Crocs stock (NASDAQ:CROX) is currently undergoing a strong rebound, with shares trading 41% higher from last month’s lows of about $74. Despite the strong rally over the past month, I believe that Crocs’ rebound has only just begun. The company’s results remain exceptionally strong, progress toward deleveraging has exceeded expectations, and management has resumed share repurchases. Coupled with the fact that shares appear to be trading at an attractive valuation, my bullish view of CROX is intact.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue Growth Continues to Exceed Expectations

At the core of my optimistic outlook for Crocs lies the company’s strong revenue growth, which keeps exceeding both management’s and Wall Street’s expectations. In Crocs’ most recent third-quarter results, the company posted revenue growth of 6.2% to $1.05 billion. This is the first Q3 for Crocs in which its revenues exceeded the $1.0 billion threshold. Importantly, this result beat both Wall Street’s estimate by $20 million and the high-end of management’s prior Q3 outlook range of about $1.013 to $1.034 billion.

Let’s take a deeper look at each of Crocs’ brands — The Crocs brand and the HEYDUDE brand.

The Crocs Brand

The Crocs brand had a phenomenal Q3, with its revenues reaching $798.8 million, up 11.1% compared to last year, driven by strong DTC growth of 15.3%. Notably, the brand sold 29 million pairs of shoes. Asia was a major contributor to this growth, with the region’s revenues growing 29% to $175 million, including broad-based growth all across countries and channels. Some highlights include Australia, where growth came in the triple digits, and China, whose revenues exceeded 90% year-over-year.

Another strong revenue contributor for the Crocs brand was its sandals branch, whose revenues grew by 6%. While this may not sound like an exciting number, it definitely becomes one when we consider that sandal sales in Q3 grew on top of about 20% growth in 2022 and a 35% increase on a trailing 12-month basis. Given that the market expects cyclicality in Crocs’ sales (due to seasonality, inventory transitions, and fashion trend shifts), continuous growth in sandals is rather impressive.

The HEYDUDE brand

The HEYDUDE brand also performed well. At first glance, the fact that its Q3 revenues declined by 8.3% to $246.9 million may sound worrisome. However, I would mostly attribute this decline to headwinds faced by wholesalers in general, not so much about the brand not generating enough demand.

Notably, during Q3, the company experienced a notable surplus in inventory among its longstanding customers, leading to a 19.4% year-over-year decline in Wholesale revenues. Despite this, the appeal of HEYDUDE shoes remains robust among consumers, evidenced by a 14.6% increase in Direct-to-Consumer (DTC) revenues during the same period.

It appears that the company is strategically directing its focus toward transitioning HEYDUDE sales channels from wholesalers to DTC, a move that should expand margins over time. This shift, although likely to keep translating to short-term challenges, is anticipated to be a positive trend in the long run.

Record Profits Outlook Exposes Cheap Valuation

With Crocs consistently achieving robust revenue growth and realizing enhanced profit margins through operational efficiencies, the company is expected to celebrate another year of record-breaking profits. I would argue that the blend of record earnings and shares remaining notably lower from its past highs exposes the stock’s cheap valuation.

Specifically, Crocs’ gross margin has reached an outstanding 55.6%, marking a commendable increase from the previous year’s 54.9%. This substantial growth serves as a testament to the positive impact of DTC sales over Wholesale sales.

Anticipated strong sales in Q4, coupled with enhanced margins, led management to project FY2023 adjusted diluted EPS to be in the range of $11.55 to $11.85. The midpoint of this forecast, at $11.70, implies a year-over-year growth rate of 7.1% and a new milestone for the company’s bottom line.

In the meantime, it’s worth noting that Crocs’ proactive deleveraging has successfully reduced its leverage ratio to 1.7x, down from 2.25x at the end of 2022. Management also kept its promise of resuming repurchases when leverage was to fall below 2.0x. Indeed, the company repurchased $150 million worth of stock during the quarter.

Interestingly, Crocs’ guidance currently excludes the impact of these repurchases. As a result, I expect the year-end results to be notably stronger than management’s outlook.

Is CROX Stock a Buy, According to Analysts?

Checking Wall Street’s sentiment on the stock, Crocs currently boasts a Strong Buy consensus rating based on eight Buys and two Holds assigned in the past three months. At $122.10, the average Crocs stock forecast implies 16.4% upside potential.

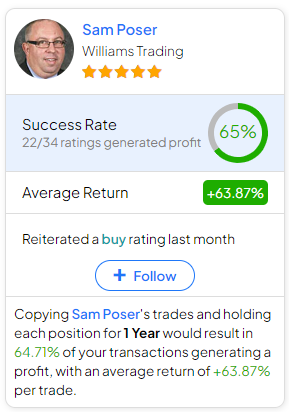

If you’re wondering which analyst you should listen to if you want to buy and sell CROX stock, the most accurate analyst covering the stock (on a one-year timeframe) is Sam Poser, representing Williams Trading. His track record is robust, with an average return of 63.87% per rating and a 65% success rate. Click on the image below to learn more.

The Takeaway

I believe Crocs stock is poised for further upside despite its 41% surge from recent lows. The company’s lasting revenue growth, particularly in its flagship Crocs brand, showcases resilience. The HEYDUDE brand, while facing short-term challenges, is strategically shifting towards direct-to-consumer channels, promising long-term success.

Overall, record-breaking profits, proactive deleveraging, and buybacks at a cheap valuation (forward P/E of 9x at the midpoint of management’s guidance) signal a promising trajectory. As a result, I remain bullish on the stock and will keep adding to my position during any dips.