CVS Health Corporation (CVS) is a healthy remedy to a dyspeptic portfolio.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

I am bullish on CVS. (See Analysts’ Top Stocks on TipRanks)

Big Is Beautiful

Analysts appear to be in harmony, beyond a consensus, that CVS is worth buying at its current share price. The company operates almost 10,000 pharmacy locations. Though you might run in at 3 a.m. to buy a cola, or band-aids, or fill a prescription, CVS is much more.

Operations comprise of pharmacy services, retail goods, long-term care products, beauty, and health care benefits, simple medical services, insurance communications, and more. CVS offers benefit management services in medical, dental, pharmaceutical, and behavioral health products and services.

CVS will pay its next dividend on November 1. Investors have until October 21 to buy the stock to be eligible for a dividend payment. The current yield is 2.3%. The stock has a 36.7% payout ratio, and sports 13 years of dividend growth.

Shares are up 46.1% over the past 12 months. Shares reached a high of $90.61 in May. The price steadily climbed from a low of $55.36 last October.

Shares Rising

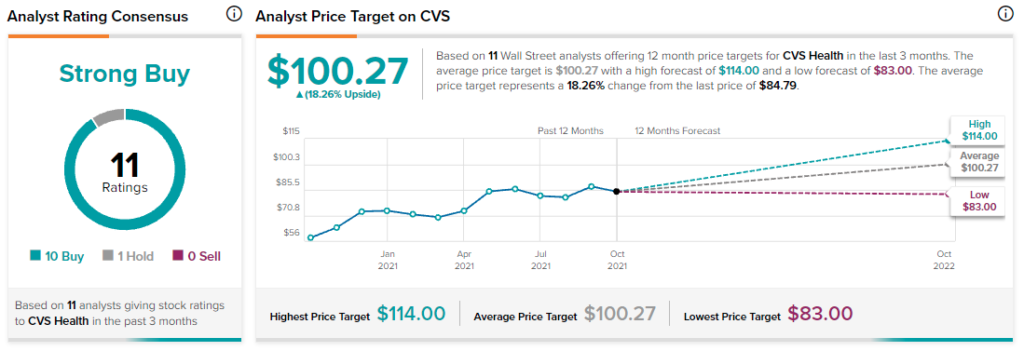

The average CVS price target from 11 analysts is $100.27 per share, implying 18.3% upside potential.

CVS is highly profitable, has high growth potential, offers low risk, and shares will keep rising in price with the stock market. Shares have been more lightly traded in recent weeks than usual.

The website seems to be getting more attention. Q3 visits are up 55.4% year-over-year. Year-to-date, total visits on all devices are up 98.4% from the same period last year.

Two years ago, CVS tied its future to e-commerce and digital healthcare. Management realized the strategy increases access for patients expecting greater sales for the company.

It was behind the thinking of buying Aetna, and its 40 million members, and rebranding the stores as HealthHubs. CVS is a model for retailers employing Big Data and AI to expand their businesses. This strategy has the potential to drive the share price up.

CVS holds a “Perfect 10” TipRanks Smart Score, with analysts rating CVS a Strong Buy.

Hedge funds have been steadily increasing their shares since last May. The news sentiment is in positive territory over the past seven days.

Drugs Have Their Risks

CVS shareholders face some risks buying the stock. The entire sector faces many of the same risks.

Class action lawsuits are a lingering threat to pharmacy chains for their part in the opioids crisis. Political pressures mount to lower drug prices.

The gross profit margin hovers around a low of 17%. Competition from other online sellers of pickup merchandise and front-of-the-store products is fierce. CVS’ $60 billion in debt warrants caution. CVS has been using it to fund growth.

On a brighter note, the debt is being whittled down. Cash tops $10 billion, and can be used to cover some of the debt.

CVS is going to have to continue having strong earnings and revenue over the next few years to be more than a defensive stock play.

Disclosure: At the time of publication, Harold Goldmeier did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment, and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.