Cybersecurity stocks have been gaining momentum in recent months alongside the rest of the tech sector. Undoubtedly, trimming away from a firm’s cybersecurity budget tends to be a pretty risky (potentially even dangerous) move to get one’s IT spending budget below a certain threshold. By skimping on cybersecurity spending, one potentially opens the door to cyber threats and even pricier damages in the event of a future breach.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Though cybersecurity stocks haven’t been as defensive during the tech sell-off of 2022, their 2023 rebound has been quite robust. Going into 2024, I expect more resilience from the pack as rates retreat and artificial intelligence (AI) comes into play. In the age of AI, I believe there will be more emphasis on having the very best cybersecurity (preventative and after-the-fact measures) defenses in place. Indeed, vigilance remains key as cyber threats themselves evolve over time.

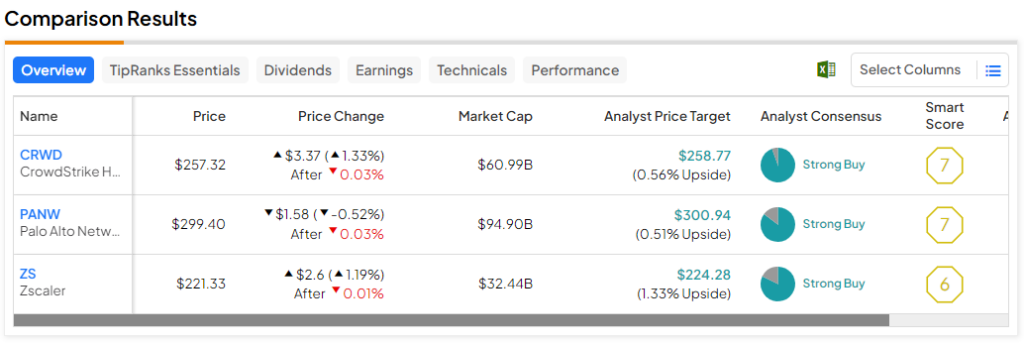

Therefore, let’s check out TipRanks’ Comparison Tool to stack up a trio of cybersecurity plays and see where Wall Street stands on them heading into the new year.

CrowdStrike (NASDAQ:CRWD)

CrowdStrike remains one of the top players to consider when going on the hunt for a leading cybersecurity stock. The $61 billion firm exploded higher this year, surging around 145% year-to-date, recovering a massive chunk of the ground lost in the prior year. As shares eye new all-time highs in 2024, questions linger as to whether it’s too late to punch one’s ticket into the cyber kingpin as it has the opportunity to flex its AI muscles further.

The Wall Street community still views CRWD stock as a “Strong Buy.” To add to the bullish case, Wells Fargo (NYSE:WFC) recently named CrowdStrike as one of two top picks to place in the cybersecurity space. Additionally, another table-pounding bull from Barclays (NYSE:BCS) cited AI as a major catalyst that could bring forth even more upside. Like the bullish analysts, I have to stay bullish on the stock as the AI tailwind approaches, even though I’m not normally one to chase a recent high-flyer.

The 2023 AI-driven run still has legs, especially when it comes to the names outside of the red-hot semiconductor scene. As the AI rally further broadens out, I view the entire cybersecurity scene as really standing out as the companies in the sector look to leverage AI in a way to make their products even better amid rising cyber threats.

CrowdStrike’s Charlotte AI automates many aspects of the cyber process and could prove a real game-changer once it moves out of beta. Apart from its AI prowess, investors should also respect the firm’s robust cash flows.

As Barclays analyst Saket Kalia put it, CrowdStrike isn’t just a great growth company; it’s one backed by “strong cash flow support.”

What is the Price Target for CRWD Stock?

CrowdStrike stock is a Strong Buy, according to analysts, with 34 Buys and two Holds assigned in the past three months. The average CRWD stock price target of $258.77 implies 0.6% upside potential potential.

ZScaler (NASDAQ:ZS)

ZScaler is the other cyber stock in Wells Fargo’s top picks list for the cyber scene. The recovery in ZS stock has been less pronounced than CRWD over the past year, with shares recovering just north of 98% year-to-date.

That’s still a hot run, but its valuation seems somewhat more palatable than that of CrowdStrike, at least on a price-to-sales (P/S) basis (ZS stock goes for 18.6 times P/S vs. CRWD at 21.8 times P/S). ZScaler is also much smaller than CrowdStrike, sporting a market cap of $32.4 billion. With similar skin in the AI game and slightly less overheated stock, I’m even more bullish on ZS.

