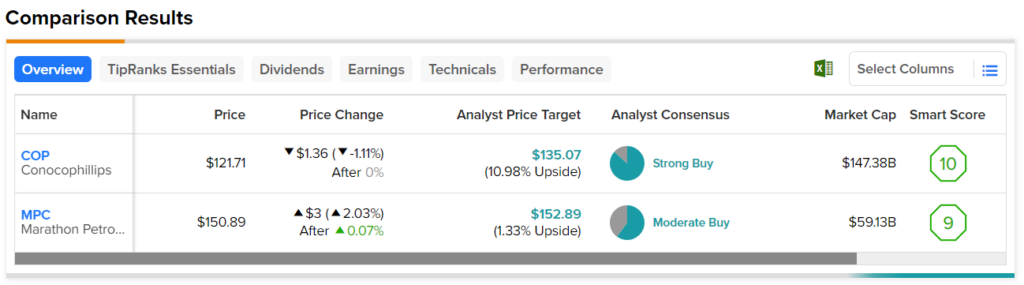

In this piece, I evaluated two energy stocks, ConocoPhillips (NYSE:COP) and Marathon Petroleum (NYSE:MPC), using TipRanks’ comparison tool to determine which is better. ConocoPhillips engages in hydrocarbon exploration, while Marathon Petroleum is a petroleum refiner, marketer, and transporter that was spun off from Marathon Oil (NYSE:MRO) in 2011.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Shares of ConocoPhillips are up 9% year-to-date, bringing their one-year gain to 13%, while Marathon Petroleum shares have rallied 33% year-to-date and are now up 50% over the last 12 months.

With such a dramatic share-price performance, it may be surprising which of the two companies is trading at a significantly higher valuation than the other. Both are profitable, so we’ll compare their price-to-earnings (P/E) ratios to gauge their valuations.

For comparison, the U.S. oil and gas industry is currently trading at a P/E of 8.2. We’ll also consider their enterprise value/EBITDA (EV/EBITDA) multiples, which take into account debt in addition to equity.

This multiple is often used for energy company valuations due to the unique aspects of exploration and production, which typically cause energy companies to carry lots of debt. The industry is currently trading at an EV/EBITDA multiple of 4.45 versus its five-year median EV/EBITDA of 5.0.

ConocoPhillips (NYSE:COP)

At a P/E of 11.8 and an EV/EBITDA of 5.5, ConocoPhillips is trading at a sizable premium, both to its industry and to Marathon Petroleum. However, due to its shareholder-friendly activities, which make it an excellent addition to a dividend portfolio, and its long-term staying power, a bullish view seems appropriate.

ConocoPhillips is heavily focused on returning capital to shareholders, paying $6.7 billion in dividends and repurchasing $8.5 billion worth of shares over the last 12 months. The company sports a dividend yield of 3.7%, in line with the energy sector average, which makes it a solid dividend play.

While the primary focus for ConocoPhillips is on its capital-return policies, its valuation and fundamentals are solid, too, and capable of supporting those policies for the long term. Free cash flow is an important metric for oil companies, and ConocoPhillips grew its free cash flow by more than 55% to $18.2 billion in 2022.

As one of the world’s largest exploration and production companies by production and proven reserves, ConocoPhillips is significantly exposed to oil prices. Goldman Sachs (NYSE:GS) said earlier this week that oil prices could reach $107 a barrel in 2024 if Saudi Arabia and Russia don’t reverse their production cuts.

However, the firm doesn’t expect OPEC+ to target a price significantly higher than $100. Currently, West Texas Intermediate crude is hovering below $87 a barrel, while Brent crude is hovering around $90, so the bull thesis for ConocoPhillips may need to be revisited if oil prices plummet, although that seems unlikely.

What is the Price Target for COP Stock?

ConocoPhillips has a Strong Buy consensus rating based on 13 Buys, two Holds, and zero Sell ratings assigned over the last three months. At $135.07, the average ConocoPhillips stock price target implies upside potential of 11%.

Marathon Petroleum (NYSE:MPC)

Even after its massive rally, Marathon Petroleum is trading at a deep discount to its industry and ConocoPhillips on both a P/E and EV/EBITDA basis, at 5.4 and 4.1, respectively. At the current valuation, a bullish view also looks appropriate for Marathon.

Marathon repurchased $12 billion worth of shares and paid $1.3 billion in dividends over the last 12 months, so it also follows some shareholder-friendly capital-return policies. The company has a solid dividend yield of 2.06%, below the sector average, although it has raised its dividend annually for at least the last 12 years.

As a refiner, transporter, and marketer, Marathon operates in a different segment of the oil and gas business than ConocoPhillips, so it is less exposed to oil and gas prices, providing a level of protection from commodity-price volatility. Marathon also nearly quadrupled its free cash flow in 2022, bringing it to $13.9 billion.

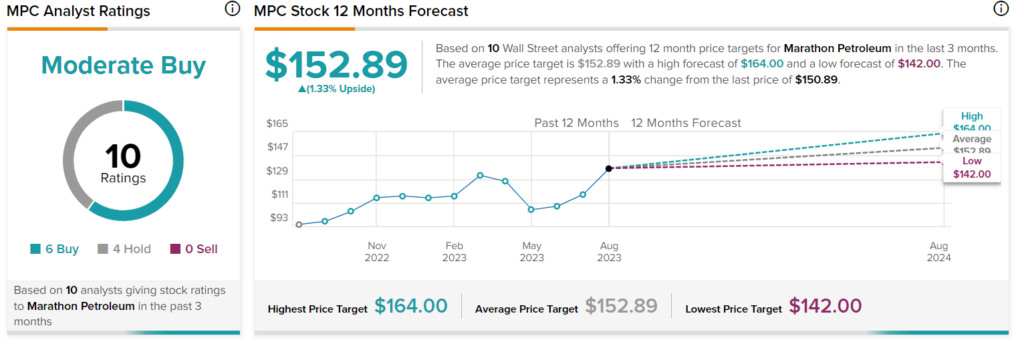

What is the Price Target for MPC Stock?

Marathon Petroleum has a Moderate Buy consensus rating based on six Buys, four Holds, and zero Sell ratings assigned over the last three months. At $152.89, the average Marathon Petroleum stock price target implies upside potential of 1.3%.

Conclusion: Bullish on COP and MPC

In some ways, the bull cases for ConocoPhillips and Marathon Petroleum are similar. Both focus on returning capital to shareholders and generate plenty of free cash flow while benefiting from positive trends in the oil and gas industry.

However, ConocoPhillips is the winner of this pairing because of its significantly better net income margin, which has ranged from 17% in 2021 to 23% in 2022. Meanwhile, Marathon’s net income margin has been stable at 8% in 2021, 2022, and over the last 12 months.

Finally, both stocks are long-term compounders, with ConocoPhillips up 96% over the last five years and over 33,000% since 1968, while Marathon Petroleum has gained 119% over the last five years and over 1,000% since 2011.