CrowdStrike Holdings (NASDAQ:CRWD) has been dominating the cybersecurity industry. Despite a challenging market environment, CrowdStrike has consistently exhibited unparalleled growth, solidifying its position as the unrivaled leader in the field. The company’s latest results once again impressed, showcasing relentless momentum that shows no signs of abating.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

As the importance of cybersecurity escalates in our interconnected world, CrowdStrike’s cutting-edge cloud platform is poised to witness unwavering adoption, thus paving the way for continued success, moving forward. Hence, even though shares of CrowdStrike are currently trading at a premium price tag, I believe the company will comfortably grow into its valuation in the coming quarters. Thus, I am bullish on the stock.

Cloud-Native Architecture Gains Continuous Adoption

CrowdStrike’s cloud-native architecture continues to see elevated adoption from all sorts of enterprises over time and has therefore been one of the company’s core growth drivers. The way Salesforce (NYSE:CRM) defined the CRM (customer relationship management) Cloud, ServiceNow (NYSE:NOW) defined the Service Management Cloud, and Workday (NASDAQ:WDAY) defined the HR Cloud, CrowdStrike has defined the Cybersecurity Cloud.

In simple terms, this comes with several advantages compared to more traditional solutions because, through CrowdStrike’s cloud-native architecture, security solutions are built and delivered from the cloud. Other advantages include scalability, flexibility, and real-time threat intelligence, which allows for rapid response deployment, easy updates, and global coverage, giving it an edge over competitors relying on classic on-premises solutions.

With CrowdStrike uniquely built solutions, the company has made an indelible impact in the realm of endpoint security. CrowdStrike is, in fact, claiming that it is the #1 market leader in the space – and it’s not all talk; the company has the numbers to back this claim. Specifically, CrowdStrike’s clients include 556 of the Forbes Global 2000 companies, 251 of the Fortune 500, and 70 of the Fortune 100 companies.

In fact, showcasing the immense trust bestowed upon CrowdStrike’s platform, an impressive 15 out of the leading 20 U.S. banks have chosen to employ the company’s cutting-edge solutions. And just to highlight the speed at which CrowdStrike is growing, the company has grown its subscription customer count from 2,516 in Fiscal 2019 to a staggering 23,019 at the end of Fiscal 2023 – that’s a nearly 10x increase in four years while onboarding some of the world’s most prominent companies on the way.

Impressive Growth Despite Macro Challenges

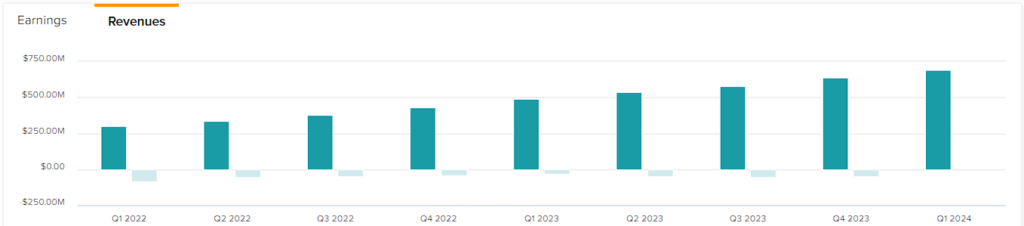

CrowdStrike kicked off Fiscal 2024 on a high note, delivering impressive growth despite the underlying macro challenges of the past year. In its most recent results, the company posted total revenues of $692.6 million, a 42% increase, compared to $487.8 million in the prior-year period.

Besides a growing number of customers, revenue growth was also driven by a higher dollar-based net retention rate (the percentage change in revenue from existing customers, considering upsells, cross-sells, downgrades, and churn), which was once again higher than the company’s 120% benchmark.

At the end of the quarter, a notable portion of CrowdStrike’s subscription customers exhibited a growing preference for a greater number of solutions. Specifically, those with five or more, six or more, and seven or more modules accounted for 60%, 40%, and 23% of the total subscription customer base, respectively.

This trend is expected to continue as the escalating demand for robust cybersecurity solutions drives enterprises to increase spending in this area, which should allow the company to sustain significant growth, moving forward.

Can CrowdStrike’s Earnings Growth Justify Its Pricy Valuation?

On the one hand, with CrowdStrike propelling its high-margin business rapidly, investors expect significant earnings growth from here. That said, this has resulted in shares trading at a pricy valuation.

To add some color here, CrowdStrike’s business model is incredibly scalable, as the company undertakes a minimal amount of incremental costs for each new customer it onboards or whenever a customer subscribes to an additional module. Therefore, its margins have expanded over time. In its most recent Q1 results, the company’s subscription margin expanded from 77% to a new record of 78%.

The combination of gradually higher margins and growing revenues has set high earnings growth expectations. Consensus adjusted earnings-per-share estimates by Wall Street for Fiscal 2024 point toward $2.39, implying year-over-year growth of 55%.

Note that this estimate excludes stock-based compensation. Still, it illustrates the company’s earnings growth prospects, which could justify the current implied forward P/E of roughly 64x. Even if the company’s earnings growth were to decelerate notably, CrowdStrike would still grow into its valuation relatively quickly at a, say, 30%+ earnings growth rate over the medium term.

Is CRWD Stock a Buy, According to Analysts?

Turning to Wall Street, CrowdStrike has a Strong Buy consensus rating based on 29 Buys and two Holds assigned in the past three months. At $174.90, the average CrowdStrike stock price target implies 15.8% upside potential.

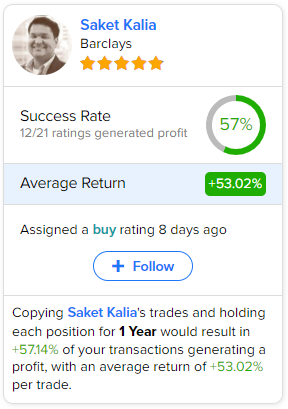

If you’re wondering which analyst you should follow if you want to buy and sell CRWD stock, the most profitable analyst covering the stock (on a one-year timeframe) is Saket Kalia from Barclays, with an average return of 53.02% per rating and a 57% success rate.

The Takeaway

CrowdStrike Holdings has solidified its position as the dominant force in the cybersecurity industry, showcasing relentless growth and unrivaled performance. With its cutting-edge cloud platform and cloud-native architecture, CrowdStrike is well-positioned to capitalize on the increasing importance of cybersecurity in our interconnected world. Despite its premium valuation, the company’s impressive track record and projected earnings growth likely comprise a compelling investment opportunity.