The discount retail scene looks like a great place to put money to work if you’re looking to play defense ahead of market volatility. There’s no question that some hot tech stocks are starting to overheat. And if some of the market’s biggest contributors go down, so too could the rest of the market. Therefore, in this piece, we’ll consider three Strong Buy-rated retail plays (COST, KR, and DLTR) that seem well-insulated from a potential tech correction.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

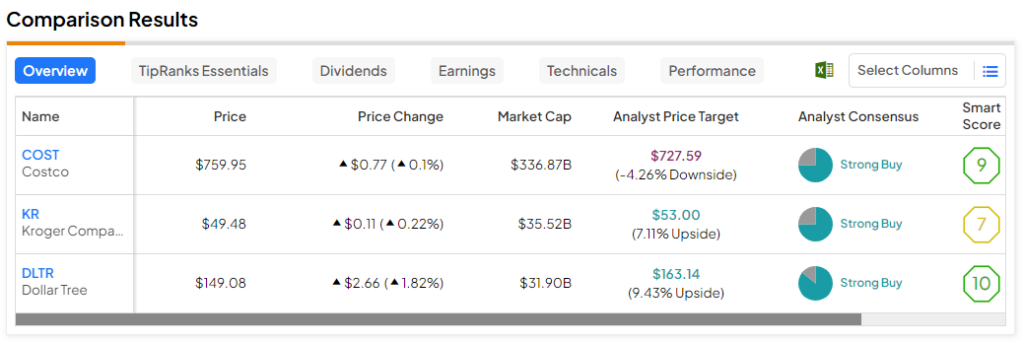

Each name sports a well-earned Strong Buy rating from the analyst community alongside low betas that could make them relative pillars of stability come the next market sell-off. So, let’s use TipRanks’ Comparison Tool to gain a quick glimpse of the three retail plays that could have what it takes to power higher, even if Mr. Market’s next big move is lower.

Costco (NASDAQ:COST)

Costco’s loyal members can’t seem to stop buying Costco bargains in bulk, and it’s not just high inflation to thank for recent strength. The wholesale retailer (and king of bargain-priced bulk buys) boasts a superb management team that seems to have the magic formula down. For this reason, it’s hard not to be bullish, even as last year’s parabolic run begins to show signs of tapering off.

Undoubtedly, after such an explosive move, a period of sideways action is always justified. In fact, it’s only normal for a correction or period of consolidation to take hold after a sudden surge. That is unless we’re talking about the red-hot semiconductor stocks, which only seem to keep shooting to the moon.

Even if the rest of the market goes sideways-to-south from here, Costco stands out as a firm that can get creative to keep sales growth humming along. Beyond offering a wider range of non-traditional goods (think gold bullion) and the expansion opportunity in Asia, Costco also stands to gain a lot from the rise of AI and automation.

Yes, Costco, a warehouse retailer, has skin in the AI game. The company’s already efficient inventory management stands to become even more efficient with some help from AI.

Additionally, greater automation could drive costs even lower, helping Costco enhance its margins or pass on even more value to its members. Personally, I think the firm can justify jacking up annual membership prices if it were to do this.

Costco seems to already be ahead of the pack on the front of automation. Did you know Costco has been using robots to help make the pizzas sold at its food court for more than five years now? That’s a testament to management’s willingness to embrace technology as a means to save money and get things done faster.

At 51.8 times trailing price-to-earnings, COST stock seems a bit hot ahead of its earnings (on tap for March 7). Perhaps it’s prudent to wait for a potential post-earnings pullback before jumping in.

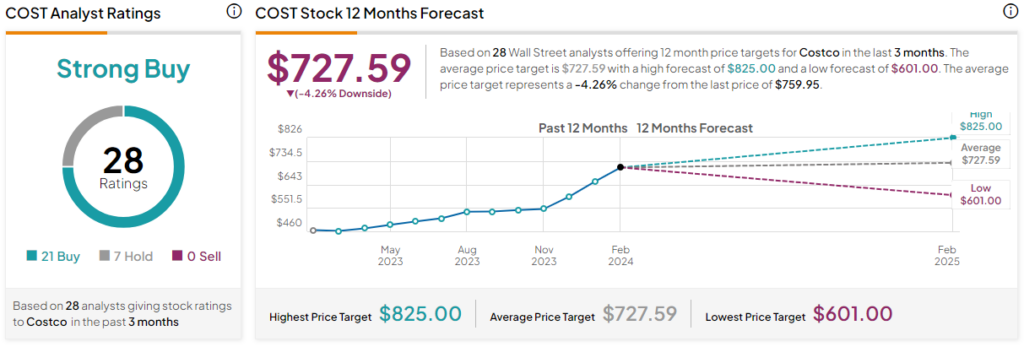

What Is the Price Target of COST Stock?

COST stock is a Strong Buy, according to analysts, with 21 Buys and seven Holds assigned in the past three months. The average COST stock price target of $727.59 implies 4.3% downside potential.

