Investors planning to invest in energy stocks may consider ConocoPhillips (NYSE:COP). Shares of this leading hydrocarbon exploration and production company remain the top energy pick of hedge fund expert Boykin Curry of Eagle Capital Management. COP accounts for 7.96% of his total portfolio.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

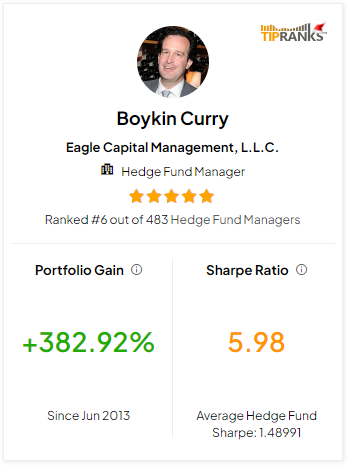

It’s worth mentioning that TipRanks offers a variety of tools to help investors access expert insights for selecting stocks. Among these tools is the Top Hedge Fund Managers feature, which evaluates hedge fund managers based on their average returns and success rates. According to the rankings, Boykin Curry is sixth among the 483 hedge fund managers evaluated by TipRanks.

Curry’s portfolio has demonstrated remarkable performance, gaining 382.92% since June 2013, with an average return of 42.23% in the last 12 months. Moreover, a significant portion of the hedge fund manager’s investments are concentrated in communication services (30.88%), followed by financial (17.23%).

Given this context, let’s explore what the Street is saying about COP stock.

What is the Forecast for ConocoPhillips?

Besides for Curry, Wall Street is optimistic about COP stock. The company’s strong financial performance, improving production, and focus on enhancing shareholders’ returns through increased dividend payments and share buybacks support its bull case.

ConocoPhillips stock has a Strong Buy consensus rating based on 15 Buy and four Hold recommendations. Further, analysts’ average price target of $139.84 implies 19.84% upside potential from current levels.

Bottom Line

Curry’s success in delivering impressive returns underscores the effectiveness of his portfolio allocation strategy, making him a noteworthy reference for investors seeking informed investment decisions. Moreover, investors can leverage TipRanks’ other valuable tools, including the Expert Center and Smart Score, for long-term investments.