CRISPR Therapeutics AG (CRSP) is a biotechnology gene-editing company. Its proprietary platform, CRISPR/Cas9-based therapeutics, is focused on providing precise and directed changes to genomic DNA. It makes gene-based medicines that transform the lives of patients with serious diseases. The company was founded in 2014, and has its headquarters in Switzerland.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I am bearish on CRSP stock. The reasons are fundamental ones and related to the current valuation of the company.

See Top Smart Score Stocks on TipRanks >>

Plethora of Products; None on the Market

I admit that every time I come across a biotechnology company that is publicly traded and has only a pipeline with no products that are marketable, yet it has a Buy rating, I am puzzled. Why? The first line of analyzing any stock is revenue.

CRISPR Therapeutics has a pipeline consisting of four categories: Hemoglobinopathies, Immuno-Oncology, Regenerative Medicine, and In Vivo Approaches.

This pipeline is diverse and promising, yet today none of these products in its pipeline is marketed. The focus now is on CTX001, an autologous CRISPR/Cas9 gene-edited hematopoietic stem cell therapy in development for patients suffering from β-thalassemia and sickle cell disease. It is under co-development and co-commercialization with Vertex Pharmaceuticals Incorporated (VRTX).

A press release about the collaboration stated, “Under terms of the amended agreement, Vertex to lead worldwide development, manufacturing and commercialization of CTX001.” It continued, “Revised agreement provides Vertex with 60% and CRISPR with 40% of program economics,” and “CRISPR to receive $900 million upfront payment with potential for additional $200 million milestone payment upon CTX001 regulatory approval.”

For any pharmaceutical or biotech company, receiving an official FDA approval and starting to market its products may take several years. Generally, only a small number of medicines are approved after a very analytical and tough screening procedure to meet the standards set by the FDA. This means that without any officially approved product by the FDA in the U.S., CRISPR Therapeutics generates revenue only in the form of collaboration revenues with Vertex Pharmaceuticals.

Fundamentals: Plenty Of Cash, Net Losses, and Stock Dilution

What does the fundamental analysis of CRSP stock suggest now? According to the press release about its full 2020 results, CRISPR Therapeutics had cash, cash equivalents, and marketable securities of $1,690.3 million as of December 31, 2020, compared to $943.8 million as of December 31, 2019.

But this increase of cash was only the result of financing activities, proceeds from the company’s public offering, and funds received from its “at-the-market” offering during 2020, or in other words, stock dilution. Total collaboration revenue was $0.2 million for the fourth quarter of 2020 compared to $77.0 million for the fourth quarter of 2019, and $0.5 million for the year ended December 31, 2020, compared to $289.6 million for the year ended December 31, 2019.

Additionally, there was a net loss of $107.0 million for the fourth quarter of 2020, compared to income of $30.5 million for the fourth quarter of 2019, and a net loss of $348.9 million for the year ended December 31, 2020, compared to income of $66.9 million for the year ended December 31, 2019.

Also, R&D expenses and G&A expenses both increased in 2020, compared to 2019. I expect this trend to continue as CRISPR Therapeutics develops its pipeline.

What about quarterly results? For the first quarter of 2021, CRISPR Therapeutics announced total collaboration revenue of $0.2 million for the first quarter of 2021 compared to $0.2 million for the first quarter of 2020. At the same time, the net loss was $113.2 million for the first quarter of 2021 compared to a net loss of $69.7 million for the first quarter of 2020.

For the second quarter of 2021, total collaboration revenue was $900.2 million for the second quarter of 2021, compared to less than $0.1 million for the second quarter of 2020.

But this is solely attributed to the $900.0 million upfront payment from Vertex, and charges related to partners for research activities. At the same time, net income was $759.2 million for the second quarter of 2021, compared to a net loss of $79.7 million for the second quarter of 2020.

This surge in revenue and net income for the second quarter of 2021 is a one-time event, as discussed above. In fact, for the years 2016-2020, CRISPR Therapeutics had been unprofitable in four of the five years, and stock dilution had increased the diluted shares outstanding from 12.26 million in 2016 to 65.95 million in 2020.

Furthermore, this biotech company is burning cash, as expected, with a negative free cash flow again in four out of the past five years. 2019 was an exception to this rule, with a positive free cash flow reported of $49.99 million.

CRISPR Therapeutics AG Conclusion

Without any approved and marketable products, the fundamental analysis of CRSP stock is not good. Aspects of the company to worry about include lack of revenue growth, net losses, and stock dilution, along with burning cash.

Wall Street’s Take

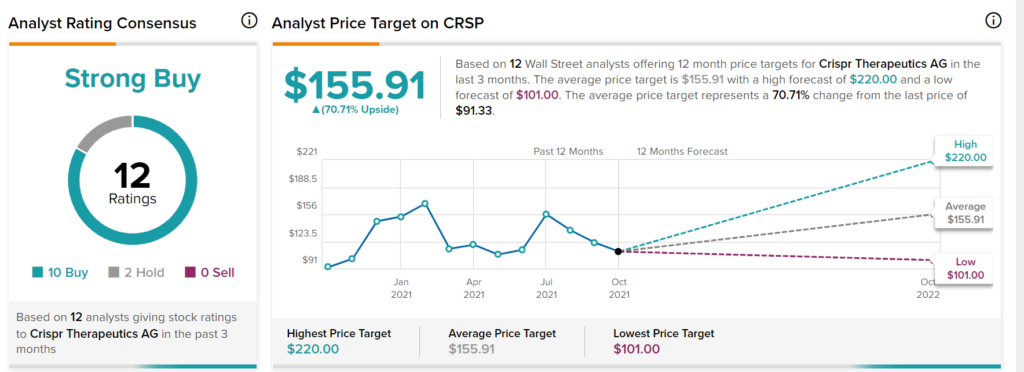

CRISPR Therapeutics AG has a consensus Strong Buy rating, based on 10 Buys, 2 Holds, and 0 Sells. The average CRISPR Therapeutics price target of $155.91represents a 70.7% change from the last price of $91.33.

Disclosure: At the time of publication, Stavros Georgiadis, CFA did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.