Corsair’s (CRSR) shares spiked shortly after its IPO, followed by a gradual downward decline back toward the stock’s original levels that lasted nearly two years. Admittedly, the stock was rather overvalued following its initial spike.

However, following the recent correction and the company posting positive developments through this period, I believe that Corsair has now entered value territory. For this reason, I am bullish on the stock.

Corsair’s Position & Advantage in a Competitive Industry

Corsair Gaming is one of the leading manufacturers of high-performance equipment for gamers and content creators. The company was founded in 1994 and currently generates close to $2 billion in annual revenues.

Corsair’s high-end computer gear aims to allow both casual and professional gamers to perform at their best. Further, the company’s streaming-related equipment enables creators to produce top-notch quality content to share with the world.

With both gaming and content creation becoming increasingly prevalent forms of communication and entertainment, companies such as Corsair have been gaining increasing traction.

Corsair is a relatively new constituent of the public markets. The company went public less than two years ago, striving to raise capital in order to pursue its growth goals in a thriving industry – and if anybody has the expertise and know-how to dominate the growing PC peripherals industry, it’s Corsair.

This is because the company has been one of the most prominent computer-gear players for more than two decades, with more than one of its product classes preserving a #1 U.S. market share position. Specifically, the company has the highest market share in both the gaming components and gaming memory markets, at 45% and 65%, respectively.

Corsair has managed to achieve this because its products are known for their genuineness and high-end engineering. As a result, the company has managed to retain a loyal customer base, which, besides being a great competitive advantage, allows for Corsair’s leading market position to be retained.

Having a dominant market share and a loyal customer base is critical in the PC peripherals market because the space is highly competitive. Among a number of private companies, there are other publicly-traded companies like Logitech (LOGI) and Turtle Beach Corporation (HEAR), which constantly fight to grow their presence in the market. Thus, Corsair’s powerful brand is a tremendous intangible asset.

Corsair is Growing, but Profitability is Getting Squeezed

Corsair’s Q1-2022 results came in quite strong, with net revenues landing at $380.7 million. While this suggests a decline of 28.1% compared to Q1-2021, last year’s results were inflated due to stimulus checks and boosted demand for PC peripherals due to the working-from-home economy. For a more contextual comparison, revenues actually grew 23.4% compared to the pre-pandemic Q1-2020.

Specifically, the Gamer & Creator Peripherals division’s revenues came in at $134.1 million, an increase of 76.8% compared to the pre-pandemic first quarter.

The Gaming Components & Systems segment’s net revenues came in at $246.5 million, also growing 6% compared to the pre-pandemic Q1 2020. Thus, we see that besides last year’s one-off effect on demand, the overall trajectory of Corsair’s growth remains quite vigorous.

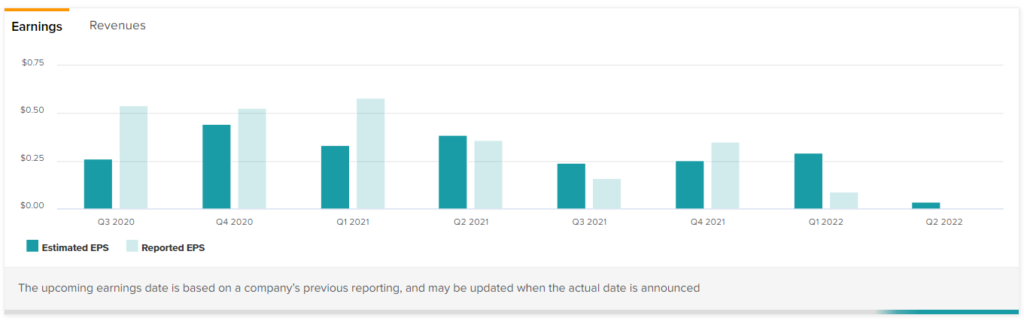

Regarding profitability, adjusted net income came in at $9.1 million, or $0.09 per share, compared to net income of $58.1 million or $0.58 per share in the prior-year period. In this case, I am comparing the company’s results to those of last year to illustrate the massive effect lower sales can have on the company’s margins and profitability.

Due to its cyclical, hardware-heavy business model, net income can skyrocket when sales surge like last year but plummet as soon as sales temporarily weaken.

This, combined with a rise in expenses as a result of the lasting inflationary environment and the enduring supply-chain bottlenecks, has likely resulted in the market expecting thin profitability levels in the near future. Therefore, the ongoing sell-off is not unjustified to some extent.

Wall Street’s Take on CRSR Stock

Consulting Wall Street, Corsair Gaming has a Moderate Buy consensus rating based on five Buys and four Holds assigned in the past three months. At $21.00, the average Corsair Gaming price prediction implies 66.3% upside potential.

Conclusion: Relative Undervaluation Could Overshadow Bottom-Line Weakness

Corsair’s recent performance is hard to like. The company’s results are weak against last year’s inflated numbers, while the current challenges regarding expenses are not helping the company produce meaningful profitability.

Despite Corsair recording thin margins, however, the fact that the company continues to be profitable even during challenging times means that its book value is growing. This, combined with the ongoing decline in the stock price, has resulted in shares trading at a record low price-to-book multiple of 2.1x.

For context, despite its competitor Logitech finding itself in a similar situation, shares are still trading at a price-to-book multiple of 3.7x – a relative premium of roughly 75%.

With analysts expecting earnings to normalize next year, consensus EPS estimates for Fiscal 2023 stand at $1.32, which would imply a P/E of 9.6x at the time based on the current stock price levels. Despite its cyclical nature, this is a very attractive multiple for an industry leader that is still growing at a noteworthy pace.

Thus, don’t give up on Corsair’s shares yet, in my view. Instead, consider paying attention to its value-oriented investment case.