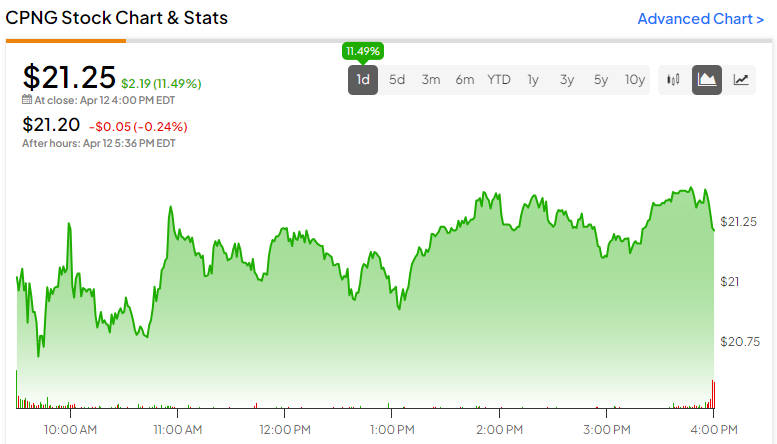

Maybe you’ve seen the trending stock tickers today and noticed that Coupang (NYSE:CPNG) stock was on a rocket ride higher. There’s nothing wrong with momentum, but investors should look into the reason for the move and make their own decisions. I am bearish on CPNG stock, and as we delve into what’s actually going on with Coupang, you might decide to find better investment opportunities elsewhere.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The easiest way to describe Coupang is as South Korea’s version of Amazon (NASDAQ:AMZN). It’s a popular e-commerce company with an order-fulfillment service called Rocket Delivery.

CPNG stock was on the move today, and you may be tempted to go all-in on the South Korean Amazon. However, be sure to learn all of the relevant facts before making any investment decisions. After all, a stock can be vulnerable to a pullback if a rally isn’t really justified.

A Bigger Company Could Threaten Coupang

Before we get into the headline news, there’s a development that prospective Coupang investors can’t afford to ignore. Specifically, a huge company is reportedly taking steps to compete directly with Coupang.

This company is much bigger than Coupang — and no, it’s not Amazon. Rather, it’s China-based e-commerce giant Alibaba (NYSE:BABA), which has a $184.13 billion market cap, as opposed to Coupang’s $38.16 billion market cap.

Here’s the scoop, courtesy of Nikkei’s Kotaro Hosokawa (via TheFly). Apparently, Alibaba plans to invest $1.1 billion “over the next three years to create a logistics network in South Korea.” With this move, Alibaba intends to take on Coupang “by leveraging low prices and speedy deliveries.”

For an e-commerce business, being threatened by Alibaba in Asia would be like being threatened by Amazon in the U.S. It’s just bad news for Coupang.

Furthermore, Alibaba has the capital resources to cause problems for Coupang. Reportedly, Alibaba will build a logistics center in a 180,000-square-meter lot this year, as well as a call center with 300 employees. Plus, Alibaba plans to establish a “purchasing department to sell local products overseas, aiming to boost exports for 50,000 small South Korean businesses over three years.”

Today, the market is simply ignoring this news, as short-term traders are obsessing over a new development with Coupang. Still, big-picture thinkers shouldn’t just dismiss the threat that Alibaba will pose to Coupang in the coming years.

Why Was Coupang Stock Up 11.5% Today?

So, here’s the catalyst that caused CPNG stock to rally 11.5% today. As The Korea Times reported, Coupang plans to increase its monthly Wow service (which is similar to Amazon’s Prime service) membership fee from 4,990 South Korean won previously to a new price of 7,890 won (equivalent to approximately $5.74).

If this doesn’t seem like a big deal, bear in mind that $5.74 can be a lot of money for families in different regions of the world. Moreover, this is a 58% increase in the monthly Wow service fee.

Surely, Coupang’s customers are now saying “wow” to the “Wow” service, but not in a good way. This probably should go without saying, but The Korea Times stated, “Many consumers [are] displeased with [the] steep price hike.”

Let’s put this into perspective. Without a doubt, some customers haven’t been particularly happy about Amazon’s Prime membership price hikes throughout the years. However, at least Amazon had the sense to make those price increases somewhat gradual — not 58% all at once.

My point is that this could backfire in a big way. In the immediate term, stock traders are probably over-focused on the revenue-generating potential of Coupang’s Wow service price hike. If the company loses angry customers, though, then there could be long-term damage to Coupang’s bottom line. That’s the last thing Coupang needs as Alibaba makes major moves to steal some of the company’s market share in South Korea.

Is Coupang Stock a Buy, According to Analysts?

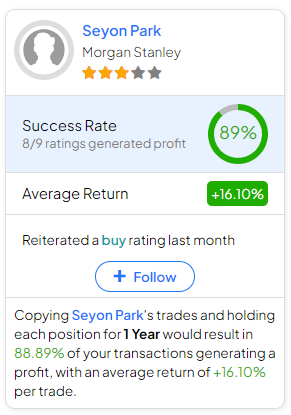

On TipRanks, CPNG comes in as a Moderate Buy based on three Buys and two Hold ratings assigned by analysts in the past three months. The average CPNG stock price target is $21.75, implying 2.35% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell CPNG stock, the most profitable analyst covering the stock (on a one-year timeframe) is Seyon Park of Morgan Stanley (NYSE:MS), with an average return of 16.1% per rating and an 89% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Coupang Stock?

Coupang is certainly an intriguing company that might be compared to Amazon. Yet, even the mammoth Amazon didn’t have the audacity to raise its subscription service fee by 58% all at once. Truly, Coupang’s huge price hike is either a brilliant move or just reckless and greedy.

Personally, I don’t consider it to be a brilliant move. Coupang needs to keep its customers happy, especially with Alibaba threatening to make a move into Coupang’s home turf. Consequently, even though CPNG stock is quickly moving higher, I’m not considering owning it now.