The broader basket of fashion stocks has felt the force of macro headwinds lately. Many of them crumbled under the pressure, but certain firms may be equipped for a stylish revival as expectations overshoot to the downside.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As the economy encounters a recession (the odds still seem elevated), there are some reasons to believe the pains will get worse. However, even with a recession considered, a lot of the damage (to stock prices) and lowered expectations may prove excessive at this juncture.

Indeed, stock markets do not usually “bottom” ahead of a recession. That said, every recession is created and recovered from differently. Fed-driven recessions don’t tend to catch too many people off-guard, given how much of the financial headlines have been hogged by Fed speak.

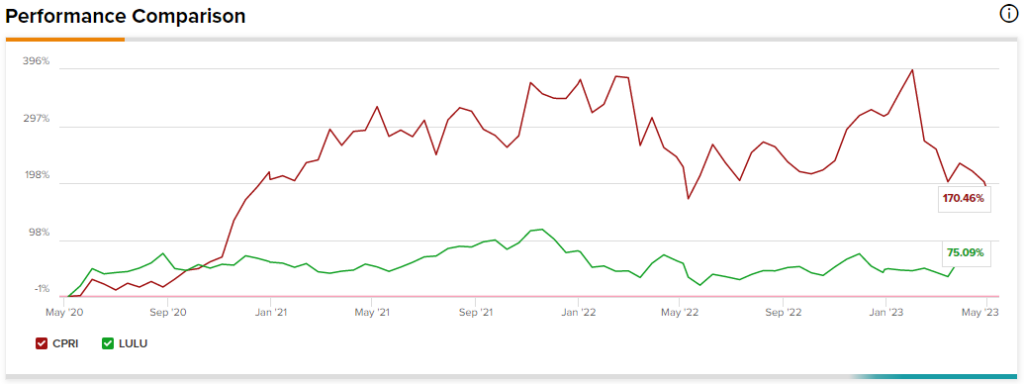

Though it’s hard to say what’s up next for fashion, I do find the following two names — CPRI and LULU — worth looking into as they look to rebound off recent lows, but one looks more attractive than the other at the moment. Therefore, let’s use TipRanks’ Comparison Tool to see how the following two names in fashion stack up.

1. Capri Holdings (NYSE:CPRI)

Capri Holdings is a fashion firm behind such labels as Versace and Michael Kors. The stock has been sent to the discount rack following the firm’s third-quarter earnings miss ($1.84 EPS vs. $2.22 consensus estimate).

Undoubtedly, demand for high-end luxury goods hasn’t been plunging as you’d expect in the face of headwinds and inflation, but Capri has been hit a lot harder than the likes of its fashionable rival, LVMH (OTC:LVMUY).

LVMH performed incredibly well of late, surging to a new high this year. Unfortunately for Capri shareholders, CPRI stock hasn’t been nearly as resilient, with shares now down more than 45% from their February 2023 peak of $69 and change.

In recent weeks, analysts have had differing opinions on the firm after its earnings flop, with some upgrading as others downgrade. After such a sizeable plunge, I remain bullish as apparel headwinds seem overly baked in here.

Despite analyst downgrades, Raymond James analyst Rick Patel stands out as a bull, recently rating the stock a “Strong Buy” with a $60 price target. Mr. Patel thinks that earnings beats and a valuation multiple expansion could help lift the stock. Mr. Patel could be proven correct in a big way once Capri reports its fourth-quarter results on May 29, 2023.

Too many people are bearish on the name right now. I view Capri stock as a relative bargain in the high-end apparel space. Following its recent plunge, the stock trades at a 7.3 times trailing price-to-earnings (P/E) ratio. That’s well below the 24.6 times trailing P/E ratio of the apparel and accessories industry average.

Ultimately, Capri’s strong brands can help it out of its funk. The low earnings bar certainly helps, too!

What is the Price Target for CPRI Stock?

Capri stands at a Moderate Buy, with eight Buys and six Holds. The average CPRI stock price target of $58.14 implies 52.2% upside potential from here.

2. Lululemon Athletica (NASDAQ:LULU)

Lululemon stock is back in rally mode following a solid quarterly earnings result, although shares of the athleisure giant are still down about 20% from their 2021 peak. While the recent beat has many encouraged and revising the name to the upside, I remain cautious (and neutral) as the valuation multiple is, once again, getting a bit too stretched (pardon the pun) for my liking.

At writing, the stock trades at a lofty 57.2 times trailing P/E, well above the apparel and accessories industry averages. Understandably, Lululemon has a stunning growth profile and room for margin enhancement as it continues to bolster its direct-to-consumer business while building more brand affinity.

Inventory swelled a bit (up about 50%) in the fourth quarter, but compared to rivals, Lululemon didn’t seem to be at risk of margin erosion at the hands of excess discounting. If you’ve got a strong brand and relatively resilient demand, the bargain rack doesn’t have to fill up as recession headwinds approach.

While management is doing a stellar job of persevering in this environment, I’m unwilling to pay today’s premium price tag, especially with rising competition. For now, Lululemon’s had its way with rivals, but just how long that will last in a tougher economic environment remains to be seen.

What is the Price Target for LULU Stock?

Lululemon is sitting at a Moderate Buy consensus rating right now, with 18 Buys, three Holds, and three Sells assigned in the past three months. The average LULU stock price target of $398.24 entails a mere 3.5% gain from current levels. After such a run, I’d look for analyst revisions to come flowing in.

The Bottom Line

Both Capri Holdings and Lululemon Athletica are navigating through economic headwinds in the fashion sector. However, CPRI stock looks more attractive due to its relatively low valuation and higher upside potential (52.2%, according to analysts), while Lululemon’s elevated valuation and lower upside potential make it a less appealing option, in my opinion.