The market is flooded with plenty of growth ETFs, dividend ETFs, and sector-specific ETFs. How about an ETF that takes an entirely different approach? That’s exactly what the Pacer Cash Cows ETF (BATS:COWZ) does, and it has produced phenomenal annualized total returns of ~31% over the past three years (as of the end of the first quarter of 2023). Therefore, let’s break down COWZ and why it could make sense as a core portfolio holding for many investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Who Let the COWZ Out?

The Pacer Cash Cows ETF is a $13.5 billion ETF that invests in the top 100 companies in the Russell 1000 index based on their free cash flow (FCF) yield. Free cash flow is simply the cash that a company has left over after it pays for its expenses, interest, taxes, and long-term investments. This cash can then be used to create value for shareholders by being used for share buybacks, dividends, or M&A activity.

Free cash flow yield is simply a company’s free cash flow per share divided by its share price. The higher the free cash flow yield, the more attractive a stock looks on this basis. Some investors feel that looking at free cash flow is superior to using earnings to evaluate stocks because it paints a clearer picture of a company’s “true” profitability. This is because management teams can and do make a variety of arbitrary adjustments to a company’s earnings with things like amortization and depreciation, but it’s harder to do this with a cash flow statement.

Pacer believes that focusing on free cash flow yield indicates “whether a company is producing more cash than it needs to run its businesses, therefore allowing for growth opportunities through other investments.” It says that these companies are more likely to survive turbulent economic times and also more likely to reinvest this spare cash in long-term growth, dividends, and share buybacks.

Track Record

While no strategy is fail-proof, COWZ’s strategy seems like a solid one, and it is borne out by the funds’ strong performance over time. At the end of the most recent quarter, COWZ had a loss of 3.9% trailing-year loss (remember that the broader market was in bear-market territory over much of the past year). However, over the past three years, COWZ stock has returned an exceptional 31.1% on an annualized basis, trouncing the returns of the broader market over the same time frame.

This type of remarkable annualized return likely isn’t sustainable over the long term, but zooming further out, even the fund’s five-year annualized return of 12.6% is a fruitful result that beats the S&P 500 (SPX). Further, since its inception, COWZ has produced an annualized total return of 12.9%, a result that most investors, including myself, would be very satisfied with.

Is COWZ Stock a Buy, According to Analysts?

In addition to this strong track record, COWZ enjoys a largely favorable (if unspectacular) view from the analyst community. Analysts collectively give the ETF a Moderate Buy rating, and the average COWZ price target of $55.63 implies 16.5% upside potential from current levels.

Of the 1,132 analyst ratings on COWZ, 51.6% are Buys, 41% are Holds, and 7.4% are Sells.

Cash COWZ

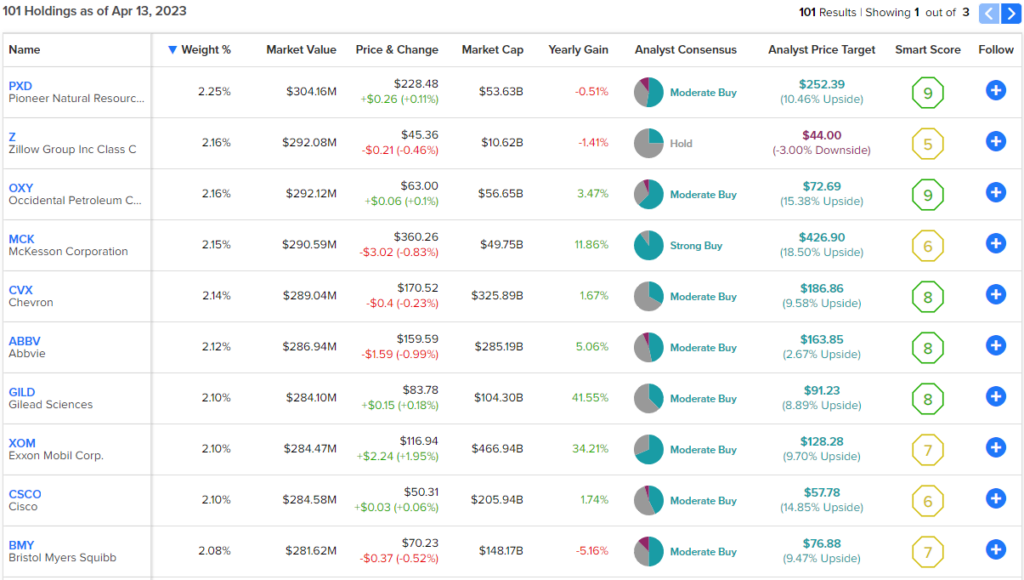

As mentioned earlier, COWZ invests in the top 100 stocks in the Russell 1000 based on free cash flow yield, so it has ample diversification, sporting 101 holdings. Furthermore, the fund caps each investment at 2% of assets, and it rebalances these positions on a frequent basis, so COWZ’s top 10 holdings make up just 21.4% of the fund as of right now.

The fund’s top position is oil producer Pioneer Natural Resources (NYSE:PXD), and energy companies, in general, are well-represented in the top 10 (shown below) through oil powerhouses like Occidental Petroleum (NYSE:OXY), Chevron (NYSE:CVX), and ExxonMobil (NYSE:XOM).

This is unsurprising as oil companies are seeing their free cash flows swell because of oil prices that have sustained higher levels over the past several years. Altogether, the energy sector accounts for 36.1% of the fund, making it the sector with the largest weighting in the COWZ ETF.

In addition to energy, there are quite a few large-cap health and pharma stocks in the top 10, including McKesson (NYSE:MCK), AbbVie (NYSE:ABBV), Gilead (NASDAQ:GILD), and Bristol Myers (NYSE:BMY). With a weighting of 18.75%, healthcare is the second-largest sector in COWZ’s portfolio.

One additional point of interest about COWZ holdings is that it mostly excludes stocks from the financial sector from its investment universe.

Clearly, Pacer believes that screening for free cash flow yield is a strong way to select holdings, and there is some overlap between Pacer’s criteria and TipRanks’ Smart Score system as five of the top 10 holdings have Smart Scores of 8 or better, which is equivalent to an Outperform rating.

The Smart Score is TipRanks’ proprietary quantitative stock scoring system that evaluates stocks on eight different market factors. The result is data-driven and does not require any human intervention.

Final Thoughts

It’s important to remember that no strategy is guaranteed to outperform over the long term, but COWZ’s strategy of focusing on the top 100 stocks in the Russell 1000 based on FCF yield seems like a sound one, and its results over the last few years are hard to argue with.

One minor risk factor worth mentioning is the fund’s outsized weighting towards energy, which exposes it to more risk if oil prices go down. However, this isn’t necessarily a negative as valuations in the energy sector are fairly cheap, to begin with, and if you are bullish on oil, then this is a feature, not a bug.

Another thing worth noting is COWZ’s expense ratio of 0.49%, which is not high but also not very low. Additionally, the ETF currently has a 2% dividend yield.

To conclude, given its strong track record, ample diversification, and focus on high-quality companies producing strong free cash flows, COWZ looks like a good ETF that can serve as a sturdy building block in investors’ portfolios.