated levels seen in 2022 due to the Russia-Ukraine conflict. Oil prices in recent weeks have benefited from supply disruption in Africa and lower shipments from Russia, both tightening the market. That said, oil prices might face pressure if demand weakens further due to macro challenges. With an uncertain backdrop in mind, we used TipRanks’ Stock Comparison Tool to place Chevron (NYSE:CVX), ConocoPhillips (NYSE:COP), and SLB (NYSE:SLB) against each other to find the energy stock that could provide the best returns.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Chevron (NYSE:CVX)

Integrated oil and gas giant Chevron generated solid profits last year, driven by the surge in energy prices due to the Russia-Ukraine war. In the first quarter, Chevron exceeded Wall Street’s earnings expectations, as the strong performance of the refining business offset the decline in energy prices and oil and gas production.

Looking ahead, Chevron is focused on growing its traditional oil and gas business, while expanding into new lower-carbon businesses. In May, the company announced an agreement to acquire PDC Energy (NASDAQ:PDCE) for $6.3 billion. Through this deal, Chevron will benefit from PDC’s high-quality assets that are expected to deliver higher returns in lower carbon-intensity basins in the U.S.

Chevron is scheduled to announce its second-quarter results on July 28. Analysts expect the Q2 adjusted EPS to decline 47% year-over-year to $3.10 due to a decline in energy prices compared to the prior-year quarter.

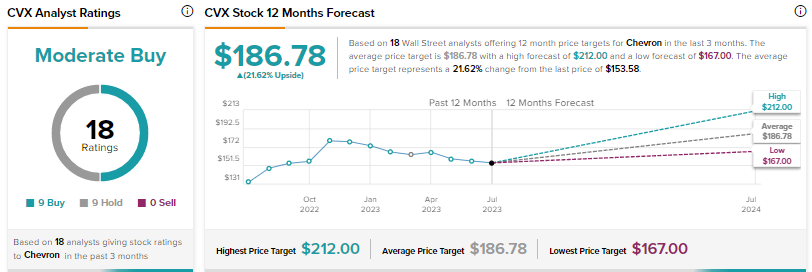

Is CVX a Buy, Sell, or Hold?

On July 11, Mizuho analyst Nitin Kumar raised his price target for Chevron to $205 from $202 and reiterated a Hold rating. The analyst expects the company’s Q2 EBITDA and free cash flow to miss consensus estimates due to a sequential decline in commodity prices.

The analyst thinks that investors’ main focus will be on well productivity in the Permian Basin, given the underperformance of Delaware wells in 2022. Kumar adds that his firm’s proprietary database indicates that CVX is seeing improvements in well performance. Overall, the analyst thinks that improving well productivity may offset the impact of commodity price weakness.

Wall Street’s Moderate Buy consensus rating on CVX stock is based on nine Buys and nine Holds. The average price target of $186.78 implies nearly 22% upside. CVX shares have declined more than 14% so far in 2023. CVX offers a dividend yield of 3.8%.

ConocoPhillips (NYSE:COP)

ConocoPhillips is one of the leading oil and gas exploration and production companies. The company’s adjusted EPS declined 27% to $2.38 in Q1 due to lower realized prices but came ahead of analysts’ expectations.

ConocoPhillips is slated to announce its Q2 results on August 3. Analysts expect the Q2 adjusted EPS to decline to $2.08 from $3.91 in the prior-year quarter, reflecting a pullback in energy prices.

Despite near-term pressures, Wall Street remains bullish on COP, with several analysts cheering the company’s May announcement about purchasing the remaining 50% interest in Surmont from TotalEnergies EP Canada for $3 billion and contingent payments of up to $325 million. The company feels that this move will help in improving the return on capital employed (ROCE), lower the free cash flow breakeven level, and support the company’s capital return plans in 2023.

