Barely a day goes by right now without another tech company announcing a toning down of its staff. Following culls to the workforce in June and November, earlier today (Jan 10), Coinbase (COIN) announced another 20% reduction to the workforce. The job cuts will affect 950 employees and are part of Coinbase’s plan to better manage expenses. Along with other cost-cutting endeavors, the move should lower the crypto exchange’s operating costs by 25% in the March quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Mizuho’s Dan Dolev reckons the cut will reduce the company’s 2023 cost basis by around $250 million per quarter. Ultimately, however, the measures are rather futile. “While this creates a near-term filler for COIN’s dwindling operating leverage,” says the analyst, “it does not help fix the #1 problem: deteriorating volumes amid retail crypto trading fatigue.”

By Dolev’s calculations, consensus sales expectations are still way too high. Should take rates and volumes remain at present levels – the current $1.2 billion daily volume run-rate (trailing 30-day) suggests yearly transaction revenue of roughly $1 billion – and accounting for a “generous” ~$1 billion of other revenue, suggests total revs of around ~$2 billion. This is still “over 30% below 2023 consensus.”

Putting aside the concern around what happens to revenues and profits as crypto volumes “deteriorate further,” the wisdom of further slashing the workforce goes against the company’s ambitions and may also “deepen COIN’s ability to generate non-trading revenue as it potentially hurts its efforts to reinvent the ‘cryptoeconomy.’”

One piece of “good news” to take away from the announcement is that the company has come good on its pledge to deliver adj. EBITDA losses for 2022 no greater than -$500 million.

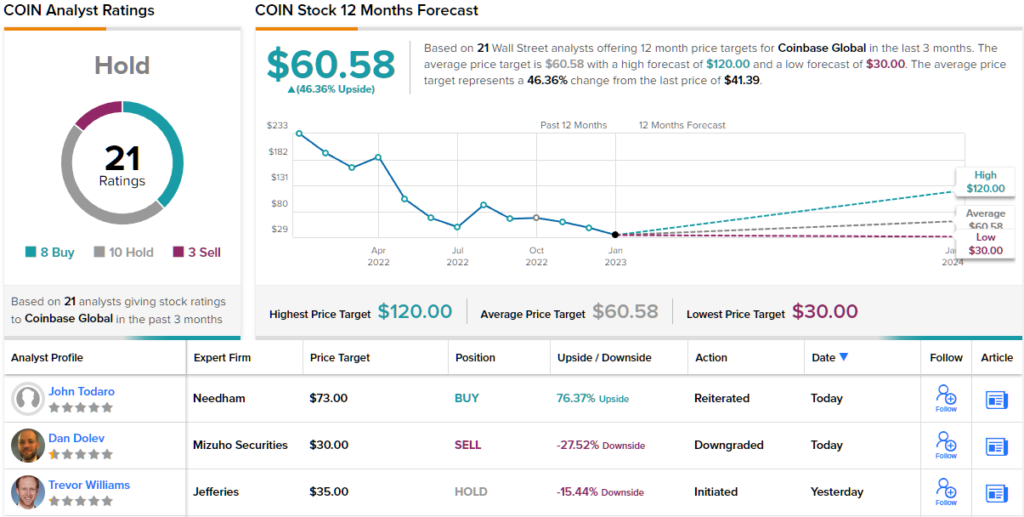

However, that is far from enough to satisfy Dolev, who keeps an Underperform (i.e., Sell) rating on the shares, while his $30 price target suggests the stock is overvalued by 27%. (To watch Dolev’s track record, click here)

Dolev is one of the Street’s most prominent COIN bears, with reviews being generally mixed. The stock receives a Hold consensus rating, based on 8 Buys, 10 Holds (i.e. Neutrals) and 3 Sells. (See Coinbase stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.