Importantly, with the SEC recently imposing new rules on cyber breaches, we could be entering an era where cybersecurity reporting becomes just as important as financial reporting. Indeed, far too many consumers have been affected by data breaches, and it’s about time for regulators to put a foot down. Not only can the new rules push firms to allocate more funds to preventative measures, but they may also be inclined to help firms keep up with SEC reporting standards in the event of a breach.

ZScaler’s Risk360 platform stands out as a big beneficiary from the new SEC rules, at least according to Macquarie’s Fred Havemeyer, who stated Risk360 is at “the nexus of cyber threat and SEC reporting requirement trends.” That’s a big deal. I think increased SEC regulation on cybersecurity may make stocks in that sector even more defensive in the face of future economic downturns, as cybersecurity looks to become pushed to the lowest on the list of expenses to cut in the face of financial pressures.

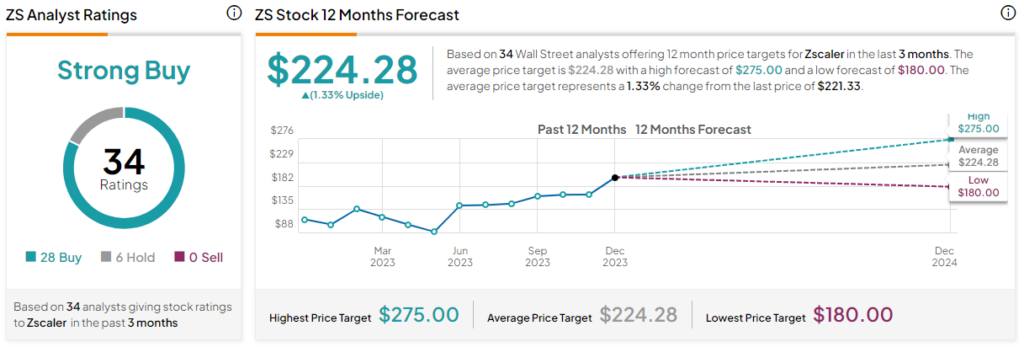

What is the Price Target for ZS Stock?

ZScaler stock is a Strong Buy, according to analysts, with 28 Buys and six Holds assigned in the past three months. The average ZS stock price target of $224.28 implies 1.3% downside potential.

Palo Alto Networks (NASDAQ:PANW)

Palo Alto Networks has also been on a scorching hot run, now up 109% year-to-date. As shares flirt with all-time highs (off just 6% from its recent peak of $318 per share), PANW is now quite the juggernaut with its $95 billion market cap. Though the Wall Street crowd remains very bullish, it’s hard to ignore the recent downgrade at Raymond James. Still, despite the notable downgrade, which applied a bit of pressure to shares, I remain bullish as the cybersecurity run looks to extend into 2024.

Raymond James is no longer a fan of the price of admission to shares after more than doubling in 2023. The firm admitted it’s still a fan of Palo Alto’s growth prospects but stated the “risk/reward” has grown less “favorable.”

Indeed, a case could be made that all the leading cybersecurity plays are a tad too frothy at these levels. Though the stakes have risen over the past year, as the share price (and investor expectations) rose, I view Palo Alto as less vulnerable than other enterprise software companies in the face of looming macro headwinds. Cybersecurity is no longer a place to skimp.

Further, Wedbush believes the company is poised to do well from strong demand for cybersecurity solutions, upgrading the stock to $350.00 from $290.00.

What is the Price Target for PANW Stock?

Palo Alto Networks stock is a Strong Buy, according to analysts, with 29 Buys and five Holds assigned in the past three months. The average PANW stock price target of $300.94 implies 0.5% downside potential.

Conclusion

Cybersecurity stocks have a ton of momentum going into the new year. But just because their hot runs and valuations are getting stretched doesn’t mean they’re overdue for a vicious decline. Wall Street remains bullish, and it’s not hard to see why as the cybersecurity landscape looks to benefit from the rise of generative AI and new SEC rules on cybersecurity.

Of the trio, CrowdStrike has the best buy-to-hold ratio (35 Buys, two Holds), making it the most enticing pick through the eyes of the analyst community. I have to agree.