Wendy’s (NASDAQ:WEN), during the Q1 conference call, unveiled Wendy’s Fresh AI, a voice AI (Artificial Intelligence) solution to power its drive-through ordering that makes use of Google (NASDAQ:GOOGL)(NASDAQ:GOOG) Cloud’s generative AI and large language models technology. The use of technology will likely improve the unit economics of its restaurants, which will in turn support its stock price.

The voice AI solution will enable the company to offer its customers a faster, frictionless, and differentiated experience. Thanks to the use of technology, its staff can focus more on food preparation and service to elevate the customer experience.

Wendy’s will launch a pilot in June and expects the AI solution to boost the speed of service and customer satisfaction, which will eventually increase profitability.

Further, Wendy’s expects to leverage modern-day tech to introduce more such services in the coming months. Its CEO, Todd Penegor, said the company could “continue pushing into new and promising technology alongside our partners as we look to maximize the restaurant economic model and grow our digital sales to approximately $1.5 billion this year.”

While the use of tech will improve its unit economics and profitability, the softness in customer spending could hit Wendy’s more than peers in the short term, noted Andrew Strelzik of BMO Capital.

On May 11, Strelzik increased Wendy’s price target to $24 from $23. However, he maintained a Hold recommendation.

What’s the Prediction for Wendy’s Stock?

Wendy’s will likely benefit from voice AI, digital menu boards, and other tech advancements in the long term. However, the near-term pressure on consumer spending is keeping analysts cautiously optimistic.

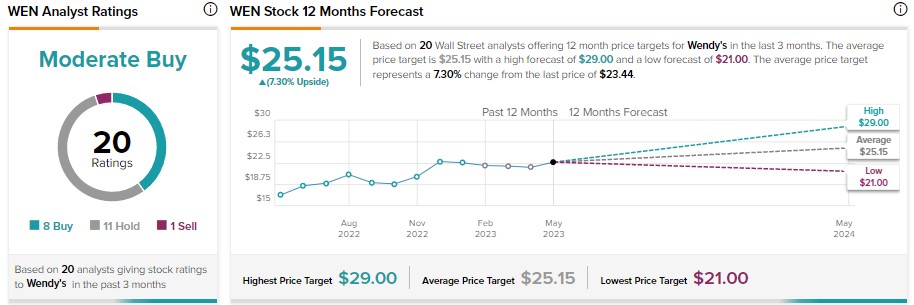

Wendy’s stock has received eight Buy, 11 Hold, and one Sell recommendations for a Moderate Buy consensus rating. At the same time, analysts’ average price target of $25.15 implies 7.3% upside potential.

Excited about AI? Learn more about AI advancements here.