The past month or so has been good for Boeing (NYSE:BA) investors. After bottoming out at $177.73 on October 25, shares have rallied by 26%, easily outpacing the S&P 500’s ~9% return over the period.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Morgan Stanley analyst Kristine Liwag thinks there are several reasons for the turnaround. She states, “After a challenging summer of multiple non-conforming manufacturing issues on the 737 MAX program, the lack of incremental bad news has been positive for the stock. Additionally, tailwinds from aircraft orders from the Dubai Air Show and the 737 MAX 10 flight certification flights have been positive for sentiment.”

Interestingly, Liwag has recently been inundated with inquiries from investors who are wondering if the time is now right to start loading up on BA shares. Some have pointed out “recent delivery momentum” and reduced consensus 2024 free cash flow (FCF) estimates that could act as catalysts.

But Liwag’s take is rather less bullish, telling investors to “curb your enthusiasm.” The potential for “positive momentum” is negated by Liwag’s view of a “balanced risk reward in the long-term.” Ongoing supply chain bottlenecks are still hampering Boeing’s capacity to deliver airplanes and capitalize on its multi-year backlog. Additionally, there is a looming concern related to the negotiation of a labor agreement with IAM District 751 in 2024, whose members represents roughly 20% of Boeing’s total workforce.

Bottom-line, due to expecting lower BCA (Boeing Commercial Airlines) and BDS (Boeing Defense, Space & Security) operating profits, and at the same time anticipating lower 737 MAX production rates over lingering supply chain issues, Liwag’s FCF estimates are below consensus. Specifically, the Street is calling for FCF of ~$9.6 billion and ~$11.7 billion in 2025-2026, while Liwag has ~$8.4 billion and ~$9.2 billion.

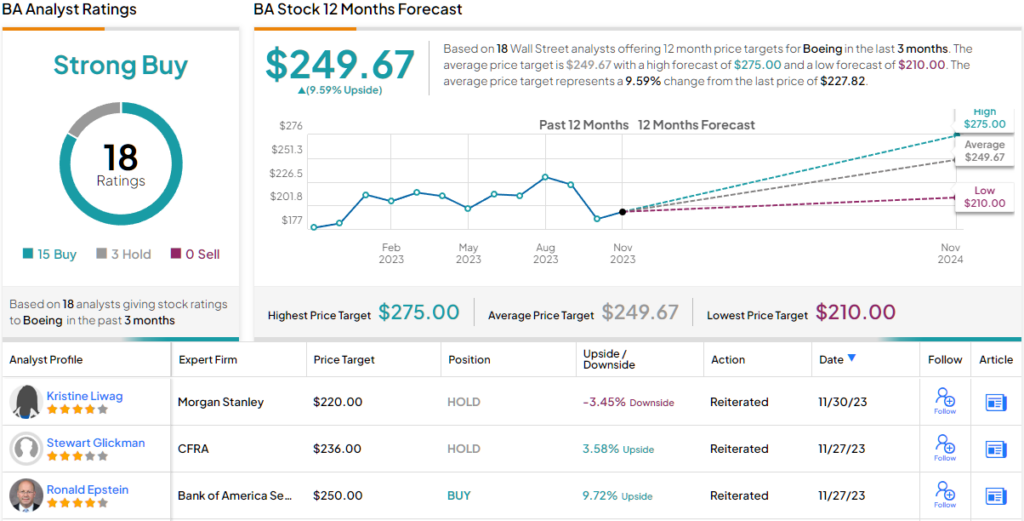

So, down to business, what does it all mean for investors? Liwag remains on the sidelines with an Equal-weight (i.e., Neutral) rating and a $220 price target, suggesting the shares are currently fairly valued. (To watch Liwag’s track record, click here)

Liwag, however, is amongst a minority on Wall Street. 2 others join her on the fence, but they are countered by 15 bullish analysts, making the consensus view here a Strong Buy. The average target stands at $249.67, implying investors will be pocketing returns of ~10% a year from now. (See Boeing stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.