Beverage maker Constellation Brands, Inc. (NYSE:STZ) is scheduled to release its third quarter Fiscal 2024 results on January 5, before the market opens. The company’s quarterly performance might have benefitted from higher alcohol demand during the festive season and the strategic introduction of new beverages. Also, an increase in consumer spending power during the quarter is likely to have aided top-line growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Remarkably, the company outpaced analysts’ expectations in seven out of the past eight quarters.

For the to-be-reported quarter, the Street expects Constellation Brands to post an adjusted profit of $3.02 per share on sales of $2.54 billion. In the comparative prior-year period, STZ reported adjusted earnings of $2.83 per share on sales of $2.44 billion.

Here’s What Analysts Expect from STZ’s Q3 Results

It is worth highlighting that five analysts have reaffirmed a Buy rating on STZ stock ahead of the company’s earnings report. Also, several analysts raised their price targets, confirming their bullish outlook on the stock.

Goldman Sachs analyst Bonnie Herzog expects the company to beat the EPS estimates for the fiscal third quarter. The analyst is optimistic about STZ’s strong volume-driven top-line growth and the potential for long-term distribution gains. Additionally, Herzog finds the company’s valuation attractive.

Herzog maintained a Buy rating on STZ stock with a price target of $290, implying 18.9% upside potential.

Likewise, analyst Bryan Spillane from Bank of America Securities reiterated a Buy rating on the stock with a $290 price target. The rating is based on the company’s robust beer sales and earnings growth, along with a strong focus on returning cash to shareholders.

Spillane also anticipates that beer margins will improve in the next few years, based on the assumptions of lower inflation and improved leverage.

Should I Buy or Sell STZ?

Wall Street is highly optimistic about the stock. STZ has a Strong Buy consensus rating based on 17 Buys and three Holds. The average stock price target of $291.63 implies 19.6% upside potential from current levels.

Insights from Options Trading Activity

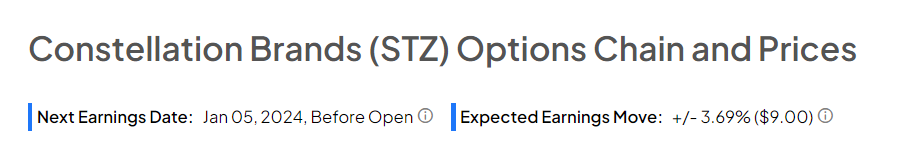

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/- 3.69% move on STZ’s earnings, compared with the previous quarter’s earnings-related move of -3.22%.

Ending Thoughts

Constellation Brands’ focus on growing its international presence and improving beer sales is expected to support the company’s performance. In addition to this, Wall Street remains bullish on STZ’s long-term growth potential.