Costco Wholesale (NASDAQ:COST) is scheduled to release its fiscal first-quarter results on December 14, after the market closes. While the slowdown in discretionary spending might have impacted the company’s performance to some extent, alleviating supply chain disruptions and the company’s focus on value offerings are likely to bolster sales and earnings in the upcoming quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Costco is a multinational retail chain that offers a wide range of products, including groceries, electronics, furniture, and more.

Expectations for COST’s Q1 Earnings

Our data shows that Costco has surpassed analysts’ earnings estimates 66.67% of the time in the past 12 months. This track record seems to be impressive. As for the to-be-reported quarter, Wall Street expects Costco to post earnings of $3.41 per share in Q1, nearly 11% higher than the prior-year period figure of $3.07. Similarly, sales are projected to rise 6.1% to $57.75 billion.

Ahead of the company’s Q1 earnings, three analysts gave COST stock a Buy, while one assigned a Hold rating. Evercore ISI analyst Greg Melich is bullish on the stock and reiterated a Buy rating on Costco.

The analyst believes solid traffic growth, especially in the U.S., and grocery share gains bode well for Costco’s upcoming Q1 earnings. Furthermore, cost savings from terminating long-dated shipping agreements and profits from gas sales are expected to further boost the company’s financial performance.

On the other hand, Citi analyst Paul Lejuez maintained its Hold rating on COST stock and kept its price target of $585.

Is COST Stock a Buy or Sell?

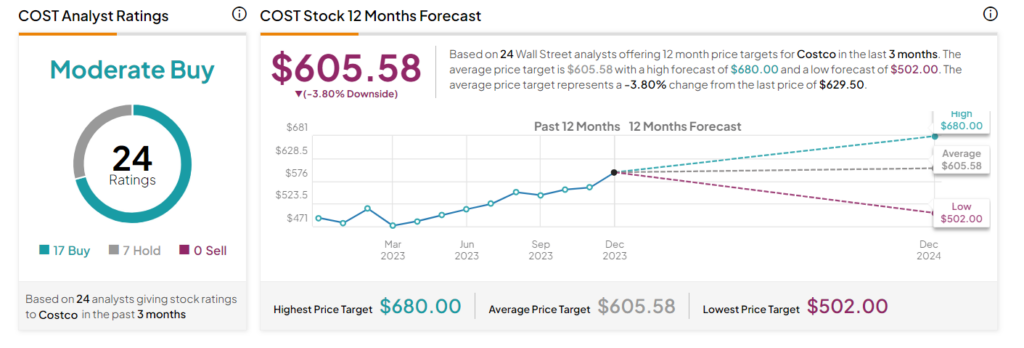

Wall Street is cautiously optimistic about Costco stock. It has a Moderate Buy consensus rating based on 17 Buys and seven Holds. The average stock price target of $605.58 implies 3.8% downside potential. COST stock is up 39.9% so far this year.

Insights from Options Trading Activity

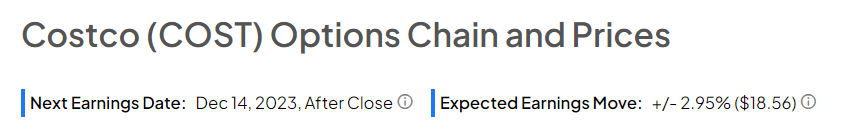

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/- 2.95% move on Costco’s earnings, compared with the previous quarter’s earnings-related move of 1.91%.

Concluding Thoughts

The company’s value pricing strategy and strong membership renewable rate help COST counter growing competition and support financials. Further, Costco reported 5.1% and 6.1% year-over-year jumps in net sales for four weeks and twelve weeks ended November 26, respectively. This bodes well for the company’s upcoming results.