Kroger (NYSE:KR)

If you seek a cheaper defensive retailer, perhaps Kroger is more your cup of tea. The stock has done virtually nothing since the midpoint of 2022 after suffering a steep slide off its April 2022 peak. Now down around 20% from these highs, Kroger seems like one of the cheaper low-beta (its 0.46 beta entails less correlation to the S&P 500 (SPX)) breakout plays on the scene.

As the technical saying goes, the higher the base (the consolidation period), the higher in space (the explosiveness of a breakout). With Kroger also slated to report earnings on March 7, 2024, alongside Costco, it’s sure to be an eventful week for the former relatively small Berkshire Hathaway (NYSE:BRK.B) holding (Kroger stock comprises less than 1% of the Berkshire portfolio as of the latest quarter).

Only time will tell if a breakout for the stock looms, but I have to say I’m a big fan of the valuation at current levels. Wall Street’s confidence and Berkshire’s blessing are also big pluses for the grocery retail juggernaut. With the $25 billion merger with Albertsons (NYSE:ACI) likely to be blocked, it will be interesting to see where Kroger goes from here as it attempts to break out of its sideways channel.

At 19.2 times trailing price-to-earnings, with a 2.36% dividend yield, KR stock stands out as one of the more value-conscious defensive stocks in the market right now.

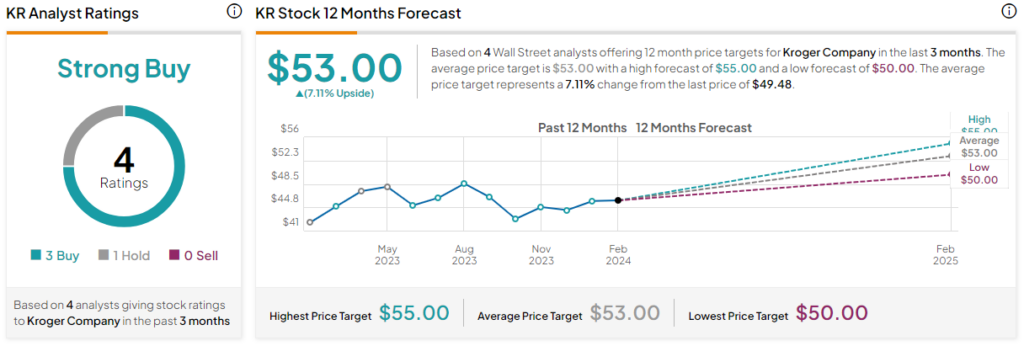

What Is the Price Target of KR Stock?

KR stock is a Strong Buy, according to analysts, with two Buys and one Hold assigned in the past three months. The average KR stock price target of $53.00 implies 7.1% upside potential.

Dollar Tree (NYSE:DLTR)

DollarTree stock has been quite disappointing lately, as shares only recently recovered from a nasty mid-2023 sell-off that saw 30% be wiped out in a matter of months. With consumers feeling inflation’s pinch for well over a year, you’d think the discount retailer would be thriving, not treading water. In any case, things could always be worse, as has been the case for some of Dollar Tree’s peers, which seem to be experiencing supply chain woes.

With shares down around 13% from their 2022 highs, DLTR stock has new highs in sight. Recent glimmers of strength from its latest quarter may just help power the discount retailer to new highs by year’s end. All things considered, I remain bullish on the stock as it looks to pull the curtain on its quarterly results next week on March 13.

At writing, shares of DLTR go for 27.8 times trailing price-to-earnings, below the discount store industry average of 33.5 times.

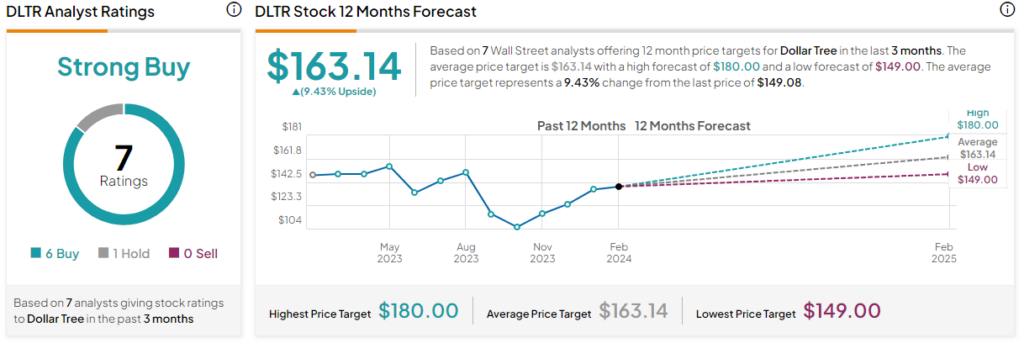

What Is the Price Target of DLTR Stock?

DLTR stock is a Strong Buy, according to analysts, with six Buys and one Hold assigned in the past three months. The average DLTR stock price target of $163.14 implies 9.4% upside potential.

The Takeaway

The aforementioned well-run retail plays have the praise of Wall Street, even as the rest of the market gets a tad on the pricy side. With earnings up ahead, the following plays are shaping up to be must-watches over the coming weeks. Of the trio, analysts expect the most gains from DLTR stock (~9.4%).