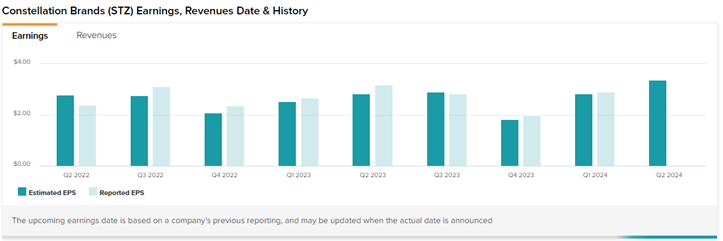

Constellation Brands (NYSE:STZ) is scheduled to report its Fiscal Q2-2024 results on October 5 before the market opens. The beverage maker outpaced analysts’ expectations in six out of the past eight quarters. Year-to-date, STZ stock has gained 10.3%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For the to-be-reported quarter, the Street expects Constellation Brands to post an adjusted profit of $3.37 per share on sales of $2.82 billion. In the comparative prior year period, STZ reported adjusted earnings of $3.17 per share on sales of $2.66 billion.

Wedbush is Bullish on STZ

Ahead of the Q2 print, Wedbush analyst Gerald Pascarelli lifted his price target on STZ to $300 (implying 20.8% upside potential) from $275 while maintaining a Buy rating. The analyst also added Constellation Brands to the firm’s Best Ideas List.

Pascarelli foresees multiple catalysts for the beer king in the near term. This, he believes, will help the company to continue its outperformance and drive solid top- and bottom-line growth. The analyst expects the second quarter’s beer performance to be strong (9.7% revenue growth), backed by further easing comps in the rest of the year.

Further, the analyst told investors that Constellation Brands’ margins will remain similar to the prior quarter, close to 38%, owing to high inflation, but should improve in the second half. He added that operating margins could improve in 2024 and “continue” into Fiscal 2025.

Finally, Pascarelli is optimistic about the company’s recent deal with Elliot Management, which could address governance issues and align the company’s goals with shareholders’ interests. Pursuant to signing the Information Sharing and Cooperation Agreements with Elliot, the company agreed to appoint two new independent directors and will share specific confidential information with Elliott prior to its investor day later in the year.

Is Constellation Brands Stock a Buy, According to Analysts?

With 11 Buys and two Hold ratings, STZ stock commands a Strong Buy consensus rating on TipRanks. Also, the average Constellation Brands stock price target of $293.46 implies 18.2% upside potential from current levels.

Conclusion

Constellation Brands is poised for better days ahead as per Wedbush analyst Pascarelli’s conviction. All in all, the company has shown a solid outperformance in the previous quarters and could continue with its winning momentum in the to-be-reported quarter.