The more Crocs stock (NASDAQ:CROX) falls these days, the more of it I buy. At this point, the company behind the iconic Crocs and the up-and-coming HEYDUDE shoe brands has grown to be one of my largest positions. Despite the stock’s continuous decline, I couldn’t feel more at ease being overweight, as the company’s persistent growth points toward notable upside moving forward. Simultaneously, shares appear to offer a wide margin of safety at their current valuation. Thus, I am bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sell-Off Persists Despite Strong Top- and Bottom-Line Growth

The Crocs stock sell-off has persisted despite the company constantly posting strong top and bottom-line growth. Over the past six months, the stock has lost about 38% of its value, notably underperforming all main indices that have gained modestly during the same period. To me, this development is baffling, given that Crocs’ financial performance has never come in disappointing. On the contrary, both of Crocs’ brands continue to display robust traction, setting the stage for record revenues and profits this year.

Revenues to Hit New All-Time Highs

Crocs posted record revenues of $3.6 billion in Fiscal 2022, an increase of 53.7% compared to the previous year. This year, the company’s top line is set to hit a new all-time high, driven by unwavering momentum across both brands.

In its latest Q2 results, Crocs showcased its relentless growth, with the brand reporting revenues of $833 million—a remarkable 14.9% increase from the previous year. This robust performance was notably fueled by an impressive 26.8% surge in direct-to-consumer (DTC) sales.

During this period, Crocs sold an impressive 33 million pairs of shoes, representing a 1.8% increase. Notably, the average selling price for Crocs products stood at $25, indicating a commendable 12.8% increase. This positive trend is attributed to well-executed pricing strategies and a reduction in DTC promotions on the international stage. It’s a clear testament to the enduring demand for the brand among consumers.

I also applaud Crocs for its strategic mission to expand into burgeoning markets. The company successfully entered the flourishing sandals market, experiencing an impressive 34% surge in sandal sales during Q2. This growth was witnessed across all regions, contributing a noteworthy 16% to the overall Crocs brand sales.

Equally noteworthy is the sustained strong performance of Jibbitz. Who would have thought that the little charming accessories people buy to attach to Crocs’ clogs and sandals would be an actual revenue contributor? Jibbitz saw growth of 13% compared to last year, with strong traction internationally.

Turning our attention to HEYDUDE, the rising star in Crocs’ portfolio, Q2 revenues reached a commendable $239.4 million, reflecting a 3% increase compared to the previous year’s figures. While these figures might seem relatively modest, it’s crucial to consider the broader context: Crocs acquired HEYDUDE just last year, driving its sales up by a staggering 96% during the equivalent period. Therefore, witnessing further growth on top of this substantial boost is truly noteworthy.

A key driver of HEYDUDE’s growth is its DTC channel, with a primary focus on e-commerce. This channel played a pivotal role in boosting revenues, showcasing an impressive 29.7% increase from the previous year. The brand’s digital sales also experienced a rise of 36.6%, contributing to a digital penetration surge of 1,000 basis points to 41.8%. This shift towards e-commerce underscores Crocs’ effort in modernizing HEYDUDE’s sales channels and positioning the company for a rise in frictionless, high-margin sales.

Overall, with both of Crocs’ brands sustaining strength this year on top of last year’s record figures, Fiscal 2023 is likely going to be another record-breaking period sales period. Specifically, management expects revenues to grow between 12.5% and 14.5% compared to Fiscal 2022 and, thus, land between $4 billion and $4.065 billion.

Record Sales & Expanding Margins Set to Drive Record Profits

With both Crocs and the burgeoning HEYDUDE brands consistently expanding their sales and enhancing operational efficiencies, the company has undergone a notable margin expansion. Its gross margin reached an impressive 57.9%, a significant jump from the prior year’s 51.6%, showcasing the positive impact of its strategic initiatives (including its DTC strategy). Moreover, the operating margin saw improvement, reaching 29.7% compared to 25.7% for the corresponding period last year.

Heightened sales and improved margins create a compelling case for another year of record profitability. Consequently, management adjusted its guidance upward, forecasting adjusted diluted EPS to fall within the range of $11.83 to $12.22, a notable increase from the previous range of $11.17 to $11.73. This adjustment implies a year-over-year growth rate of 10.1% at the midpoint, paving the way for yet another all-time high in the company’s bottom line.

Dirt-Cheap Valuation Offers Upside & Margin of Safety

Crocs has not only set the stage for record earnings, but the sharp decline in shares during this period has resulted in shares trading at a dirt-cheap valuation. A deeply-discounted valuation can offer strong upside potential due to the possibility of a valuation expansion. At the same time, it can provide a wide margin of safety as the possibility of a further drop is lower near such depressed levels. I think this is the case with Crocs.

Taking a closer look at the numbers and utilizing the midpoint of management’s updated guidance, it becomes apparent that shares are currently trading at a forward P/E of just 7.2x. I find this multiple highly attractive, especially considering Crocs’ sustained success and overall growth trajectory. Looking ahead on a next-12-month basis, the forward P/E hovers around 6.8x – one of the most attractive valuations the stock has seen in recent history.

Is CROX Stock a Buy, According to Analysts?

Regarding Wall Street’s view on the stock, Crocs features a Moderate Buy consensus rating based on five Buys and two Holds assigned in the past three months. At $130.86, the average Crocs stock price prediction implies 51.6% upside potential.

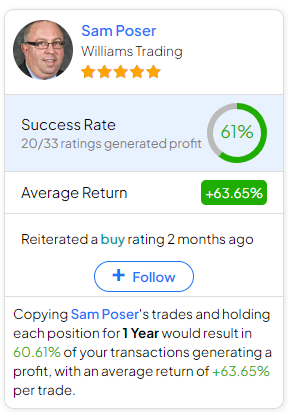

If you’re not sure which analyst you should follow if you want to buy and sell CROX stock, the most profitable analyst covering the stock (on a one-year timeframe) is Sam Poser from Williams Trading. His track record boasts an average return of 63.65% per rating and a 61% success rate. Click on the image below to learn more.

Conclusion

In conclusion, while the market may be overlooking Crocs’ robust top- and bottom-line growth, I find the current sell-off to be an opportunity to accumulate shares in a company poised for continued success. With record-breaking revenues, expanding margins, and a strategic foothold in burgeoning markets, Crocs stands as a testament to enduring consumer demand.

With shares trading at a dirt-cheap valuation, Crocs offers both upside potential and a wide margin of safety. As the company anticipates another year of profitability, the discrepancy between its performance and the stock’s decline makes Crocs an increasingly compelling investment choice.