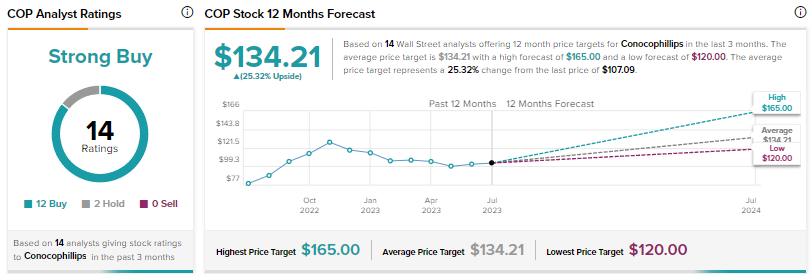

What is the Target Price for ConocoPhillips?

Earlier this month, Wolfe Research analyst Sam Margolin upgraded ConocoPhillips to Buy from Hold with a price target of $120. The analyst thinks that the bolt-on acquisition of the remaining 50% interest in Surmont cushions the downside in cash flow from operations (CFFO) in a lower oil price case in 2024 and increases free cash flow sensitivity in an upside case.

Margolin also noted that ConocoPhillips’ portfolio and valuation “compares favorably” to premium integrated oil companies.

Wall Street’s Strong Buy consensus rating on ConocoPhillips stock is based on 12 Buys and two Holds. The average price target of $134.21 implies 25.3% upside. COP shares are down more than 9% year-to-date.

COP offers an ordinary dividend and a variable dividend that is tied to the company’s performance. Based on the ordinary dividend, ConocoPhillips’ dividend yield is about 2%.

SLB (NYSE:SLB)

Oil-field services company SLB, formerly known as Schlumberger, reported upbeat first-quarter results and is confident about the road ahead. At the Bernstein Strategic Decisions Conference held on May 31, CEO Olivier Le Peuch said that the company expects a “significant baseload” of international and offshore activity to offset near-term demand volatility.

The CEO said that the company is gaining from upcycle dynamics and favorable pricing amid tight service capacity supply. SLB anticipates its core oil and gas business to continue to deliver solid growth, with the upcycle expected to continue through 2025 and beyond.

The company projects its earnings growth to continue to outpace its revenue growth through 2025. It estimates revenue and EBITDA to grow over 45% and 60%, respectively, by 2025 compared to 2022. Further, SLB aims to generate free cash flow margin of more than 10%.

SLB will announce its Q2 results on July 21. Wall Street projects Q2 adjusted EPS to increase 42% to $0.71.

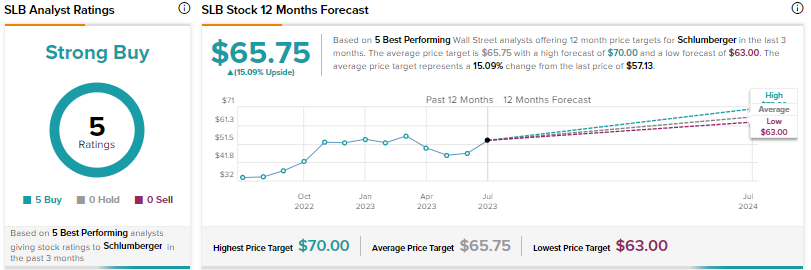

Is SLB Stock a Good Buy?

Following a meeting last month with SLB’s management, Goldman Sachs analyst Neil Mehta reiterated a Buy rating on SLB stock with a price target of $65. Mehta feels that there is potential for higher EBITDA margin “if the current cycle carries duration and remains durable longer term.”

SLB scores a Strong Buy consensus rating based on five unanimous Buys. The average price target of $65.75 implies 15% upside. Shares have advanced 7% year-to-date. SLB’s dividend yield stands at 1.8%.

Conclusion

Wall Street sees higher upside potential in ConocoPhillips stock than the other two energy stocks. Even if we include dividends, the total returns of COP are expected to be higher than CVX and SLB.

Like Wall Street, hedge funds are also bullish on COP stock. As per TipRanks’ Hedge Funds Trading Activity Tool, Hedge funds have a Very Positive confidence signal for COP and increased their holdings by 2.5 million shares last quarter.