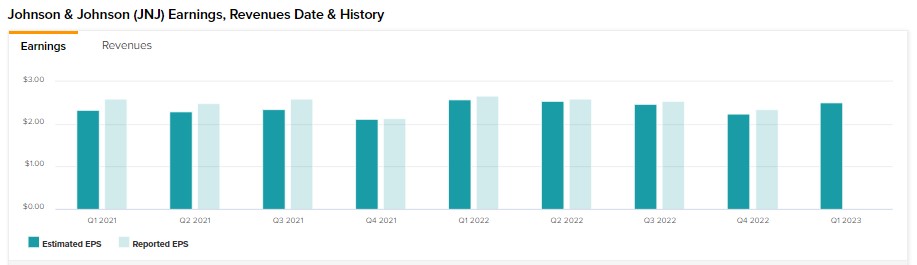

Johnson & Johnson (NYSE:JNJ) is scheduled to report its first-quarter earnings on Tuesday, April 18. JNJ has a solid track record of consistently beating analysts’ earnings forecasts in the past several quarters (refer to the image below). As for Q1, the Pharmaceutical and MedTech company faces significant headwinds. However, last week, Wells Fargo analyst Larry Biegelsen stated that he expects the company to “at least” meet the consensus estimates.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Analysts expect JNJ to post revenues of $23.62 billion in Q1, reflecting a slight increase over the prior-year quarter.

JNJ expects the second half of 2023 to be stronger than the first, led by new product launches. Meanwhile, the first half financials could take a hit due to the continued declines in LOE (Loss of Exclusivity) products in Europe and pricing pressure in the Pharmaceuticals division.

On the bottom line front, Wall Street expects Johnson & Johnson to report earnings of $2.51 per share in the first quarter, down from $2.67 reported in the prior year quarter. Inflationary cost headwinds, inventory issues, and pricing pressure could negatively impact its Q1 earnings.

Expecting a positive tone from management over the ongoing procedure recovery in the MedTech segment, Biegelsen reiterated a Buy recommendation on JNJ stock. The analyst believes that the management will reaffirm the full-year guidance.

The company expects to report adjusted operational sales growth (excluding the COVID-19 Vaccine) of 4% in 2023. Meanwhile, it projects an adjusted operational EPS of $10.50, reflecting an increase of 3.5%.

What is the Price Target for JNJ?

Wall Street is cautiously optimistic about JNJ stock ahead of Q1. It has received four Buy and 10 Hold recommendations for a Moderate Buy consensus rating. Further, these analysts’ average price target of $179 indicates 7.94% upside potential.

Bottom Line

JNJ’s Pharmaceutical and MedTech portfolio positions it well to deliver strong financials. However, the continued declines in the LOE products, inflationary headwinds, and pricing pressure could hurt its near-term financials.

Nonetheless, management expects benefits from new product launches and cost-cutting measures to support its revenue and margin in the second half of 2023.