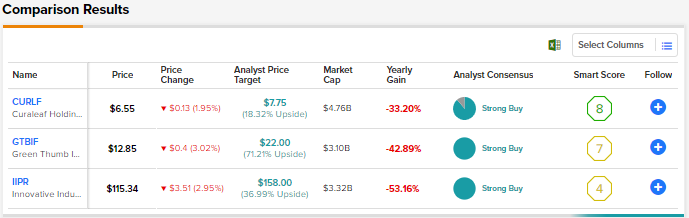

Persistent delay in the legalization at the federal level has impacted investor sentiment for cannabis stocks. President Joe Biden’s decision to pardon those convicted for “simple possession of marijuana” and review the classification of marijuana as a Schedule 1 substance has revived interest in the cannabis space. Meanwhile, more states are legalizing cannabis for recreational use, the most recent ones being Maryland and Missouri. Using TipRanks’ Stock Comparison Tool, we stacked up Curaleaf (CURLF), Green Thumb (GTBIF), and Innovative Industrial (IIPR) against each other to pick the most attractive cannabis stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Curaleaf Holdings (CURLF) Stock

Curaleaf is one of the leading U.S. multi-state operators, with a presence in 21 states. The company has rapidly grown via acquisitions. In Q3, Curaleaf acquired a 55% stake in Four 20 Pharma GmbH, a German medical cannabis company. Last month, it acquired Tryke Companies to strengthen its presence in Arizona, Nevada, and Utah.

In Q3, Curaleaf’s revenue grew 7% year-over-year to $340 million, driven by multiple drivers, including additional retail stores, the beginning of adult-use cannabis sales in New Jersey in April 2022, and new product launches. Net loss per share narrowed slightly to $0.07 from $0.08 in the prior-year quarter. Amid a tough macro backdrop and increased competition, Curaleaf is trying to improve its profitability through various measures, including headcount reduction.

What is the Price Target for Curaleaf?

Ahead of the Q3 results, BTIG analyst Jonathan DeCourcey initiated coverage of Curaleaf with a Buy rating and a price target of CAD$10. DeCourcey noted that Curaleaf is the largest multi-state operator in the U.S. and is “poised to benefit from that standing.” The analyst highlighted Curaleaf’s presence in the key U.S. states. Furthermore, it has developed an early presence in potential large-scale European markets “that could one day offer significant growth.”

Curaleaf’s Strong Buy consensus rating is based on eight Buys and one Hold. The average CURLF price target of $7.75 implies 18.3% upside potential. Curaleaf stock is down nearly 26% so far this year.

Green Thumb (GTBIF) Stock

Green Thumb is among the very few cannabis companies that are profitable. Q3 marked the ninth consecutive quarter of positive net income for the company. However, Q3 earnings per share declined 50% year-over-year to $0.04 as an 11.8% rise in revenue was more than offset by price compression, inflationary pressures, and expenses associated with expansion.

Green Thumb is making significant capital investments in Florida, Minnesota, New York, New Jersey, and Virginia. As of Q3-end, Green Thumb operated 77 retail locations and had operations across 15 U.S. states. The company is on track to surpass the $1 billion revenue mark this year.

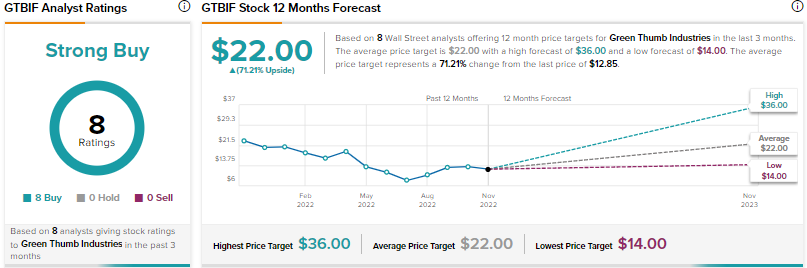

Is Green Thumb Industries a Buy?

Following the Q3 print, Cantor Fitzgerald analyst Pablo Zuanic raised the price target for GTBIF stock to $36 from $32 and reaffirmed a Buy rating. Zuanic projects Green Thumb’s sales to grow 15% in 2023 and 28% in 2024.

Green Thumb scores the Street’s Strong Buy consensus rating based on eight unanimous Buys. The average GTBIF stock price prediction of $22 implies 71.2% upside potential. Green Thumb stock has plunged 42% year-to-date.

Innovative Industrial Properties (IIPR) Stock

Innovative Industrial Properties (IIPR) is a cannabis industry focused real estate investment trust (REIT) that acquires land from state-licensed cannabis operators and leases it back to them. IIPR is an alternative way to seek exposure to the cannabis space and is a good pick for dividend-oriented investors. It offers an attractive dividend yield of 5.7%.

In Q3, IIPR’s revenue increased 32% to $70.9 million while adjusted funds from operations, a key metric used for REITs, increased nearly 25% to $2.13.

The default by one of IIPR’s key tenants, Kings Garden, spooked investors recently. IIPR subsequently reached a settlement with Kings Garden. During its Q3 conference call, the company stated that the rent collection rate from its operating portfolio stood at 97% in the first nine months of 2022.

Is IIPR a Buy or Sell?

Following the Q3 results, Roth Capital analyst Scott Fortune noted that Innovative Industrial’s rapid acquisition pace has slowed down due to a touch macro environment and higher cost of capital. Nevertheless, the analyst feels that despite the headwinds in the cannabis industry, the company’s pipeline remains strong and is well-positioned for growth when the situation improves next year and capital is raised.

Based on his investment thesis, Fortune slashed his price target for Innovative Industrial to $170 from $190 but maintained a Buy rating.

Innovative Industrial Properties stock earns a Strong Buy consensus rating backed by six unanimous Buys. The average IIPR stock target price of $158 suggests nearly 37% upside potential. Shares have tumbled 56% year-to-date.

Conclusion

Wall Street is highly bullish about Curaleaf, Green Thumb, and Innovative Industrial stocks. Currently, analysts see higher upside potential in Green Thumb than in the other two stocks. Green Thumb’s presence in lucrative states, continued expansion, and the fact that it is profitable, unlike many of its cannabis peers, makes it an attractive long-term pick.