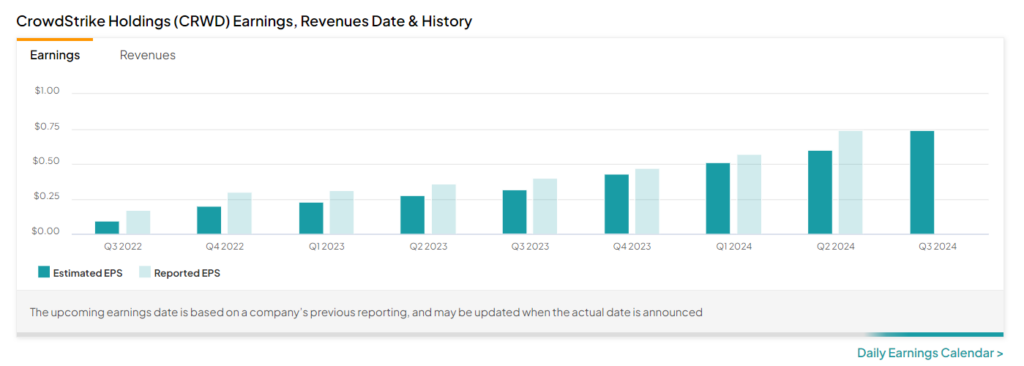

Cybersecurity provider CrowdStrike (NASDAQ:CRWD) is scheduled to announce its fiscal third-quarter earnings on Thursday, November 28, after the market closes. Importantly, CRWD has an impressive history of delivering strong quarterly performances. The company beat analysts’ earnings expectations for 15 consecutive quarters, indicating the potential for it to outperform estimates again in the to-be-reported quarter. Wall Street analysts are upbeat about the demand backdrop for CrowdStrike, given the rapidly growing cyberattacks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Street expects CRWD to post earnings of $0.74 per share in Q3 FY24, compared with $0.40 per share in the prior-year period. Meanwhile, analysts expect CrowdStrike to deliver revenue of $777.3 million in Fiscal Q3, compared to $580.9 million in the prior-year quarter.

Here’s What Analysts Are Saying about CRWD Stock

Heading into the company’s earnings release, three analysts have rated CRWD stock a Buy since last week, while one has assigned a Hold rating.

KeyBanc analyst Eric Heath emphasized substantial long-term growth drivers in CrowdStrike’s cloud-native software platform and generative AI, along with the potential for continued market share expansion in endpoint security. Regarding Q3 results, the analyst said that his firm’s checks indicated solid trends. That said, Heath is slightly cautious due to macro pressures and the robust year-to-date rally.

Heath reaffirmed a Buy rating on CRWD stock and raised the price target to $240 (implying 14% upside potential) from $200.

Meanwhile, Barclays analyst Saket Kalia anticipates CrowdStrike’s net new ARR in Fiscal Q3 to hit $215 million, up 8% year-over-year. This growth is attributed to robust customer demand and the quarter’s seasonality aligning with historical patterns. Kalia reiterated a Buy rating on the stock with a $225 price target.

Is CrowdStrike a Buy, Sell, or Hold?

Wall Street is optimistic about CrowdStrike. The stock has a Strong Buy consensus rating based on 32 Buys and one Hold rating assigned in the past three months. Following a stellar year-to-date rally of 104%, the average CRWD stock price target of $205.34 implies 2.5% downside potential.

Ending Note

The increasing frequency of cyberattacks has raised the need for advanced cybersecurity solutions. This positions CrowdStrike to benefit from an expanding total addressable market, forecasted to reach $97.8 billion by 2025. Apart from this, Wall Street continues to believe in the long-term potential of CrowdStrike.